Trustmark Wellness Claim Form

What is the Trustmark Wellness Claim Form

The Trustmark Wellness Claim Form is a document used by policyholders to request reimbursement for eligible wellness expenses. This form is essential for individuals seeking to claim benefits associated with various wellness programs, including preventive care and health screenings. By submitting this form, members can ensure they receive the financial support they are entitled to under their Trustmark insurance policy.

How to use the Trustmark Wellness Claim Form

To effectively use the Trustmark Wellness Claim Form, follow these steps:

- Obtain the form from the Trustmark website or your insurance provider.

- Fill out the required personal information, including your policy number and contact details.

- Detail the wellness expenses incurred, including dates and types of services received.

- Attach any necessary documentation, such as receipts or invoices, to support your claim.

- Review the completed form for accuracy before submission.

- Submit the form via the preferred method outlined by Trustmark, ensuring you keep copies for your records.

Steps to complete the Trustmark Wellness Claim Form

Completing the Trustmark Wellness Claim Form involves several key steps:

- Start by downloading the form from the official Trustmark website or accessing it through your insurance account.

- Provide your personal details, including your name, address, and policy number.

- List the wellness services for which you are claiming reimbursement, ensuring to include service providers' names and dates of service.

- Attach supporting documents, such as receipts or proof of payment, to validate your claim.

- Sign and date the form to certify that the information provided is accurate and complete.

- Submit the form according to the instructions provided, either online, by mail, or in person.

Legal use of the Trustmark Wellness Claim Form

The Trustmark Wellness Claim Form must be completed and submitted in accordance with applicable laws and regulations. It is important to ensure that all information provided is truthful and accurate to avoid potential legal issues. Misrepresentation or submission of fraudulent claims can lead to penalties, including denial of the claim and possible legal action.

Required Documents

When submitting the Trustmark Wellness Claim Form, certain documents are typically required to support your claim. These may include:

- Receipts for wellness services received.

- Invoices from healthcare providers.

- Any additional documentation specified by Trustmark to validate the claim.

Form Submission Methods (Online / Mail / In-Person)

The Trustmark Wellness Claim Form can be submitted through various methods, providing flexibility for policyholders. Options typically include:

- Online Submission: Many users prefer submitting their claims through the Trustmark online portal for convenience.

- Mail: Completed forms can be mailed to the address provided on the form, ensuring to use proper postage.

- In-Person: Some may choose to deliver their claims directly to a Trustmark office, allowing for immediate confirmation of receipt.

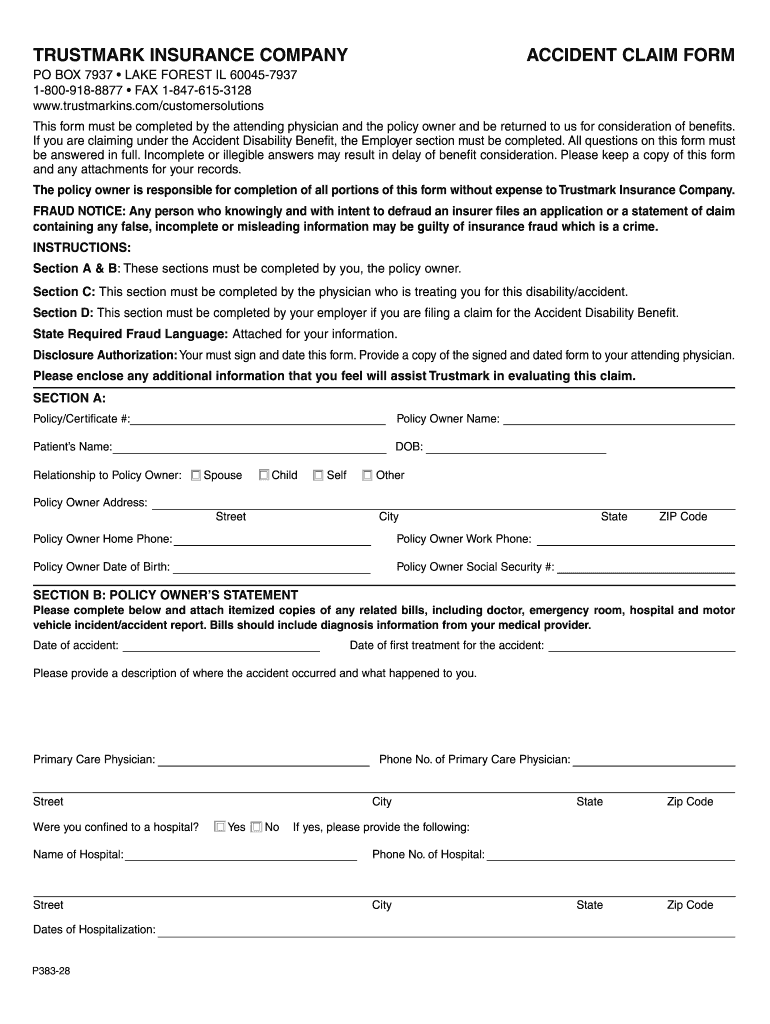

Quick guide on how to complete trustmark insurance company accident claim form

The simplest approach to discover and sign Trustmark Wellness Claim Form

Across the scale of a whole organization, ineffective procedures related to document approval can consume a signNow amount of productive time. Signing documents like Trustmark Wellness Claim Form is an inherent aspect of operations in any enterprise, which is why the effectiveness of each agreement’s lifecycle has a substantial impact on the organization’s overall productivity. With airSlate SignNow, signing your Trustmark Wellness Claim Form is as straightforward and rapid as it can be. This platform provides you with the latest version of virtually any form. Even better, you can sign it right away without the need for third-party applications on your computer or printing anything as physical copies.

Steps to obtain and sign your Trustmark Wellness Claim Form

- Browse our collection by category or use the search feature to find the document you require.

- Check the form preview by clicking Learn more to verify it’s the correct one.

- Press Get form to start editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- Once finished, click the Sign tool to approve your Trustmark Wellness Claim Form.

- Select the signature method that suits you best: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to finalize editing and move on to sharing options as needed.

With airSlate SignNow, you possess everything required to manage your documents efficiently. You can discover, complete, modify, and even dispatch your Trustmark Wellness Claim Form within a single tab without any trouble. Simplify your workflows by utilizing one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

In what cases do you have to fill out an insurance claim form?

Ah well let's see. An insurance claim form is used to make a claim against your insurance for financial, repair or replacement of something depending on your insurance. Not everything will qualify so you actually have to read the small print.

-

Do the HIPAA laws prohibit Health Insurance companies from allowing members to fill out and submit medical claim forms on line?

No, nothing in HIPAA precludes collecting the claim information online.However, the information needs to be protected at rest as well as in-flight. This is typically done by encrypting the connection (HTTPS) as well the storage media

-

How long do you have to notify your insurer of an accident?

Policy language typically says that accidents must be reported “as soon as practicable”. This is open to interpretation, depending on circumstances. If an unreasonable delay prejudices the investigation or determination of the claim, the carrier could deny coverage. However, if there is a good rationale for the delay, denial of coverage is unlikely. Having said that, please do report as soon as possible following the accident.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

What can I do about my insurance company dragging out my insurance claim after a car accident, and trying to negate or downplay my injuries?

Love the answer “turn your lawyers loose on them” that is a joke.I have seen clients with lawyers representing the injury portion of a claim… here is their modus operandi.You sign a contract with the lawyer.The lawyer files a lawsuit in 1 or 2 counties, the one in which you live and the one in which the accident occurred. These lawsuits are filed for the day before the second anniversary of the accident. Which is the limit to sue them. (You are paying these expenses, usually $500–1000 each)The lawyer places your file in a drawer and forgets about it.Whenever you call about your case the staff will respond “we're working on it” but there is nothing really being done.As it gets close to the trial date, they believe the insurer will be more willing to settle as juries are unpredictable. And if they actually start trial their fee increases signNowly.They will then accept a reasonable settlement, which is not much more than you probably would've received anyway. But now they will grind down your medical bills to get you a little more of a settlement.And penny pinch every possible fee and charge they can get out of you, like $15 to mail a letter in your behalf.In reality, if you are having trouble with an insurance company claim, contact your state's Department of Insurance or similar which regulates insurers.Also, in my experience, there are insurance companies that will delay paying as long as legally possible.Also, when speaking with opposing lawyers, watch what you say, it is not a social call, but they will trick you with vernacular… when they ask, “How are you doing?” if you say “ok” or “good” they are interpreting that as medically, and dismiss your pain, suffering, and injuries… “He said that he felt fine.” so I guess the correct answer would be, as applicable, “Well, I'm alive, suffering the worst pain I've ever felt in my life, the meds barely relieve the pain and I have not been able to sleep since the accident. I wish there were words that could adequately express what I am feeling constantly.”

-

What's the incentive for insurance company employees to investigate car accident claims thoroughly?

What's the incentive for insurance company employees to investigate car accident claims thoroughly?Most liability insurance company adjusters are college graduates and receive extensive on-the-job training. Their professional training never ends. They must be licensed in many states and are required to complete continuing education courses for each renewal on their own time. At the time of retirement I was licensed in 17 states.They are supervised closely. The supervisor is “on diary” for their claim files and will review them regularly to determine if the adjuster has adhered to “best practices”. Those requirements include, but are not limited to:Prompt contact with the insured, third party, and witnesses, usually within 24–48 hours of receiving the claim report.Preparation of an action plan outlining what is to be done on the case. Initial reserves are set, with review and revision upon every diary date.Confirmation of coverage and evaluation of any coverage issues.Completion of the investigation, including obtaining recorded or written statements from the parties involved and witnesses, ordering police reports, assigning appraisers or requesting estimates, authorizing car rental direct billing, obtaining scene photos. Retention of experts as needed.Documentation in file notes of all actions planned and completed, summaries of statements obtained and official records received, discussion of liability evaluation, decision making process, efforts made to settle or deny the claim. Completion of all data fields in the online system. Upload all documents and correspondence received. Everything must be documented.If injuries are involved, claimants are provided with medical authorization and wage loss authorization forms, medical or PIP forms. Copies of medical bills received by the claimant are requested, as are copies of medical records.As soon as the investigation is complete, prompt evaluation of liability based upon the law of the state is required.These are just the investigation guidelines. There are other best practices covering ongoing handling of the claim, required diary reviews, reports to the file, to the client, to the reinsurer, evaluation of liability and damages, supervision of defense counsel in litigated matters, prompt resolution or denial of claims.The supervisor not only will be on diary to make sure that the best practices are followed, making remedial instructions, and each quarter a certain number of closed files will be audited and graded. Those audit results are a signNow portion of the adjuster’s annual performance review. Home office auditors also review a number of each adjuster’s closed files.Most insurance companies and claims adjusters are highly ethical. Insurance companies are regulated by the states and must provide good faith claims handling. The incentive to the individual adjusters to do thorough investigations is their paychecks and personal integrity. Those who do poor jobs don’t last very long.

Create this form in 5 minutes!

How to create an eSignature for the trustmark insurance company accident claim form

How to generate an eSignature for the Trustmark Insurance Company Accident Claim Form in the online mode

How to make an electronic signature for your Trustmark Insurance Company Accident Claim Form in Chrome

How to create an electronic signature for putting it on the Trustmark Insurance Company Accident Claim Form in Gmail

How to make an electronic signature for the Trustmark Insurance Company Accident Claim Form straight from your smart phone

How to generate an eSignature for the Trustmark Insurance Company Accident Claim Form on iOS

How to create an eSignature for the Trustmark Insurance Company Accident Claim Form on Android

People also ask

-

What is trustmark insurance company and what services do they offer?

Trustmark Insurance Company is a provider of health and wellness solutions, focusing on group and individual insurance plans. They offer a variety of services including life insurance, disability coverage, and supplemental health plans. Their solutions are designed to promote health and well-being, making it easier for customers to understand their options.

-

How does trustmark insurance company compare in pricing with other insurance providers?

Trustmark Insurance Company is known for its competitive pricing structure, making it accessible for individuals and businesses alike. While prices may vary based on the plan and coverage selected, they offer various options that fit different budgets. It's recommended to compare quotes from Trustmark with other providers to find the best fit for your needs.

-

What are the key benefits of choosing trustmark insurance company?

Choosing Trustmark Insurance Company provides several advantages, including customizable plans tailored to individual needs and a focus on preventive care. Their customer service team is dedicated to assisting clients, ensuring a smooth experience. Additionally, Trustmark's commitment to innovation means that clients have access to modern insurance solutions.

-

What features does trustmark insurance company provide in their insurance plans?

Trustmark Insurance Company offers features like online account management, telehealth services, and wellness incentives in many of their plans. These features help simplify the insurance experience, making it easier for users to track their health and claims. Moreover, their flexible coverage options allow clients to select benefits that align with their lifestyle.

-

Are there integration options available with trustmark insurance company?

Yes, Trustmark Insurance Company integrates with various platforms to enhance user experience and streamline processes. Businesses can easily connect their existing systems with Trustmark’s solutions for better data management and reporting. This compatibility ensures seamless integration, making it easier for employers to manage employee benefits.

-

How can I get started with trustmark insurance company?

To get started with Trustmark Insurance Company, you can visit their website and use their plan finder tool to explore available options. You can also contact an agent for personalized assistance based on your specific needs. Signing up is straightforward, allowing for quick access to valuable insurance solutions.

-

What do customers say about their experience with trustmark insurance company?

Customer reviews of Trustmark Insurance Company often highlight the responsiveness and helpfulness of their customer service team. Users appreciate the range of options available and the straightforward claims process. Many customers also express satisfaction with the benefits provided, which support their health and well-being.

Get more for Trustmark Wellness Claim Form

Find out other Trustmark Wellness Claim Form

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online