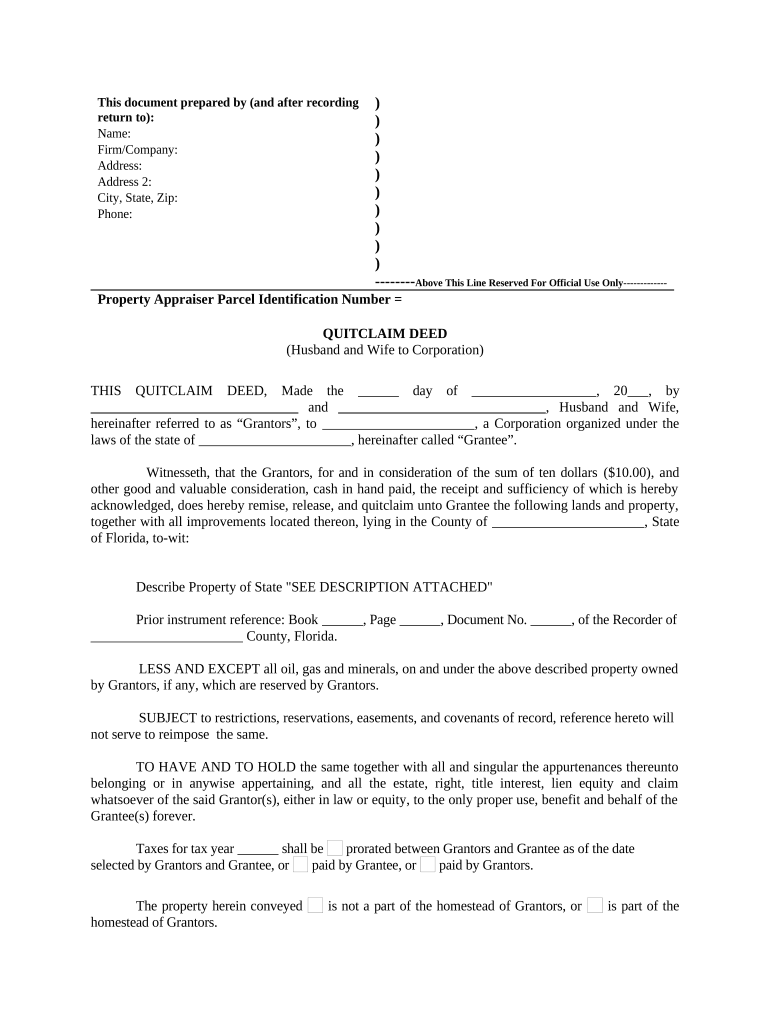

Husband Wife Corporation Form

What is the Husband Wife Corporation

A husband wife corporation is a specific type of business entity that is formed by a married couple who are both owners and operators of the business. This structure allows the couple to enjoy certain tax benefits and legal protections that are not available to sole proprietorships or partnerships. In this arrangement, both spouses can share in the management and profits of the corporation, which can be particularly advantageous for tax purposes, as it may allow for more favorable treatment under IRS regulations.

How to use the Husband Wife Corporation

To effectively utilize a husband wife corporation, both spouses should be actively involved in the business operations. This includes making decisions, managing finances, and fulfilling any legal responsibilities associated with running a corporation. It is essential to maintain clear documentation of all business activities and decisions to ensure compliance with state and federal regulations. Additionally, understanding the tax implications and benefits of this structure can help maximize financial advantages.

Steps to complete the Husband Wife Corporation

Completing the process of establishing a husband wife corporation involves several key steps:

- Choose a business name: Select a unique name that complies with state regulations.

- File articles of incorporation: Submit the necessary paperwork to your state’s Secretary of State office.

- Create bylaws: Draft the internal rules that govern the corporation’s operations.

- Obtain an Employer Identification Number (EIN): Apply for an EIN through the IRS for tax purposes.

- Open a business bank account: Keep personal and business finances separate to maintain liability protection.

Legal use of the Husband Wife Corporation

The legal use of a husband wife corporation allows couples to operate their business while enjoying limited liability protection. This means that personal assets are generally protected from business debts and liabilities. It is crucial for both spouses to adhere to corporate formalities, such as holding regular meetings and maintaining accurate records, to uphold this protection. Additionally, understanding the specific laws and regulations in your state can help ensure compliance and prevent legal issues.

IRS Guidelines

The IRS has specific guidelines regarding husband wife corporations, particularly concerning taxation. These entities may be eligible for S corporation status, which can provide significant tax benefits. Couples should be aware of the requirements for filing taxes as a corporation, including the need to file Form 1120S if electing S corporation status. It is advisable to consult with a tax professional to navigate these guidelines effectively and ensure compliance with all federal tax obligations.

Required Documents

Establishing a husband wife corporation requires several key documents, including:

- Articles of incorporation

- Bylaws of the corporation

- Employer Identification Number (EIN) application

- Business licenses and permits, as required by your state or local government

Having these documents prepared and organized is essential for a smooth formation process and ongoing compliance with legal requirements.

Eligibility Criteria

To qualify as a husband wife corporation, both spouses must be actively involved in the business. Additionally, the business must meet state-specific requirements for incorporation. Generally, there are no restrictions on the type of business that can be formed, but it is important to ensure that both spouses are willing to share responsibilities and profits. Understanding these criteria can help couples determine if this structure is suitable for their business goals.

Quick guide on how to complete husband wife corporation

Complete Husband Wife Corporation effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Husband Wife Corporation on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and electronically sign Husband Wife Corporation without hassle

- Find Husband Wife Corporation and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes just moments and holds the same legal significance as a conventional handwritten signature.

- Review all the details and click on the Done button to secure your changes.

- Choose how you wish to submit your form, via email, SMS, invite link, or download it onto your computer.

Say goodbye to lost or mislaid documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your preference. Modify and electronically sign Husband Wife Corporation and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a husband wife corporation?

A husband wife corporation is a type of business entity that is primarily owned and operated by a married couple. This structure allows for pass-through taxation, potentially reducing the overall tax burden for both spouses. Understanding how a husband wife corporation functions can help couples maximize their business advantages.

-

How can airSlate SignNow assist a husband wife corporation?

airSlate SignNow provides an efficient eSigning solution specifically tailored for a husband wife corporation. By streamlining the document signing process, it enables couples to focus on their business growth while ensuring legal compliance and document security. This tool simplifies collaboration and enhances productivity within the partnership.

-

What features does airSlate SignNow offer for small businesses like a husband wife corporation?

airSlate SignNow offers a variety of features beneficial for a husband wife corporation, including customizable templates, secure cloud storage, and multi-party signing capabilities. These tools help manage documents efficiently and ensure that all necessary signatures are captured promptly. Additionally, the platform is user-friendly and accessible from any device.

-

What are the pricing options for airSlate SignNow for a husband wife corporation?

airSlate SignNow offers flexible pricing plans suitable for a husband wife corporation, designed to accommodate small business budgets. The plans include various features that scale according to your needs and usage. You can choose a plan that best fits your corporation's document management demands, allowing for cost-effective operations.

-

Does airSlate SignNow integrate with other tools for a husband wife corporation?

Yes, airSlate SignNow seamlessly integrates with various business applications that a husband wife corporation may already use. You can connect it with CRM systems, cloud storage services, and productivity tools to create a more efficient workflow. These integrations enable you to streamline processes and enhance collaboration.

-

What benefits does using airSlate SignNow provide to a husband wife corporation?

Using airSlate SignNow provides numerous benefits to a husband wife corporation, including enhanced document security, faster transaction times, and improved flexibility. The ease of electronic signatures minimizes delays and helps maintain business continuity. Additionally, it allows for remote signing and document management, making it ideal for busy couples.

-

Is airSlate SignNow compliant with legal standards for a husband wife corporation?

Absolutely, airSlate SignNow adheres to all legal standards required for electronic signatures, making it secure for a husband wife corporation's use. All signed documents are legally binding and recognized across jurisdictions, ensuring compliance with state and federal regulations. This reliability is crucial for protecting your business interests.

Get more for Husband Wife Corporation

- Alphabet linking chart bing pdf blog alphabet linking chart form

- Sena form

- Caljobs registration form

- Brief huurverhoging form

- Genetics punnett squares practice packet ness pap biology form

- Apd 26 form

- Health guidelines for child care providers handout 35 form

- Middle class revision work set 16 kampala form

Find out other Husband Wife Corporation

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form