Debtor Person Form

What is the Debtor Person

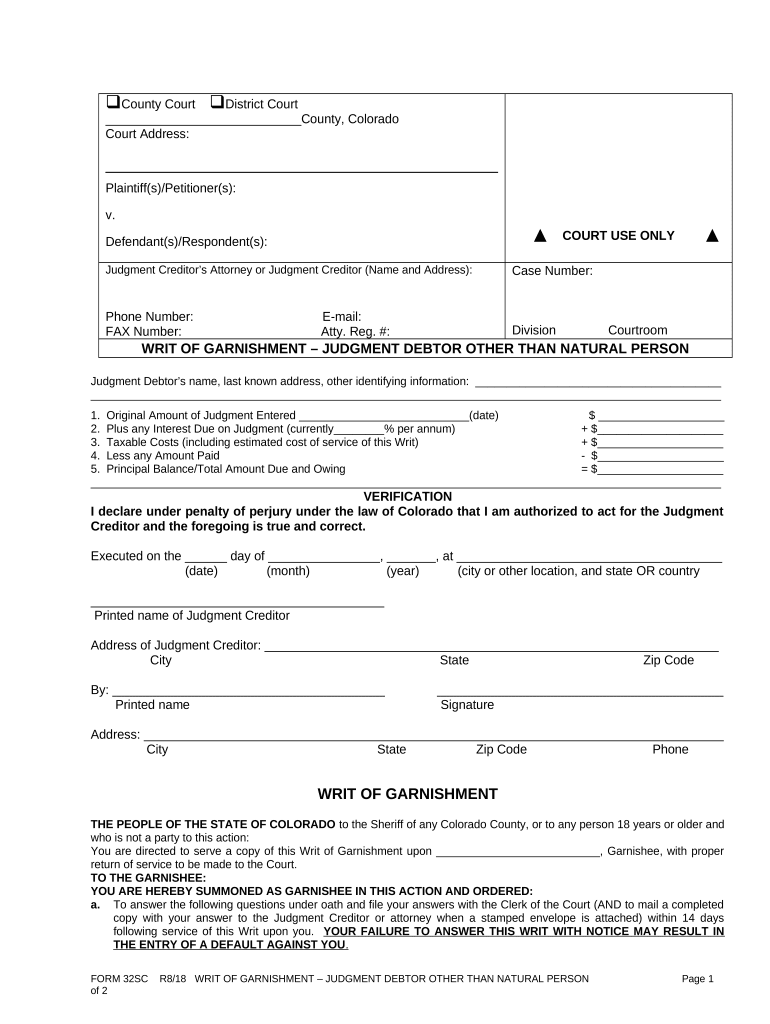

The debtor person refers to an individual or entity that owes money to a creditor, often as a result of a court judgment. In the context of a Colorado writ garnishment, the debtor person is the party whose wages or bank accounts may be subject to garnishment to satisfy a debt. Understanding the role of the debtor person is crucial, as it determines how and when funds can be legally withheld from their income or accounts.

Steps to complete the Debtor Person

Completing the debtor person form involves several key steps to ensure accuracy and compliance with legal requirements. The process typically includes:

- Gathering necessary personal information, such as the debtor's full name, address, and Social Security number.

- Identifying the creditor and the amount owed, which is essential for the garnishment process.

- Filling out the form accurately, ensuring all sections are completed to avoid delays.

- Reviewing the form for any errors or omissions before submission.

- Submitting the completed form to the appropriate court or agency as required by Colorado law.

Legal use of the Debtor Person

The legal use of the debtor person form is governed by state laws, including the Colorado Revised Statutes. This form is used to initiate the garnishment process, allowing creditors to collect debts through legal means. It is important for the debtor person to understand their rights and obligations under these laws, as improper use of the form can lead to legal complications or disputes.

State-specific rules for the Debtor Person

Each state, including Colorado, has specific rules regarding the garnishment process and the use of the debtor person form. In Colorado, the creditor must obtain a judgment before initiating garnishment. Additionally, there are limits on the amount that can be garnished from wages or bank accounts, which are designed to protect the debtor person from undue financial hardship. Familiarity with these state-specific rules is essential for both creditors and debtors.

Required Documents

To complete the debtor person form for a Colorado writ garnishment, certain documents are typically required. These may include:

- A copy of the court judgment that establishes the debt.

- Proof of the debtor person's identity, such as a driver's license or Social Security card.

- Any additional documentation that supports the creditor's claim, such as invoices or contracts.

Having these documents ready can streamline the process and ensure compliance with legal requirements.

Form Submission Methods

The debtor person form can be submitted through various methods, depending on the preferences of the creditor and the requirements of the court. Common submission methods include:

- Online submission through the court's electronic filing system, if available.

- Mailing the completed form to the appropriate court address.

- In-person submission at the courthouse, allowing for immediate processing and feedback.

Choosing the right submission method can impact the speed and efficiency of the garnishment process.

Quick guide on how to complete debtor person

Accomplish Debtor Person effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, enabling you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Debtor Person on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Debtor Person without exertion

- Locate Debtor Person and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specially supplies for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put aside worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Debtor Person and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado writ garnishment?

A Colorado writ garnishment is a legal order allowing creditors to collect debts directly from a debtor's wages or bank accounts. This process is initiated following a judgment in a civil case. Understanding the intricacies of a Colorado writ garnishment can help businesses navigate debt recovery more effectively.

-

How does airSlate SignNow facilitate the Colorado writ garnishment process?

airSlate SignNow streamlines the document signing process for Colorado writ garnishments, enabling businesses to efficiently prepare and send legal documents. The platform's eSign functionality ensures that all parties can sign documents remotely and securely. This efficient management can signNowly reduce the time involved in enforcing a writ garnishment.

-

What are the costs associated with using airSlate SignNow for Colorado writ garnishment?

airSlate SignNow offers a cost-effective solution for businesses handling Colorado writ garnishments, with various pricing plans available to suit different needs. You can select a plan that fits your volume of document handling while enjoying features like unlimited signatures and secure cloud storage. This makes managing a Colorado writ garnishment process financially feasible for all businesses.

-

Are there any specific features in airSlate SignNow for handling Colorado writ garnishment?

Yes, airSlate SignNow includes features specifically designed for the Colorado writ garnishment process, such as customizable templates and automated workflows. Users can easily create templates for repetitive documents, ensuring compliance with Colorado laws. These features enhance efficiency and accuracy when dealing with garnishment-related documents.

-

Can airSlate SignNow integrate with other applications for Colorado writ garnishment management?

Absolutely! airSlate SignNow can integrate with numerous applications to effectively manage Colorado writ garnishment processes. This integration capability allows businesses to sync data, streamline operations, and maintain better organizational control over their garnishment cases. Seamless integrations enhance your overall workflow efficiency.

-

What benefits does airSlate SignNow offer for managing legal documents like Colorado writ garnishments?

airSlate SignNow provides numerous benefits for managing legal documents like Colorado writ garnishments, including enhanced security and compliance with state regulations. The platform is user-friendly, enabling both senders and signers to navigate the processes easily. Additionally, the cloud-based nature ensures that documents are accessible anytime, anywhere.

-

Is it easy to track the status of a Colorado writ garnishment using airSlate SignNow?

Yes, airSlate SignNow makes it easy to track the status of your Colorado writ garnishment. The platform provides real-time notifications and a dashboard that allows businesses to monitor the progress of their documents. This level of visibility helps ensure timely action in the garnishment process.

Get more for Debtor Person

Find out other Debtor Person

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe