Ga Settlement Form

What is the GA Settlement?

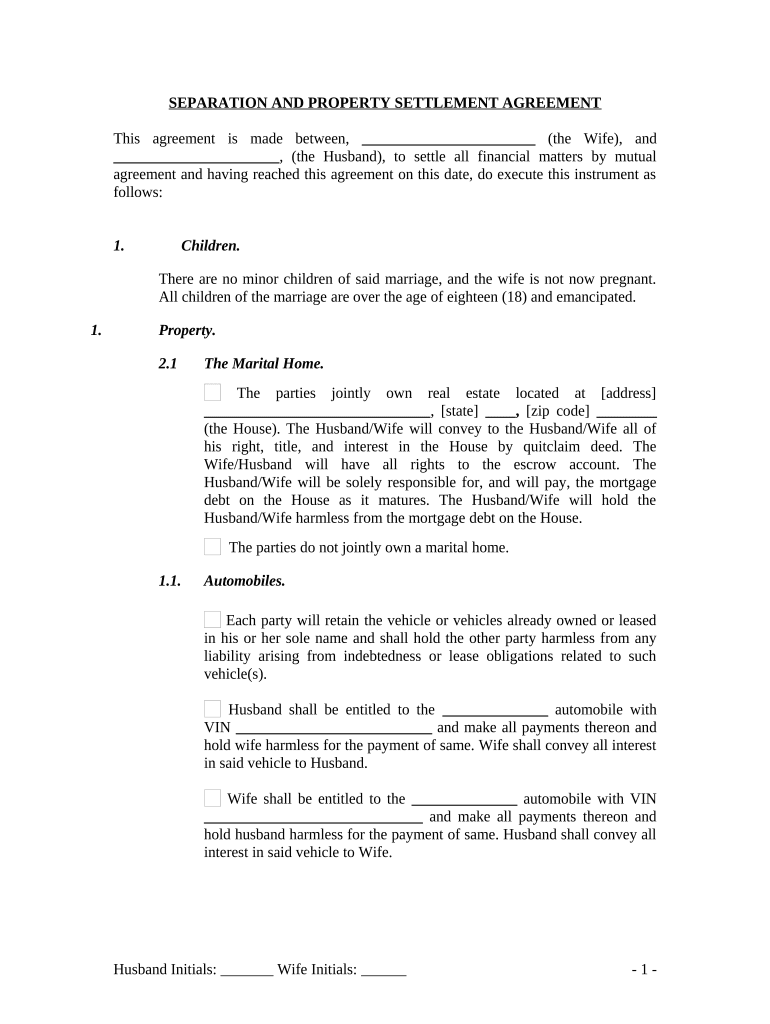

The GA settlement refers to a legal agreement that outlines the division of marital property and responsibilities between spouses in Georgia. This document is crucial during divorce proceedings, as it helps to clarify the distribution of assets, debts, and other obligations. Understanding the GA settlement is essential for individuals navigating the complexities of divorce, ensuring that their rights and interests are protected.

How to Use the GA Settlement

Using the GA settlement involves several key steps. Initially, both parties must agree on the terms of the settlement, including the division of property and any spousal support arrangements. Once an agreement is reached, the GA settlement form should be completed accurately, reflecting the agreed-upon terms. It is advisable to consult with a legal professional to ensure that the settlement complies with Georgia laws and adequately protects both parties’ rights.

Steps to Complete the GA Settlement

Completing the GA settlement involves a systematic approach:

- Gather all necessary financial documents, including income statements, tax returns, and asset valuations.

- Discuss and negotiate the terms of the settlement with your spouse.

- Draft the GA settlement form, ensuring all agreed terms are clearly stated.

- Review the completed form for accuracy and completeness.

- Both parties should sign the form in the presence of a notary public to ensure its legal validity.

Legal Use of the GA Settlement

The GA settlement is legally binding once it is signed by both parties and notarized. This document can be submitted to the court as part of the divorce proceedings. It is important to note that any changes to the settlement after submission may require further legal action. Therefore, ensuring that all terms are agreeable before signing is crucial for both parties.

Key Elements of the GA Settlement

Several key elements must be included in a GA settlement to ensure its effectiveness:

- Identification of both parties, including full names and addresses.

- A detailed list of marital assets and debts, along with their valuations.

- Terms regarding child custody, visitation, and support, if applicable.

- Provisions for spousal support, if agreed upon.

- Signatures of both parties and a notary acknowledgment.

State-Specific Rules for the GA Settlement

In Georgia, specific rules govern the creation and execution of a GA settlement. These include requirements for notarization and the necessity for both parties to voluntarily agree to the terms. Additionally, the settlement must comply with state laws regarding property division, which typically follows the principle of equitable distribution. Understanding these rules is vital for ensuring that the settlement is enforceable in court.

Quick guide on how to complete ga settlement

Prepare Ga Settlement effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly without any delays. Handle Ga Settlement on any device using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

How to modify and eSign Ga Settlement with ease

- Locate Ga Settlement and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal weight as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Ga Settlement and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a GA settlement and how does airSlate SignNow assist with it?

A GA settlement refers to the resolution of claims regarding General Agreement disputes. airSlate SignNow simplifies this process by providing a user-friendly platform to eSign and send documents related to GA settlements efficiently, ensuring all parties can agree quickly and securely.

-

What features does airSlate SignNow offer for managing GA settlements?

airSlate SignNow includes features such as document templates, audit trails, and customizable signing options specifically designed for GA settlements. These functionalities help streamline the documentation process, making it easy to track changes and maintain compliance.

-

Is airSlate SignNow a cost-effective solution for handling GA settlements?

Yes, airSlate SignNow is a cost-effective solution for managing GA settlements. With flexible pricing plans tailored to various business sizes, users can easily find a plan that fits their budget while enjoying comprehensive eSigning capabilities.

-

Can airSlate SignNow integrate with other tools for GA settlement management?

Absolutely! airSlate SignNow offers seamless integrations with popular tools and platforms, allowing users to manage GA settlements alongside their existing systems. This enhances workflow efficiency and ensures smoother operations.

-

How secure is the eSigning process for GA settlements with airSlate SignNow?

The eSigning process for GA settlements on airSlate SignNow is highly secure. The platform employs advanced encryption protocols and compliance with industry standards, ensuring that all signed documents are protected against unauthorized access.

-

How does airSlate SignNow enhance collaboration during GA settlements?

airSlate SignNow enhances collaboration during GA settlements by enabling multiple parties to review and sign documents simultaneously. This promotes faster communication and helps resolve disputes or settlements more effectively.

-

Can I customize documents for GA settlements using airSlate SignNow?

Yes, airSlate SignNow allows users to customize documents specifically for GA settlements. You can add fields, set signing orders, and include relevant information to ensure that each settlement agreement meets your organization's needs.

Get more for Ga Settlement

- Dd form 1354 excel format

- Te9 witness statement unpaid penalty charge parking form

- Nyks application form download

- Declaration for imported electronic products subject to radiation control standards form

- Aasp 60 form

- Form 58u notice of objection unimproved land valuation

- London bethlem hospital patient admission registers and form

- Fuel drive off offence report queensland police service form

Find out other Ga Settlement

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe