Non Foreign Affidavit under IRC 1445 Delaware Form

What is the Non Foreign Affidavit Under IRC 1445 Delaware

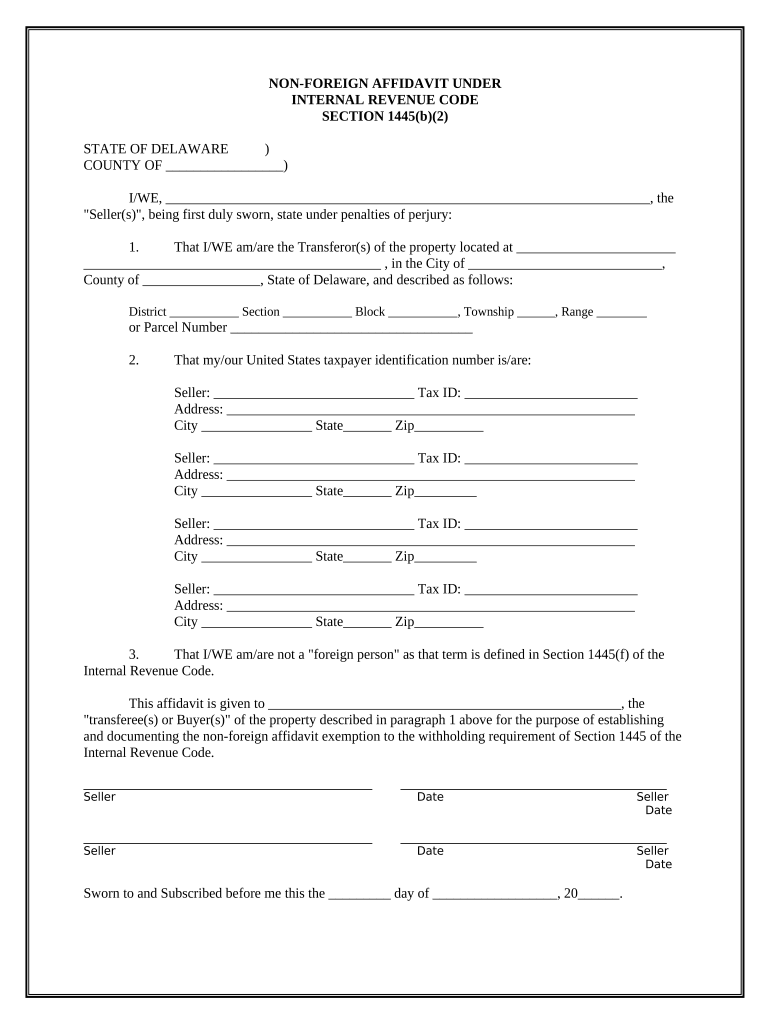

The Non Foreign Affidavit Under IRC 1445 is a legal document required in Delaware for certain real estate transactions. This affidavit certifies that the seller of the property is not a foreign person, which is significant under U.S. tax law. The Internal Revenue Code (IRC) Section 1445 mandates that buyers must withhold tax on the amount realized from the sale of U.S. real property interests by foreign persons. By submitting this affidavit, sellers confirm their status as U.S. persons, thereby exempting the buyer from withholding requirements.

How to use the Non Foreign Affidavit Under IRC 1445 Delaware

Using the Non Foreign Affidavit Under IRC 1445 involves several steps. First, the seller must complete the affidavit accurately, providing necessary personal information and confirming their non-foreign status. This form is typically presented during the closing of a real estate transaction. Buyers should ensure they receive this affidavit before finalizing the sale to avoid potential tax liabilities. Once completed, the affidavit is usually submitted to the title company or attorney handling the closing process.

Steps to complete the Non Foreign Affidavit Under IRC 1445 Delaware

Completing the Non Foreign Affidavit Under IRC 1445 requires attention to detail. Here are the key steps:

- Gather necessary information, including your full name, address, and taxpayer identification number.

- Fill out the affidavit, ensuring all fields are completed accurately.

- Sign and date the affidavit in the presence of a notary public, if required.

- Provide the completed affidavit to the buyer or their representative during the closing process.

Key elements of the Non Foreign Affidavit Under IRC 1445 Delaware

The Non Foreign Affidavit includes several critical elements that must be present for it to be valid:

- Seller's Information: Full name, address, and taxpayer identification number.

- Certification Statement: A declaration confirming the seller is not a foreign person.

- Signature: The seller's signature, often needing notarization.

- Date: The date the affidavit is signed, which is essential for record-keeping.

Legal use of the Non Foreign Affidavit Under IRC 1445 Delaware

The legal use of the Non Foreign Affidavit is crucial for compliance with federal tax laws. By accurately completing and submitting this affidavit, sellers protect themselves from potential tax withholding obligations. It serves as a legal declaration that can be used in case of audits or disputes regarding the seller's tax status. Buyers are also protected from penalties related to non-compliance with IRC Section 1445 when they obtain this affidavit.

Filing Deadlines / Important Dates

While the Non Foreign Affidavit itself does not have a specific filing deadline, it must be completed and presented at the time of closing a real estate transaction. Buyers and sellers should coordinate to ensure the affidavit is ready before the closing date to avoid any delays in the transaction. It is advisable to check for any updates on deadlines related to real estate transactions in Delaware.

Quick guide on how to complete non foreign affidavit under irc 1445 delaware

Finalize Non Foreign Affidavit Under IRC 1445 Delaware effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Non Foreign Affidavit Under IRC 1445 Delaware on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and eSign Non Foreign Affidavit Under IRC 1445 Delaware with ease

- Locate Non Foreign Affidavit Under IRC 1445 Delaware and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements within a few clicks from any device you choose. Edit and eSign Non Foreign Affidavit Under IRC 1445 Delaware and maintain exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Delaware?

A Non Foreign Affidavit Under IRC 1445 Delaware is a declaration that establishes the seller's status as a non-foreign person. This affidavit is crucial during real estate transactions to confirm tax withholding requirements. Understanding this document can help streamline your closing process and avoid unnecessary delays.

-

How does airSlate SignNow facilitate the Non Foreign Affidavit Under IRC 1445 Delaware process?

airSlate SignNow simplifies the creation and signing of a Non Foreign Affidavit Under IRC 1445 Delaware by providing an intuitive platform where users can prepare and eSign documents digitally. Our solution eliminates paperwork and ensures that your affidavit is legally compliant, saving you time and effort in the process.

-

What are the pricing options for airSlate SignNow in relation to the Non Foreign Affidavit Under IRC 1445 Delaware service?

airSlate SignNow offers a range of affordable pricing plans tailored to fit various business needs. Whether you're a casual user or a business requiring bulk document handling, our transparent pricing allows you to handle the Non Foreign Affidavit Under IRC 1445 Delaware without breaking the bank.

-

Can I customize the Non Foreign Affidavit Under IRC 1445 Delaware template in airSlate SignNow?

Yes, airSlate SignNow allows users to customize the Non Foreign Affidavit Under IRC 1445 Delaware template according to their specific requirements. You can add your branding, modify content, and ensure that the document meets all your needs while maintaining compliance.

-

What are the benefits of using airSlate SignNow for a Non Foreign Affidavit Under IRC 1445 Delaware?

Using airSlate SignNow for a Non Foreign Affidavit Under IRC 1445 Delaware provides several benefits, including reduced turnaround time and improved document security. With digital signing, you can easily share documents, track their status, and maintain a secure record of all transactions.

-

Is airSlate SignNow compliant with legal standards for the Non Foreign Affidavit Under IRC 1445 Delaware?

Absolutely! airSlate SignNow ensures that all documents, including the Non Foreign Affidavit Under IRC 1445 Delaware, are compliant with legal standards. We understand the importance of maintaining legal integrity, so our platform is designed to meet all necessary regulations.

-

What integrations does airSlate SignNow offer to support documents like the Non Foreign Affidavit Under IRC 1445 Delaware?

airSlate SignNow integrates with a variety of tools and platforms, making it easier to manage files associated with the Non Foreign Affidavit Under IRC 1445 Delaware. These integrations enhance productivity by allowing teams to work seamlessly across their favorite applications.

Get more for Non Foreign Affidavit Under IRC 1445 Delaware

Find out other Non Foreign Affidavit Under IRC 1445 Delaware

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy