Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children Connecticut Form

What is the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Connecticut

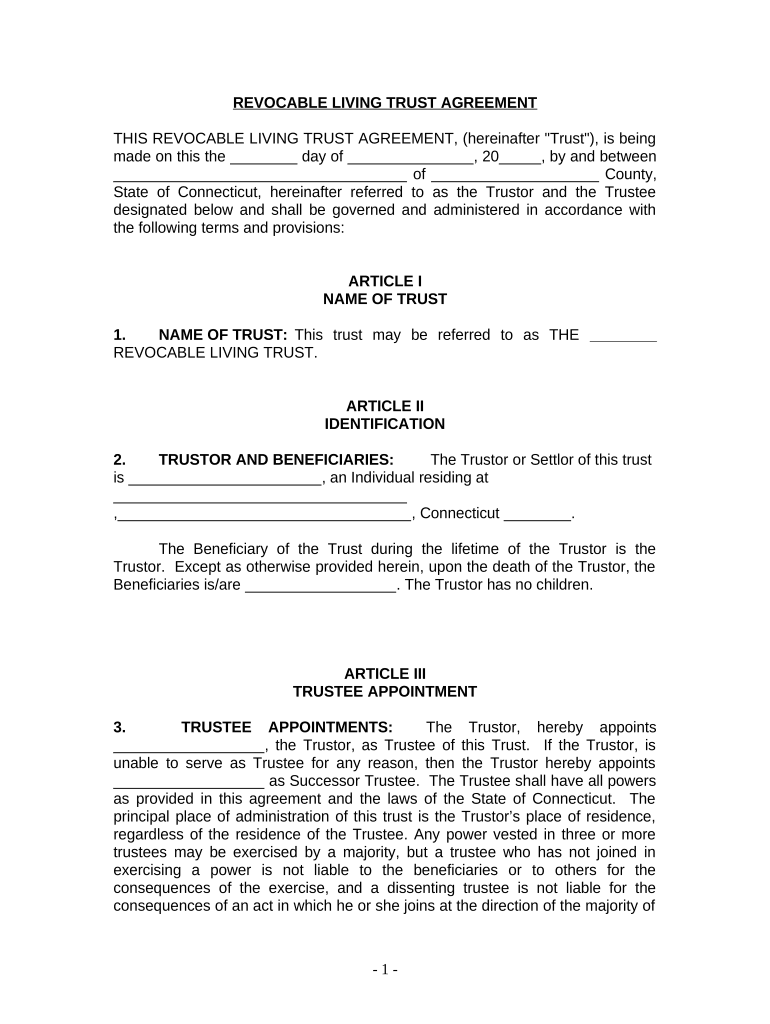

A living trust for individuals who are single, divorced, or widowed without children in Connecticut is a legal arrangement that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust can help avoid probate, which is the legal process of distributing a deceased person's assets. In Connecticut, a living trust can be revocable, allowing the individual to make changes or dissolve the trust as needed. It provides flexibility and control over asset management and distribution, ensuring that the individual's wishes are honored.

Steps to Complete the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Connecticut

Completing a living trust involves several key steps:

- Determine your assets: Identify all assets you wish to include in the trust, such as bank accounts, real estate, and investments.

- Choose a trustee: Select a trusted individual or institution to manage the trust. This person will be responsible for carrying out your wishes.

- Draft the trust document: Create a legal document that outlines the terms of the trust, including how assets will be managed and distributed.

- Fund the trust: Transfer ownership of your assets into the trust. This may involve changing titles or account names.

- Review and update: Regularly review the trust to ensure it reflects your current wishes and make updates as necessary.

Legal Use of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Connecticut

The legal use of a living trust in Connecticut allows individuals to manage their assets effectively while providing clear instructions for asset distribution after death. This trust is recognized by Connecticut law and can be used to avoid probate, which can be time-consuming and costly. It is essential to ensure that the trust document complies with state laws to be enforceable. Having a living trust can also provide peace of mind, knowing that your assets will be handled according to your wishes, regardless of your marital status or whether you have children.

State-Specific Rules for the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Connecticut

In Connecticut, there are specific rules governing living trusts that individuals should be aware of:

- Revocability: Living trusts can be revocable, allowing the grantor to modify or terminate the trust at any time during their lifetime.

- Trustee requirements: The trustee can be the grantor or another individual, but they must be legally competent and able to manage the trust assets.

- Asset transfer: To ensure the trust is effective, assets must be properly transferred into the trust, which may require legal documentation.

- Tax implications: Living trusts do not typically affect income taxes, but it is advisable to consult a tax professional regarding any potential implications.

Key Elements of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Connecticut

Key elements of a living trust include:

- Grantor: The individual creating the trust, who retains control over the assets.

- Trustee: The person or entity responsible for managing the trust according to the grantor's instructions.

- Beneficiaries: Individuals or entities designated to receive assets from the trust after the grantor's death.

- Trust document: A written legal document that outlines the terms and conditions of the trust, including how assets are to be managed and distributed.

How to Use the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Connecticut

Using a living trust involves understanding its structure and purpose. Once established, the grantor can manage their assets within the trust, allowing for seamless transitions of ownership upon death. It is important to communicate with the trustee about your wishes and ensure they understand their responsibilities. Regularly reviewing the trust can help adapt to any changes in personal circumstances or financial situations. Utilizing digital tools for signing and managing trust documents can enhance efficiency and security.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with no children connecticut

Complete Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Connecticut with ease on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents quickly without delays. Manage Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Connecticut on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Connecticut effortlessly

- Find Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Connecticut and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or hide sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Connecticut and guarantee excellent communication at every phase of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for individuals who are single, divorced, or widowed without children in Connecticut?

A Living Trust for individuals who are single, divorced, or widowed without children in Connecticut is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This type of trust can help streamline the estate planning process, provide privacy, and avoid probate.

-

How does a Living Trust benefit someone who is single, divorced, or a widow or widower with no children in Connecticut?

A Living Trust for individuals who are single, divorced, or widowed with no children in Connecticut helps simplify asset management and ensures that your wishes are honored after your passing. It provides flexibility, reduces estate taxes, and protects your assets from probate, ensuring a smoother transition for your beneficiaries.

-

What are the typical costs associated with setting up a Living Trust in Connecticut?

The costs for establishing a Living Trust for individuals who are single, divorced, or widowed without children in Connecticut can vary depending on the complexity of your estate and the attorney fees. Generally, you can expect to pay between $1,000 to $3,000 for professional services, while online services may offer more affordable options.

-

Are there any specific features of a Living Trust that cater to singles or those without children in Connecticut?

Yes, when creating a Living Trust for individuals who are single, divorced, or widowed without children in Connecticut, you can include unique features such as specifying alternate beneficiaries, setting up criteria for asset distribution, or outlining your healthcare wishes. This customization ensures that your intentions are clear and respected.

-

Can a Living Trust in Connecticut be changed after it is created?

Yes, a Living Trust for individuals who are single, divorced, or widowed with no children in Connecticut is revocable, meaning you can amend it anytime as your circumstances or intentions change. This flexibility allows you to adapt the trust to accommodate new assets or changes in your personal situation.

-

How does airSlate SignNow simplify the process of creating a Living Trust in Connecticut?

airSlate SignNow streamlines the creation of a Living Trust for individuals who are single, divorced, or widowed without children in Connecticut by providing an easy-to-use online platform for e-signing essential documents. This solution is cost-effective and allows for efficient management of your Living Trust documents securely.

-

What integrations does airSlate SignNow offer that can enhance the Living Trust process?

airSlate SignNow integrates with various applications that can improve the Living Trust creation process for individuals who are single, divorced, or widowed without children in Connecticut. These integrations include document storage solutions, cloud services, and customer relationship management (CRM) tools, enabling a seamless workflow.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Connecticut

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Connecticut

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter