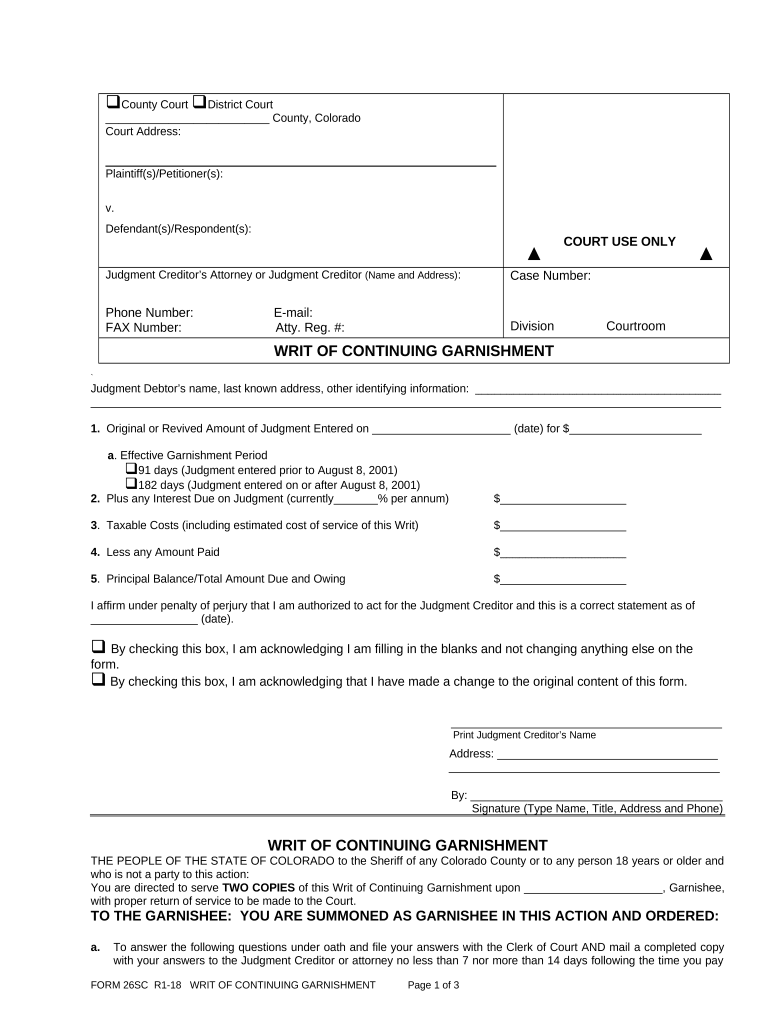

Continuing Garnishment Form

What is the continuing garnishment?

The continuing garnishment is a legal process that allows a creditor to collect debts directly from a debtor's wages or bank accounts. This method is often used to ensure that payments are made consistently over time, particularly for child support, taxes, or other financial obligations. In the United States, this process requires a court order and must adhere to specific regulations to protect the rights of the debtor while allowing creditors to recover what they are owed.

How to use the continuing garnishment

Using the continuing garnishment involves several key steps. First, the creditor must obtain a court order that specifies the amount to be garnished from the debtor's wages or bank account. Once the order is secured, the creditor can serve the garnishment notice to the debtor's employer or financial institution. It is important for both parties to understand their rights and responsibilities during this process to ensure compliance with applicable laws.

Steps to complete the continuing garnishment

Completing the continuing garnishment process involves the following steps:

- Obtain a court order that authorizes the garnishment.

- Prepare the garnishment notice to be served to the debtor's employer or bank.

- Serve the notice according to state laws, ensuring that all legal requirements are met.

- Monitor the payments received and maintain accurate records of all transactions.

- Respond to any objections or requests for hearings from the debtor.

Key elements of the continuing garnishment

Several key elements define the continuing garnishment process. These include:

- The court order, which specifies the amount and duration of the garnishment.

- The debtor's income or bank account information, which must be disclosed to initiate the garnishment.

- Compliance with federal and state laws, which govern the maximum amounts that can be garnished and the procedures for serving notices.

- The rights of the debtor, including the ability to contest the garnishment in court.

Legal use of the continuing garnishment

The legal use of the continuing garnishment is governed by both federal and state laws. These regulations ensure that garnishments are conducted fairly and protect debtors from excessive financial strain. For instance, the Consumer Credit Protection Act limits the amount that can be garnished from a debtor's paycheck to a certain percentage, ensuring that individuals retain enough income for their basic needs. Understanding these legal frameworks is crucial for both creditors and debtors to navigate the garnishment process effectively.

Filing deadlines / Important dates

Filing deadlines and important dates related to the continuing garnishment process can vary by state. Generally, creditors must file the garnishment order promptly after obtaining it, and there may be specific timelines for serving the notice to the debtor's employer or bank. Additionally, debtors often have a limited period to contest the garnishment, which can range from a few days to several weeks, depending on state laws. Keeping track of these deadlines is essential to ensure compliance and protect the rights of all parties involved.

Quick guide on how to complete continuing garnishment

Complete Continuing Garnishment effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Manage Continuing Garnishment on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The simplest method to modify and eSign Continuing Garnishment effortlessly

- Locate Continuing Garnishment and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, cumbersome form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Continuing Garnishment and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is continuing garnishment and how can airSlate SignNow help?

Continuing garnishment refers to a legal process allowing lenders to collect payments directly from a debtor's income. airSlate SignNow streamlines the documentation process required for initiating continuing garnishments, enabling businesses to sign and send necessary documents efficiently.

-

How does airSlate SignNow ensure compliance with continuing garnishment laws?

airSlate SignNow includes built-in compliance features that help businesses stay updated with the latest laws surrounding continuing garnishment. This ensures that your documents are legally binding and compliant, reducing the risk of challenges during the garnishment process.

-

What are the costs associated with using airSlate SignNow for continuing garnishment?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes. With its cost-effective solution, users can manage continuing garnishments without incurring high fees, making it budget-friendly for companies looking to automate their processes.

-

Can I integrate airSlate SignNow with other tools for managing continuing garnishment?

Yes, airSlate SignNow integrates seamlessly with popular business tools like Salesforce, Google Drive, and Dropbox. This allows for smoother collaboration and management of documentation related to continuing garnishment without needing to switch platforms.

-

What features does airSlate SignNow offer for tracking continuing garnishment documents?

airSlate SignNow includes features such as real-time tracking and automated notifications. These tools help businesses monitor the status of continuing garnishment documents, ensuring that everything remains on schedule and organized.

-

How does eSigning improve the efficiency of continuing garnishment processes?

eSigning eliminates the need for physical signatures, which can delay the continuing garnishment process. With airSlate SignNow, documents can be signed instantly online, thus speeding up the entire workflow and reducing wait times for businesses.

-

Is airSlate SignNow user-friendly for managing continuing garnishment?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage continuing garnishment documentation. Its simple interface allows users to navigate through the process without requiring extensive training.

Get more for Continuing Garnishment

- Area of a circle word problems worksheet pdf form

- Percent increase and decrease worksheet form

- Surrender partial withdrawal application form sbi life

- Rubric for storyboard form

- Electronic document preparation and management textbook pdf form

- Mylicensesite form

- Insight electronic commerce trading partner agreement form

- Bk brace form

Find out other Continuing Garnishment

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online