Revocation of Living Trust Florida Form

What is the revocation of living trust in Florida?

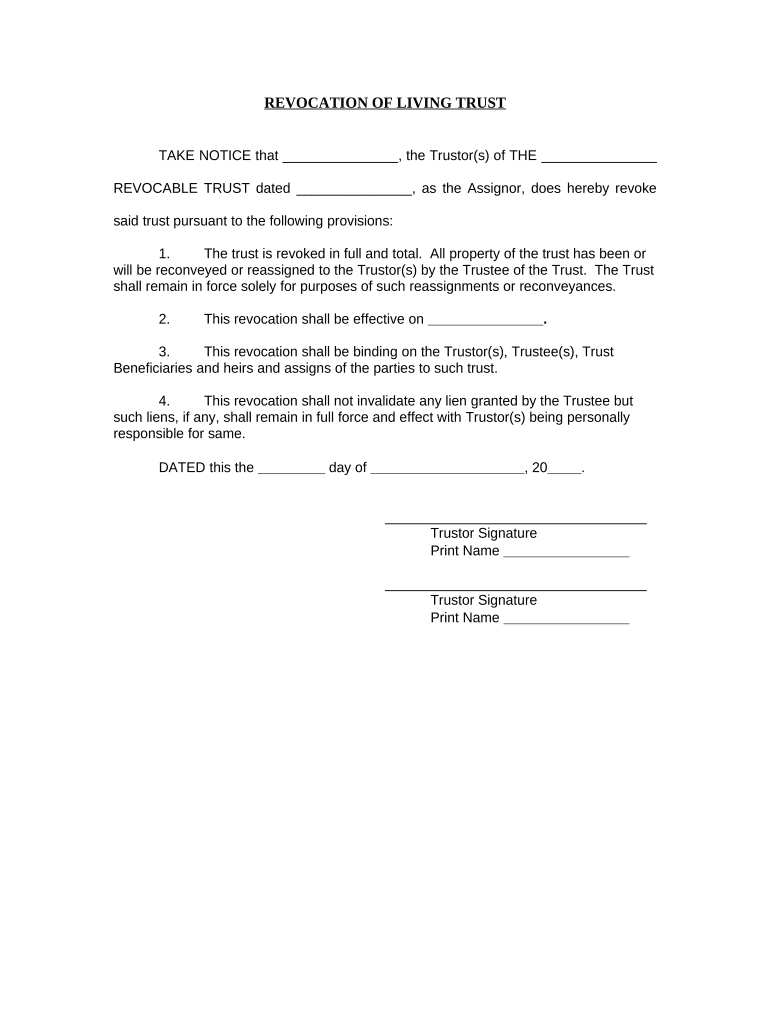

A revocation of living trust in Florida is a legal document that nullifies an existing living trust. This process allows the trust creator, known as the grantor, to reclaim control over the assets previously placed in the trust. The revocation can be necessary for various reasons, including changes in personal circumstances, financial situations, or estate planning strategies. It is essential to ensure that the revocation complies with state laws to be legally valid.

Steps to complete the revocation of living trust in Florida

Completing the revocation of a living trust in Florida involves several key steps:

- Review the original trust document: Understand the terms and conditions of the existing trust.

- Prepare the revocation document: Draft a formal revocation of living trust document, clearly stating the intent to revoke.

- Sign the document: The grantor must sign the revocation in the presence of a notary public to ensure its validity.

- Notify relevant parties: Inform any beneficiaries and financial institutions involved about the revocation.

- Retain copies: Keep copies of the signed revocation document for personal records and future reference.

Legal use of the revocation of living trust in Florida

The legal use of a revocation of living trust in Florida is crucial for ensuring that the document is recognized by courts and financial institutions. To be legally binding, the revocation must meet specific requirements outlined in Florida law. This includes proper execution, which typically involves notarization. Additionally, it is advisable to follow any state-specific guidelines to avoid potential disputes or challenges later on.

Key elements of the revocation of living trust in Florida

When drafting a revocation of living trust in Florida, certain key elements must be included to ensure its effectiveness:

- Identification of the trust: Clearly state the name of the trust and the date it was established.

- Grantor's information: Include the full name and address of the grantor.

- Statement of revocation: A clear declaration that the trust is being revoked.

- Signature and notarization: The grantor's signature must be notarized to validate the document.

State-specific rules for the revocation of living trust in Florida

Florida has specific legal requirements for the revocation of living trusts. The revocation must comply with the Florida Statutes, particularly Chapter 736, which governs trusts. It is important to follow these rules to ensure that the revocation is enforceable. Failure to adhere to state-specific guidelines may result in the revocation being deemed invalid, leading to complications in estate management.

Examples of using the revocation of living trust in Florida

There are several scenarios in which a revocation of living trust may be necessary in Florida:

- Change in marital status: A divorce or marriage may prompt the need to revoke a trust to reflect new family dynamics.

- Change in beneficiaries: If the grantor wishes to alter the beneficiaries of the trust, revocation may be required.

- Financial changes: Significant changes in financial status may necessitate a reevaluation of the trust structure.

Quick guide on how to complete revocation of living trust florida

Easily prepare Revocation Of Living Trust Florida on any device

Managing documents online has become increasingly favored by organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Revocation Of Living Trust Florida on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and electronically sign Revocation Of Living Trust Florida effortlessly

- Find Revocation Of Living Trust Florida and click Get Form to begin.

- Use the tools available to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Revocation Of Living Trust Florida and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a living trust in Florida?

A living trust in Florida is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. It helps avoid probate, ensuring a smoother transition for your heirs. By establishing a living trust, you retain control over your assets while simplifying the estate planning process.

-

How does a living trust in Florida benefit my estate planning?

Creating a living trust in Florida can provide numerous benefits, including avoiding probate and reducing estate taxes. It ensures that your assets are distributed according to your wishes without court intervention. Additionally, it offers privacy, as a living trust does not become public record like a will.

-

What are the costs associated with setting up a living trust in Florida?

The costs of setting up a living trust in Florida can vary depending on the complexity of your estate and whether you choose to work with an attorney or use an online service. Generally, it can range from a few hundred dollars to several thousand. Utilizing airSlate SignNow can help streamline the documentation process, making it more cost-effective.

-

What documents do I need to create a living trust in Florida?

To create a living trust in Florida, you'll typically need a trust document, which outlines your wishes, and a list of the assets you plan to include. You may also need to retitle your assets in the name of the trust. Using airSlate SignNow can facilitate the creation and signing of these important documents.

-

Can I modify my living trust in Florida after it's created?

Yes, one of the key features of a living trust in Florida is that it is revocable, allowing you to modify or revoke it any time during your lifetime. This flexibility ensures that your estate plan can adapt to changes in your circumstances or wishes. airSlate SignNow provides an easy way to update your trust documents securely.

-

Do I need an attorney to create a living trust in Florida?

While it's not legally required to have an attorney assist you in creating a living trust in Florida, it is highly recommended, especially if your estate is complex. An attorney can provide valuable insights and ensure that your trust is legally sound. Alternatively, airSlate SignNow offers user-friendly tools to help you create a living trust on your own.

-

How does a living trust in Florida interact with other estate planning tools?

A living trust in Florida works in conjunction with other estate planning tools like wills and powers of attorney. It's important to coordinate these documents to ensure they align with your overall plan and intentions. Using airSlate SignNow can help you organize and manage these documents effectively.

Get more for Revocation Of Living Trust Florida

Find out other Revocation Of Living Trust Florida

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer