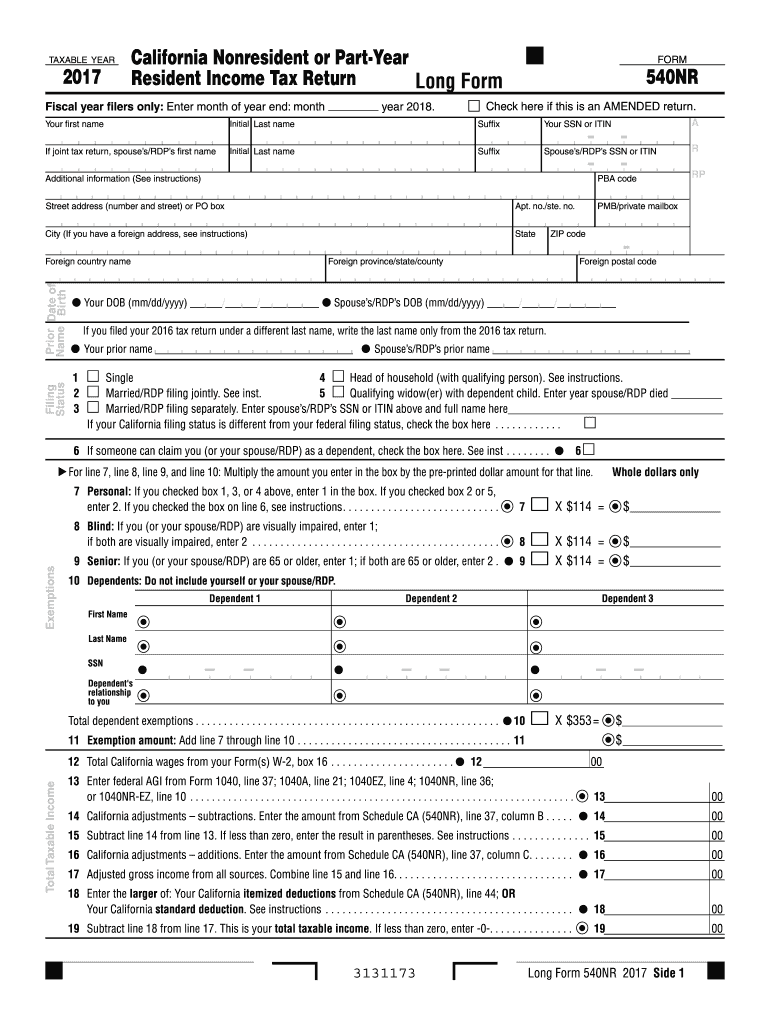

Form 540NR Long California Nonresident or Part Year Resident Income Tax Return Form 540NR Long California Nonresi

Understanding the 2017 Form 592

The 2017 Form 592 is a California tax form used for reporting the income of nonresidents and part-year residents. This form is essential for individuals who earn income in California but do not reside in the state for the entire year. It allows the California Franchise Tax Board to assess the correct amount of tax owed based on the income generated within the state. Understanding the purpose and requirements of this form is crucial for compliance with California tax laws.

Steps to Complete the 2017 Form 592

Completing the 2017 Form 592 requires careful attention to detail. Here are the key steps involved:

- Gather all necessary documentation, including income statements and any relevant tax documents.

- Fill out the personal information section, ensuring accuracy in your name, address, and taxpayer identification number.

- Report your total income earned in California, including wages, rental income, and other sources.

- Calculate your total tax liability based on the income reported.

- Sign and date the form, certifying that the information provided is accurate and complete.

Legal Use of the 2017 Form 592

The 2017 Form 592 is legally binding when filled out correctly and submitted to the appropriate tax authorities. It is important to ensure that all information is truthful and complete, as inaccuracies can lead to penalties or legal repercussions. The form must be filed according to California state tax regulations, and it is advisable to keep a copy for your records.

Filing Deadlines for the 2017 Form 592

Timely submission of the 2017 Form 592 is essential to avoid penalties. The filing deadline typically aligns with the due date for personal income tax returns in California. For most taxpayers, this is April 15 of the following year. However, if you are unable to meet this deadline, you may be eligible for an extension, but it is crucial to check the specific requirements and procedures for extensions.

Required Documents for the 2017 Form 592

To complete the 2017 Form 592 accurately, you will need several documents, including:

- W-2 forms from employers for income earned in California.

- 1099 forms for any freelance or contract work.

- Records of rental income or other sources of income generated in California.

- Previous tax returns, if applicable, to ensure consistency in reporting.

Form Submission Methods for the 2017 Form 592

The 2017 Form 592 can be submitted through various methods, including:

- Online submission via the California Franchise Tax Board's website, if applicable.

- Mailing a paper copy of the completed form to the designated tax office.

- In-person submission at local tax offices, ensuring you have all necessary documentation.

Quick guide on how to complete 2017 form 540nr long california nonresident or part year resident income tax return 2017 form 540nr long california nonresident

Complete Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi without any hassle

- Locate Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Craft your eSignature using the Sign feature, which takes just a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi while ensuring excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 540nr long california nonresident or part year resident income tax return 2017 form 540nr long california nonresident

How to generate an eSignature for the 2017 Form 540nr Long California Nonresident Or Part Year Resident Income Tax Return 2017 Form 540nr Long California Nonresident online

How to make an electronic signature for the 2017 Form 540nr Long California Nonresident Or Part Year Resident Income Tax Return 2017 Form 540nr Long California Nonresident in Chrome

How to generate an electronic signature for putting it on the 2017 Form 540nr Long California Nonresident Or Part Year Resident Income Tax Return 2017 Form 540nr Long California Nonresident in Gmail

How to generate an eSignature for the 2017 Form 540nr Long California Nonresident Or Part Year Resident Income Tax Return 2017 Form 540nr Long California Nonresident from your mobile device

How to create an electronic signature for the 2017 Form 540nr Long California Nonresident Or Part Year Resident Income Tax Return 2017 Form 540nr Long California Nonresident on iOS

How to make an eSignature for the 2017 Form 540nr Long California Nonresident Or Part Year Resident Income Tax Return 2017 Form 540nr Long California Nonresident on Android OS

People also ask

-

What is the Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi?

The Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi is a tax form used by individuals who are nonresidents or part-year residents of California. This form allows taxpayers to report their income earned in California and calculate their tax liability accurately. Utilizing this form is essential for compliance with California state tax laws.

-

How can I complete the Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi?

You can complete the Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi by gathering your income documents, deductions, and credits applicable to your situation. You can fill out the form manually or use online tax software that guides you through the process step by step. Ensure all information is accurate to avoid delays with your tax return.

-

What are the benefits of using airSlate SignNow for signing the Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi?

Using airSlate SignNow for signing the Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi provides a fast, secure, and legally binding way to eSign documents. It simplifies the process by allowing you to sign from anywhere, reducing the need for printing and mailing. Additionally, you can track the status of your document in real-time.

-

Is there a cost associated with using airSlate SignNow for the Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi?

Yes, there is a cost associated with using airSlate SignNow, but it is typically more cost-effective than traditional methods of document signing. Pricing plans are flexible and designed to accommodate different business needs. You can choose a plan based on the volume of documents you need to sign, ensuring you get the best value for your requirements.

-

Can I integrate airSlate SignNow with other tools when handling the Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and CRM systems. These integrations allow for seamless document management and help simplify the process of preparing and signing the Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi. This ensures all your documents are organized and easily accessible.

-

What features does airSlate SignNow offer for managing the Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi?

airSlate SignNow provides a range of features specifically designed to manage the Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi effectively. Key features include customizable templates, bulk sending capabilities, and advanced security measures like encryption. These tools enhance efficiency and ensure your documents are handled securely.

-

How does airSlate SignNow ensure the security of the Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi?

Security is a top priority for airSlate SignNow when handling the Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi. The platform employs high-level encryption, secure data storage, and compliance with industry standards to protect your sensitive information. This ensures that your tax documents are safe from unauthorized access.

Get more for Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi

- Quality us environmental protection agency epa form

- Wisconsin hud room board rates form

- Onlineguestteachercom form

- A typeable version of the california ccw application form

- San luis obispo sheriff dept form

- Suburban hospital scholarship form

- Youth fund mobile loan form

- Where to obtain form c1 for renewing british

Find out other Form 540NR Long California Nonresident Or Part Year Resident Income Tax Return Form 540NR Long California Nonresi

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement