Chart for Determining Amount of Wages Subject to Attachment Garnishment 15% Delaware Form

What is the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware

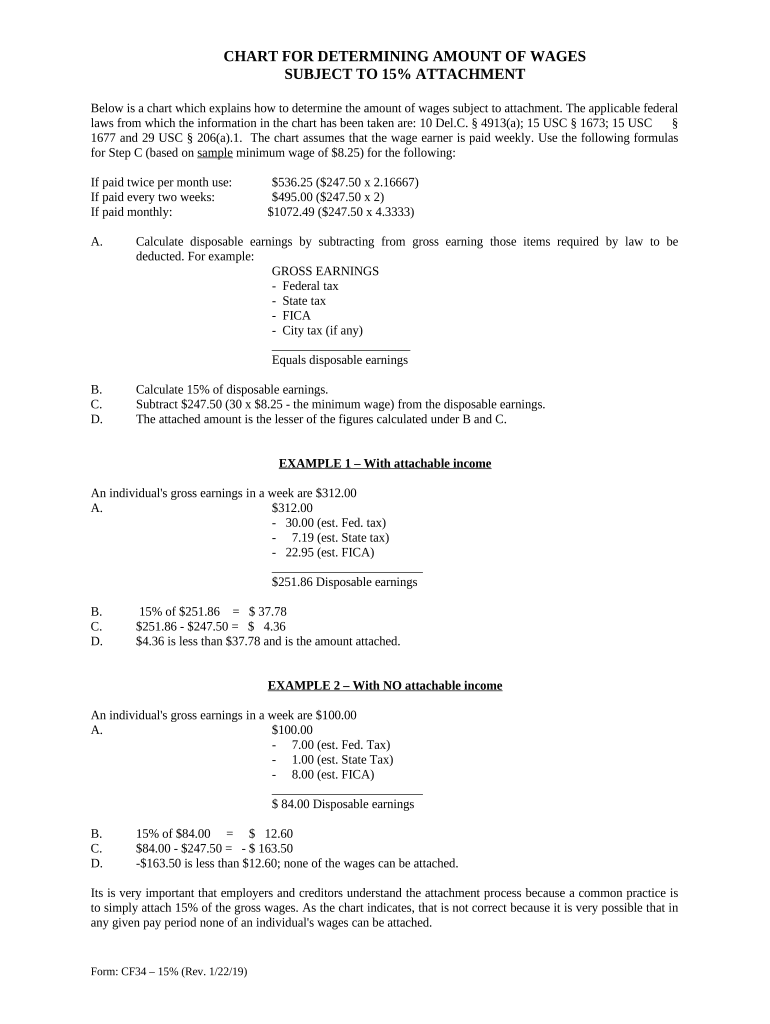

The Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware is a legal tool used to calculate the portion of an employee's wages that can be garnished under Delaware law. This chart is significant for employers and employees alike, as it provides clear guidelines on how much of an individual's earnings may be subject to garnishment for debts. The 15% figure refers to the maximum percentage of disposable earnings that can be withheld from an employee's paycheck, ensuring compliance with state regulations while protecting a portion of the employee's income.

How to use the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware

Using the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware involves a few straightforward steps. First, identify the employee's disposable earnings, which are the earnings left after mandatory deductions such as taxes and social security. Next, refer to the chart to find the applicable percentage based on the employee's income level. This will help determine the exact amount that can be garnished. It is essential to follow these steps carefully to ensure compliance with Delaware's garnishment laws and to protect the rights of the employee.

Steps to complete the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware

Completing the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware requires several key actions:

- Calculate the employee's disposable earnings by subtracting mandatory deductions from gross pay.

- Locate the employee's income level on the chart.

- Determine the garnishment amount by applying the 15% garnishment rate to the disposable earnings.

- Document the calculation for payroll records and ensure the employee is informed of the garnishment.

Legal use of the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware

The legal use of the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware is crucial for employers to avoid potential legal issues. Employers must adhere to the guidelines set forth in the chart to ensure that they are not garnishing more than the law allows. Failure to comply can result in penalties or legal action from employees. It is important for employers to stay updated on any changes in state laws regarding wage garnishment to maintain compliance and protect both their business and their employees.

State-specific rules for the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware

Delaware has specific rules regarding wage garnishment that are reflected in the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15%. These rules dictate the maximum percentage that can be garnished and outline the process employers must follow. For instance, Delaware law mandates that garnishments must not exceed 15% of disposable earnings, and employers are required to notify employees about the garnishment process. Understanding these state-specific rules is essential for ensuring compliance and protecting the rights of employees.

Examples of using the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware

Examples of using the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware can help clarify its application. For instance, if an employee earns $1,000 in disposable income, the maximum amount that can be garnished would be $150, which is 15% of their disposable earnings. Another example is if an employee's disposable earnings are $800, the garnishment would be $120. These examples illustrate how the chart functions in real-world scenarios and emphasize the importance of accurate calculations to ensure compliance with state laws.

Quick guide on how to complete chart for determining amount of wages subject to attachment garnishment 15 delaware

Easily Prepare Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric workflows today.

The simplest way to modify and eSign Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware effortlessly

- Locate Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important parts of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and has the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Modify and eSign Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware?

The Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware outlines how much of an employee's wages can be garnished based on their disposable earnings. Understanding this chart is essential for employers to ensure compliance with Delaware wage garnishment laws while managing payroll effectively.

-

How does airSlate SignNow help in managing wage garnishments?

airSlate SignNow simplifies the process of managing wage garnishments by allowing businesses to document, track, and eSign necessary forms quickly. With features tailored to comply with the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware, businesses can streamline their payroll compliance activities.

-

Is airSlate SignNow cost-effective for small businesses handling wage garnishments?

Yes, airSlate SignNow offers a cost-effective solution for small businesses needing to handle wage garnishments. By utilizing our platform, you can access resources and templates related to the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware, minimizing both time and costs associated with documentation.

-

What features of airSlate SignNow support compliance with Delaware's garnishment laws?

airSlate SignNow includes features such as customizable document templates, automated workflows, and compliance alerts. These tools help ensure that businesses adhere to the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware, making it easier to handle garnishments accurately and legally.

-

Can airSlate SignNow integrate with payroll systems to manage garnishments?

Absolutely! airSlate SignNow can integrate seamlessly with various payroll systems. This integration allows for the efficient management of wage garnishments, ensuring compliance with the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware directly within your payroll processes.

-

What benefits can businesses expect from using airSlate SignNow for wage garnishment documents?

Using airSlate SignNow for wage garnishment documents provides numerous benefits, including improved efficiency, reduced paperwork, and increased accuracy. By leveraging our platform for the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware, businesses can ensure that they handle garnishments in a timely and effective manner.

-

How can I get started with airSlate SignNow for handling wage garnishments?

Getting started with airSlate SignNow is simple! Sign up for our service and explore our library of templates and tools related to the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware. Our user-friendly interface makes it easy for any business to implement effective wage garnishment practices.

Get more for Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware

Find out other Chart For Determining Amount Of Wages Subject To Attachment Garnishment 15% Delaware

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors