Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Delaware Form

What is the Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children in Delaware

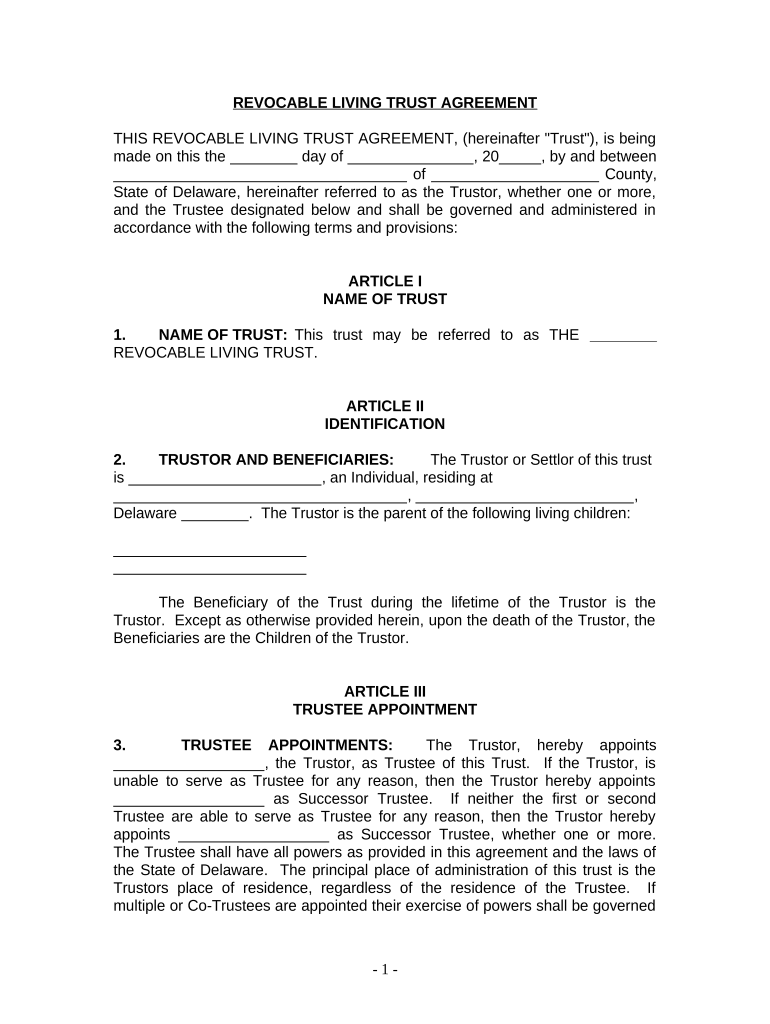

A living trust is a legal document that allows an individual to manage their assets during their lifetime and specify how those assets should be distributed after their death. For individuals who are single, divorced, or widowed with children in Delaware, a living trust can provide significant benefits. It helps avoid the probate process, which can be lengthy and costly. Additionally, it allows for more privacy regarding asset distribution, as trusts do not become public records like wills do. This type of trust can be particularly beneficial for individuals wanting to ensure their children are taken care of after their passing.

How to Use the Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children in Delaware

To effectively use a living trust, an individual must first create the document, detailing how their assets will be managed and distributed. This involves listing all assets, including real estate, bank accounts, and personal property. Once the trust is established, the individual must transfer ownership of these assets into the trust. This process is known as funding the trust. It is essential to keep the trust updated, especially after significant life changes, such as remarriage or the birth of additional children.

Steps to Complete the Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children in Delaware

Completing a living trust involves several key steps:

- Identify your assets: List all assets you wish to include in the trust.

- Choose a trustee: Decide who will manage the trust, which can be yourself or another trusted individual.

- Draft the trust document: This can be done with the help of a legal professional or using a reliable online service.

- Fund the trust: Transfer ownership of your assets into the trust.

- Review and update: Regularly review the trust to ensure it reflects your current wishes and circumstances.

Legal Use of the Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children in Delaware

In Delaware, a living trust is legally recognized and can be used to manage an individual's assets. It is essential to ensure that the trust complies with state laws to be enforceable. This includes proper execution, which typically requires the trust document to be signed and notarized. Additionally, the trust must clearly outline the terms of asset distribution to avoid potential disputes among beneficiaries.

State-Specific Rules for the Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children in Delaware

Delaware has specific laws governing living trusts that individuals should be aware of. For instance, Delaware allows for the creation of revocable living trusts, which can be altered or revoked by the grantor at any time. It's important to note that Delaware does not impose a state inheritance tax, making it an attractive option for estate planning. Furthermore, individuals should consider consulting with a local attorney to ensure compliance with any unique state regulations and to address any specific needs related to their family situation.

Key Elements of the Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children in Delaware

Key elements of a living trust include:

- Grantor: The individual creating the trust.

- Trustee: The person or entity responsible for managing the trust.

- Beneficiaries: Individuals or entities that will receive assets from the trust.

- Terms of the trust: Specific instructions on how assets should be managed and distributed.

- Revocation clause: A provision that allows the grantor to change or revoke the trust at any time.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children delaware

Prepare Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Delaware effortlessly on any gadget

Online document management has become increasingly favored by companies and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed paperwork, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delay. Handle Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Delaware on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest method to alter and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Delaware without hassle

- Locate Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Delaware and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this function.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from a device of your choice. Modify and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Delaware and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware?

A Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware is a legal document that allows individuals to manage their assets during their lifetime and specifies how they will be distributed after death. This trust can be especially beneficial for those with children, ensuring a clear plan for their care and inheritance.

-

How much does it cost to create a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware?

The cost of creating a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware varies depending on the complexity and specific requirements of your situation. Typically, you can expect to pay between $500 and $2,500 depending on whether you use a legal service or hire an attorney.

-

What are the benefits of a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware?

Having a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware offers numerous benefits including avoiding probate, maintaining privacy, and providing clear instructions for asset distribution. This ensures that your children are taken care of according to your wishes without unnecessary delays or legal complications.

-

Can I update my Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware?

Yes, one of the key features of a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware is that it can be amended or revoked at any time during your lifetime. This flexibility allows you to make changes as your circumstances change, such as a new marriage or the birth of additional children.

-

Are there any tax implications for a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware?

Generally, a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware does not affect your tax situation, as assets placed in the trust are still considered part of your estate for tax purposes. However, consulting a tax professional is advisable to understand specific implications based on your financial situation.

-

How does a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware differ from a will?

A Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware differs from a will primarily in how assets are managed and distributed. A trust avoids probate, thus offering faster distribution of assets, while a will typically goes through probate, potentially delaying the process and making it public.

-

Is it necessary to hire an attorney for my Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware?

While it's not strictly necessary to hire an attorney for a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Delaware, it is highly recommended if your situation involves complex assets or signNow wealth. An attorney can provide expert advice tailored to your needs, ensuring that your trust is set up correctly and complies with Delaware laws.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Delaware

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Delaware

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free