Instructions for Closing a Small Estate Informally Colorado

What is the Instructions For Closing A Small Estate Informally in Colorado

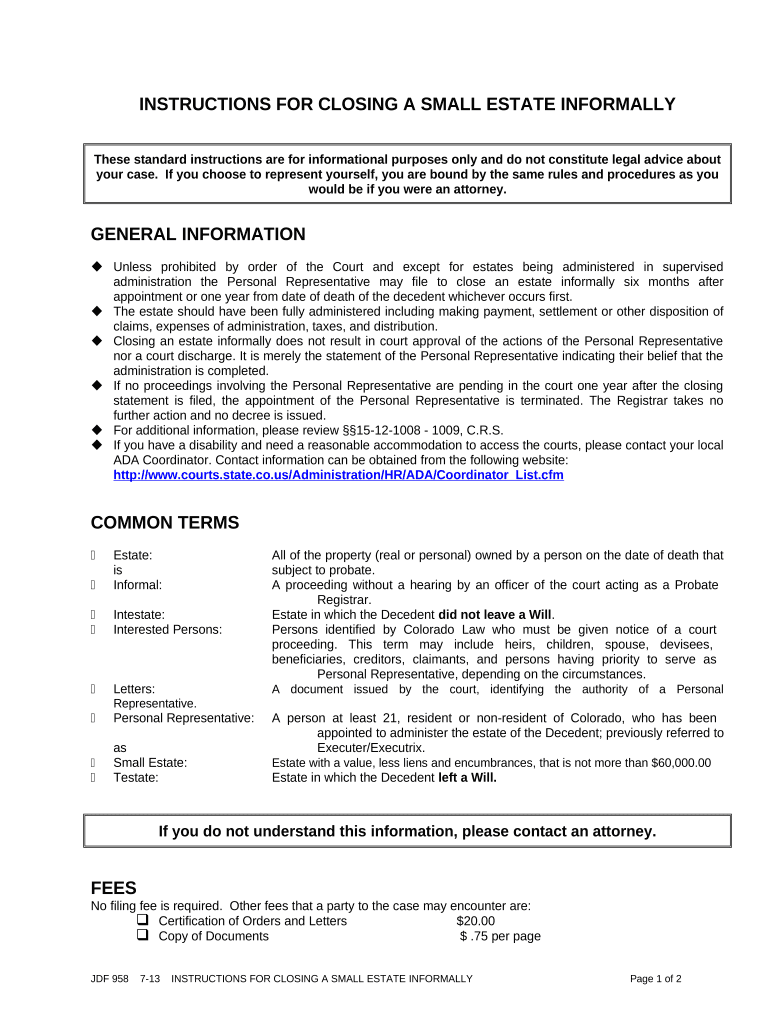

The Instructions For Closing A Small Estate Informally in Colorado provide a streamlined process for settling the estate of a deceased individual without formal probate. This method is particularly beneficial for small estates, where the total value of assets falls below a specified threshold, allowing heirs to avoid the complexities of traditional probate proceedings. The informal process typically involves gathering necessary documents, notifying heirs, and distributing assets according to the deceased's wishes or state law.

Steps to Complete the Instructions For Closing A Small Estate Informally in Colorado

To effectively close a small estate informally in Colorado, follow these essential steps:

- Determine if the estate qualifies as a small estate under Colorado law.

- Gather all relevant documents, including the death certificate and any existing wills.

- Notify all heirs and beneficiaries of the estate.

- Compile an inventory of the deceased's assets and debts.

- Distribute the assets according to the will or state intestacy laws if no will exists.

- Complete any necessary forms to finalize the estate closure.

Legal Use of the Instructions For Closing A Small Estate Informally in Colorado

Legal use of the Instructions For Closing A Small Estate Informally in Colorado requires adherence to state laws governing small estates. The process must comply with specific regulations, including the value limits set by the state and the proper notification of heirs. It's crucial to ensure that all documentation is accurate and complete, as any discrepancies could lead to legal challenges or delays in the estate settlement.

Key Elements of the Instructions For Closing A Small Estate Informally in Colorado

Several key elements must be considered when utilizing the Instructions For Closing A Small Estate Informally in Colorado:

- Eligibility criteria for small estates, including asset value limits.

- Required documentation, such as death certificates and wills.

- Notification procedures for heirs and beneficiaries.

- Asset distribution methods, whether according to a will or state intestacy laws.

- Finalization of the estate closure, including any necessary forms.

State-Specific Rules for the Instructions For Closing A Small Estate Informally in Colorado

Colorado has specific rules governing the informal closure of small estates. The total value of the estate must not exceed a certain amount, which is adjusted periodically. Additionally, the process requires that all interested parties be notified, and any outstanding debts must be settled before asset distribution. Understanding these state-specific rules is essential for ensuring compliance and avoiding potential legal issues.

Required Documents for Closing a Small Estate Informally in Colorado

Closing a small estate informally in Colorado necessitates several key documents:

- Death certificate of the deceased.

- Last will and testament, if available.

- Inventory of assets and debts.

- Notices sent to heirs and beneficiaries.

- Any forms required by the state to finalize the estate closure.

Quick guide on how to complete instructions for closing a small estate informally colorado

Complete Instructions For Closing A Small Estate Informally Colorado seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the correct form and store it securely online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Instructions For Closing A Small Estate Informally Colorado on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to alter and eSign Instructions For Closing A Small Estate Informally Colorado with ease

- Locate Instructions For Closing A Small Estate Informally Colorado and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that task by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Instructions For Closing A Small Estate Informally Colorado and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the general Instructions For Closing A Small Estate Informally in Colorado?

The basic Instructions For Closing A Small Estate Informally in Colorado involve preparing a small estate affidavit, collecting the decedent's assets, and distributing them according to the state's probate rules. This process allows heirs to settle the estate without court intervention, simplifying and speeding up the process. Additionally, it is essential to ensure that the value of the estate falls within the small estate limits set by Colorado law.

-

How can airSlate SignNow help with Instructions For Closing A Small Estate Informally in Colorado?

airSlate SignNow streamlines the process of handling documents related to Instructions For Closing A Small Estate Informally in Colorado. By using our eSigning platform, you can create, share, and sign necessary documents electronically, ensuring faster execution. This reduces the need for physical paperwork and enhances the efficiency of managing your small estate.

-

Are there any costs associated with using airSlate SignNow while following the Instructions For Closing A Small Estate Informally in Colorado?

Using airSlate SignNow comes with a variety of pricing plans that cater to different user needs. These plans are designed to be cost-effective while providing essential features to assist with the Instructions For Closing A Small Estate Informally in Colorado. You can choose a plan based on your estate's complexity and your document management needs.

-

What features does airSlate SignNow offer that are useful for the Instructions For Closing A Small Estate Informally in Colorado?

airSlate SignNow offers features like customizable templates, secure eSignatures, and the ability to track document status in real time. These features can signNowly simplify the process of following the Instructions For Closing A Small Estate Informally in Colorado and ensure that all parties are informed and up to date throughout the estate closing process.

-

Can I integrate airSlate SignNow with other applications while managing Instructions For Closing A Small Estate Informally in Colorado?

Yes, airSlate SignNow provides seamless integrations with various third-party applications, enhancing your workflow while following the Instructions For Closing A Small Estate Informally in Colorado. Whether you need to connect with document management systems, CRMs, or team collaboration tools, our platform supports multiple integrations for a smoother experience.

-

What benefits can I expect when using airSlate SignNow for Instructions For Closing A Small Estate Informally in Colorado?

By using airSlate SignNow for Instructions For Closing A Small Estate Informally in Colorado, you can expect improved efficiency, reduced paperwork, and faster document processing times. Our platform ensures that all required signatures are obtained quickly, allowing you and your beneficiaries to settle the estate without unnecessary delays or complications.

-

Is airSlate SignNow secure for handling sensitive documents during the Instructions For Closing A Small Estate Informally in Colorado?

Yes, airSlate SignNow employs robust security measures to protect your sensitive documents while you follow the Instructions For Closing A Small Estate Informally in Colorado. We use bank-level encryption, secure data storage, and compliant practices to ensure your documents are safe throughout the entire signing process.

Get more for Instructions For Closing A Small Estate Informally Colorado

Find out other Instructions For Closing A Small Estate Informally Colorado

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple