Notice of Levy Colorado Form

What is the Notice Of Levy Colorado

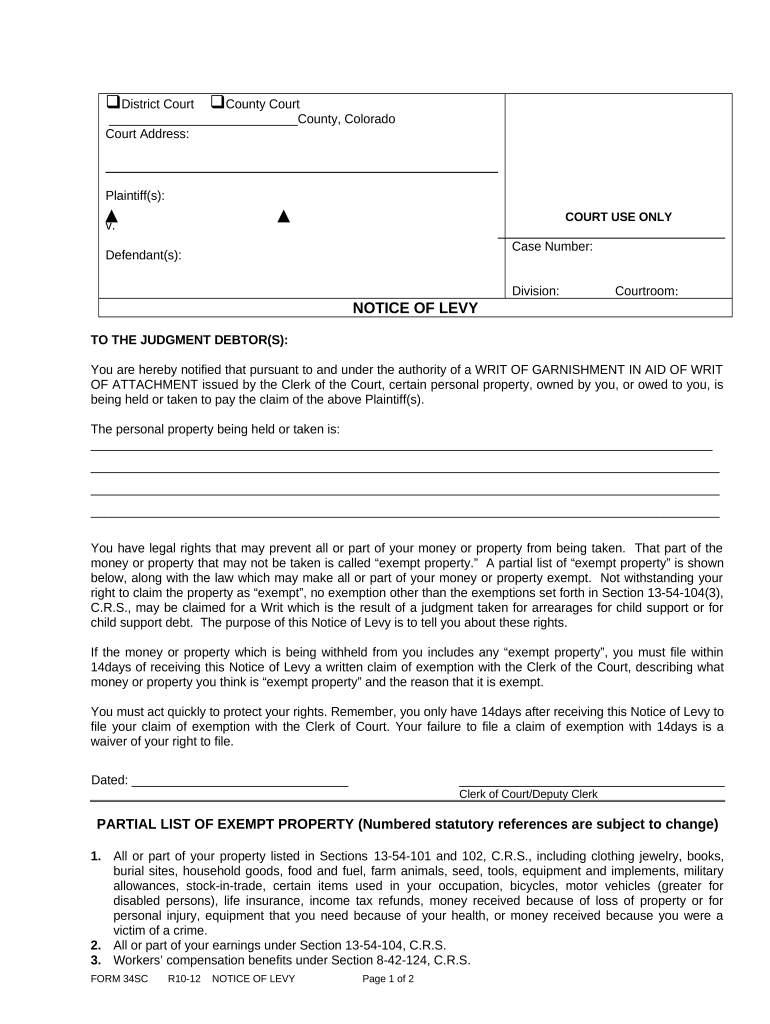

The Notice of Levy in Colorado is a legal document issued by the state to inform individuals or businesses that their property or assets are being seized to satisfy a tax obligation. This form is often associated with unpaid taxes and is a crucial step in the collection process. It serves as an official notification that the state has taken action to recover owed amounts, which may include wages, bank accounts, or other assets. Understanding this document is essential for anyone facing tax issues in Colorado.

How to use the Notice Of Levy Colorado

Using the Notice of Levy in Colorado involves several steps. Once you receive the notice, it is important to review the details carefully. This includes checking the amount owed, the assets being levied, and any deadlines for response. If you believe the levy is unjust, you have the right to contest it. You can request a hearing or negotiate with the tax authorities to resolve the issue. Properly addressing the notice is crucial to protect your rights and assets.

Steps to complete the Notice Of Levy Colorado

Completing the Notice of Levy in Colorado involves a systematic approach to ensure accuracy and compliance. Here are the steps to follow:

- Gather all relevant financial documents, including tax returns and correspondence with tax authorities.

- Fill out the form with accurate information, ensuring that all required fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate channels, which may include online submission, mail, or in-person delivery.

Key elements of the Notice Of Levy Colorado

The Notice of Levy in Colorado includes several key elements that are essential for its validity. These elements typically consist of:

- The name and address of the taxpayer.

- The specific amount owed to the state.

- A description of the property or assets being levied.

- The date of the notice and any relevant deadlines.

- Instructions on how to respond or contest the levy.

Legal use of the Notice Of Levy Colorado

The legal use of the Notice of Levy in Colorado is governed by state tax laws. This document must be executed in accordance with these laws to ensure its enforceability. Tax authorities are required to follow specific procedures when issuing a levy, including providing adequate notice to the taxpayer. Understanding the legal framework surrounding this form helps individuals and businesses navigate their rights and obligations effectively.

Filing Deadlines / Important Dates

Filing deadlines associated with the Notice of Levy in Colorado are critical for taxpayers. Typically, the notice will specify a deadline by which the taxpayer must respond or contest the levy. Missing this deadline can result in the automatic enforcement of the levy, leading to the seizure of assets. It is essential to mark these dates on your calendar and take timely action to protect your interests.

Quick guide on how to complete notice of levy colorado

Complete Notice Of Levy Colorado effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Notice Of Levy Colorado on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-driven process today.

The easiest way to modify and eSign Notice Of Levy Colorado with ease

- Obtain Notice Of Levy Colorado and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure private information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Notice Of Levy Colorado and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Notice of Levy in Colorado?

A Notice of Levy in Colorado is a legal document used by the Colorado Department of Revenue to seize an individual's or business's assets in order to satisfy tax obligations. This notice informs the taxpayer of the impending seizure and provides them an opportunity to address their tax debts. Understanding this process is crucial for anyone facing tax liens in Colorado.

-

How can airSlate SignNow help with the Notice of Levy process in Colorado?

airSlate SignNow simplifies the process of managing important documents like the Notice of Levy in Colorado by allowing businesses to electronically sign and send documents securely. Our platform streamlines communication with tax authorities, ensuring that you can quickly respond to notices and manage your tax affairs efficiently. Using our service can signNowly reduce processing time and improve compliance.

-

What are the costs associated with using airSlate SignNow for handling a Notice of Levy in Colorado?

airSlate SignNow offers cost-effective solutions tailored to fit your business needs. Pricing depends on the number of users and features you select, making it flexible for small businesses or larger enterprises dealing with Notices of Levy in Colorado. For detailed pricing, visit our website or contact our customer support for a personalized quote.

-

What features does airSlate SignNow provide for managing a Notice of Levy in Colorado?

Our platform offers features such as eSignature capabilities, document templates, and secure document storage. These functionalities allow you to easily create, sign, and store vital documents, including the Notice of Levy in Colorado, ensuring you have everything you need at your fingertips. Additionally, we provide real-time notifications to keep you updated on your document status.

-

Is airSlate SignNow legally compliant for handling Notices of Levy in Colorado?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, ensuring that documents like the Notice of Levy in Colorado are valid and enforceable. Our platform adheres to the ESIGN Act and UETA, giving you peace of mind that your electronic transactions meet legal requirements. Trust us for your documentation needs.

-

Can I integrate airSlate SignNow with other software for handling Notices of Levy in Colorado?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, including CRM systems and document management tools. This capability allows you to consolidate your workflow and efficiently manage the Notice of Levy in Colorado alongside other important business documents. Check our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for tax-related documents in Colorado?

By using airSlate SignNow for tax-related documents such as the Notice of Levy in Colorado, you benefit from increased efficiency, faster processing times, and enhanced security. Our electronic signature solution eliminates the hassles of printing and mailing, allowing you to manage your tax documents from anywhere. Avoid delays and streamline your processes with our user-friendly platform.

Get more for Notice Of Levy Colorado

- Symbiotic relationships worksheet form

- The way you are expected to act by others at work answers form

- Living in balance curriculum pdf form

- United states postal service retail quick tip sheet 2022 form

- Final wishes worksheet pdf form

- Ankle band exercises pdf form

- Inr log sheet form

- Culinary union disability benefits 515905476 form

Find out other Notice Of Levy Colorado

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document