Rut 50 Form

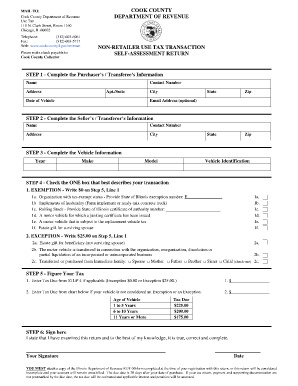

What is the Rut 50?

The Rut 50 is a tax form used in Illinois for reporting various tax credits and adjustments related to individual income tax. It is primarily utilized by residents who are eligible for specific tax benefits, allowing them to claim credits that can reduce their overall tax liability. The form is essential for ensuring compliance with state tax laws and for accurately reflecting any adjustments that may apply to an individual's tax situation.

How to obtain the Rut 50

To obtain the Rut 50 form, individuals can visit the Illinois Department of Revenue's official website, where the form is available for download in PDF format. Additionally, physical copies may be available at local tax offices or public libraries. It is advisable to ensure that the most current version of the form is used to avoid any issues during filing.

Steps to complete the Rut 50

Completing the Rut 50 involves several key steps:

- Gather necessary documents, including income statements and any relevant tax credit information.

- Download the Rut 50 form and open it using a PDF viewer or print it out for manual completion.

- Carefully fill in all required fields, ensuring accuracy in reporting income and applying for credits.

- Review the completed form for any errors or omissions before submission.

- Submit the form either electronically or by mailing it to the designated address provided by the Illinois Department of Revenue.

Legal use of the Rut 50

The Rut 50 is legally recognized as a valid tax form when completed accurately and submitted in accordance with state regulations. To ensure its legal standing, taxpayers must adhere to the guidelines set forth by the Illinois Department of Revenue. This includes providing truthful information and maintaining records that support the claims made on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Rut 50 align with the state income tax filing deadlines. Typically, taxpayers must submit their Rut 50 by April 15 of each year. However, it is essential to check for any updates or changes to deadlines, especially for extensions or specific circumstances that may affect filing requirements.

Form Submission Methods (Online / Mail / In-Person)

The Rut 50 can be submitted through various methods:

- Online: Taxpayers can file electronically using approved e-filing platforms that support the Rut 50 form.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Illinois Department of Revenue.

- In-Person: Individuals may also submit the form in person at designated tax offices during business hours.

Quick guide on how to complete rut 50 100080579

Effortlessly Prepare Rut 50 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to quickly create, modify, and eSign your documents without delays. Manage Rut 50 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The easiest way to edit and eSign Rut 50 without any hassle

- Find Rut 50 and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Select important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for such tasks.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Modify and eSign Rut 50 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rut 50 100080579

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rut 50 pdf and how can it benefit my business?

The rut 50 pdf is a digital document format that simplifies the signing process for users. It allows for secure and efficient electronic signatures, which can save time and reduce paperwork. Utilized within airSlate SignNow, it enhances workflow and productivity for businesses by streamlining document management.

-

How much does airSlate SignNow cost for using the rut 50 pdf?

Pricing for airSlate SignNow varies based on the plan you choose, starting at an affordable rate for basic features. Each plan supports the use of rut 50 pdf documents, allowing you to send, sign, and manage your documents efficiently. A free trial is also available to help you evaluate the service before committing.

-

What features are included with rut 50 pdf in airSlate SignNow?

When you use the rut 50 pdf format with airSlate SignNow, you gain access to a variety of features such as template creation, document tracking, and eSignature verification. These features streamline the signing process, making it easy to manage multiple documents. Additionally, the platform offers robust security to keep your data safe.

-

Can I integrate rut 50 pdf with other software tools?

Yes, airSlate SignNow offers integrations with numerous software tools, allowing you to incorporate rut 50 pdf into your existing workflow seamlessly. Whether you're using CRM systems or document management software, these integrations can enhance productivity and data flow. Check the integration options to see which tools you currently use.

-

Is it safe to use rut 50 pdf for sensitive documents?

Absolutely, using rut 50 pdf with airSlate SignNow is secure for handling sensitive documents. The platform employs industry-standard encryption and security protocols to protect your data. This ensures that your electronic signatures and document contents are safe from unauthorized access.

-

How do I create a rut 50 pdf to send for signatures?

Creating a rut 50 pdf in airSlate SignNow is straightforward. Simply upload your document, make any needed adjustments, and prepare it for signatures by adding signature fields. Within minutes, you can send it out for signing, making it incredibly efficient.

-

What makes rut 50 pdf different from other document formats?

The rut 50 pdf format is specifically designed to facilitate the electronic signing process, which distinguishes it from traditional document formats. With optimized features for eSigning, users can enjoy a more streamlined experience when collecting signatures. airSlate SignNow leverages this format to enhance document workflows effectively.

Get more for Rut 50

- Reaffirmation agreement secured debt south dakota form

- South dakota agreement form

- Verification of creditors matrix south dakota form

- Correction statement and agreement south dakota form

- Closing statement south dakota form

- Flood zone statement and authorization south dakota form

- Name affidavit of buyer south dakota form

- Name affidavit of seller south dakota form

Find out other Rut 50

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document