Deed Secure Debt Form

What is the Georgia Deed to Secure Debt?

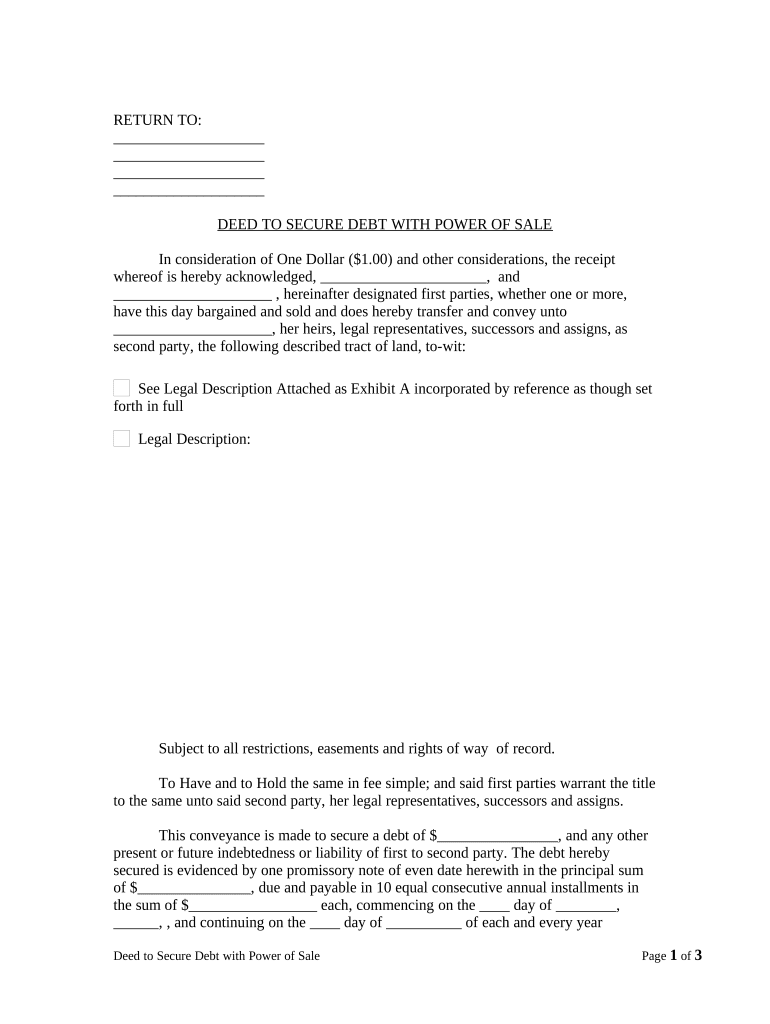

The Georgia deed to secure debt is a legal document that establishes a security interest in real property. This type of deed is commonly used in the context of securing loans, where the property serves as collateral. In essence, it allows lenders to claim the property if the borrower defaults on the loan. The deed outlines the terms of the loan, including the amount borrowed, interest rates, and repayment terms. It is crucial for both parties to understand the implications of this document, as it binds them to the agreed-upon terms.

Key Elements of the Georgia Deed to Secure Debt

Several key elements must be included in a Georgia deed to secure debt for it to be legally binding. These elements typically include:

- Parties Involved: The names of the borrower and lender must be clearly stated.

- Property Description: A detailed description of the property being used as collateral is essential.

- Loan Amount: The total amount of the loan secured by the deed should be specified.

- Interest Rate: The interest rate applicable to the loan must be clearly defined.

- Repayment Terms: The schedule for repayment, including due dates and any penalties for late payments, should be outlined.

Steps to Complete the Georgia Deed to Secure Debt

Completing a Georgia deed to secure debt involves several important steps:

- Gather Required Information: Collect all necessary details about the parties involved and the property.

- Draft the Document: Use a template or legal assistance to draft the deed, ensuring all key elements are included.

- Review the Document: Both parties should carefully review the deed to ensure accuracy and mutual agreement.

- Sign the Document: The deed must be signed by both parties in the presence of a notary public.

- Record the Deed: File the signed deed with the appropriate county office to make it legally effective.

Legal Use of the Georgia Deed to Secure Debt

The legal use of a Georgia deed to secure debt is governed by state law. It is essential for both lenders and borrowers to understand their rights and obligations under this agreement. The deed must comply with Georgia's statutory requirements to be enforceable in court. This includes proper execution, notarization, and recording. Failure to adhere to these legal standards may result in the deed being deemed invalid, which can have significant consequences for both parties involved.

Who Issues the Georgia Deed to Secure Debt?

The Georgia deed to secure debt is typically issued by the lender, who drafts the document as part of the loan agreement process. However, borrowers may also seek legal assistance to ensure their interests are adequately protected. Once the deed is executed, it is recorded with the county clerk's office, which serves as the official record of the security interest in the property. This recording is crucial, as it provides public notice of the lender's claim to the property.

State-Specific Rules for the Georgia Deed to Secure Debt

Georgia has specific rules and regulations governing the deed to secure debt. These include requirements for the document's format, the necessity of notarization, and the process for recording the deed with the county. It is important for both lenders and borrowers to familiarize themselves with these state-specific rules to ensure compliance. Understanding these regulations can help avoid potential legal issues and ensure that the deed is enforceable in the event of a dispute.

Quick guide on how to complete deed secure debt

Effortlessly Prepare Deed Secure Debt on Any Device

The management of online documents has gained signNow traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Handle Deed Secure Debt on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

The Easiest Way to Modify and Electronically Sign Deed Secure Debt Without Stress

- Obtain Deed Secure Debt and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether via email, text (SMS), or invitation link, or download it directly to your computer.

Say goodbye to lost or mislaid files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Deed Secure Debt while ensuring excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Georgia deed secure debt?

A Georgia deed secure debt is a legal instrument that secures a loan by using real estate as collateral. This type of deed provides lenders with a legal claim to the property in the event of default, ensuring greater security for both parties. Understanding this concept is essential when considering real estate transactions in Georgia.

-

How can airSlate SignNow help with Georgia deed secure debt transactions?

airSlate SignNow allows users to easily prepare, send, and eSign documents related to Georgia deed secure debt. Our platform streamlines the process, ensuring that all necessary agreements are completed efficiently and securely. By using our service, you can reduce the complexity and time involved in managing these transactions.

-

What are the costs associated with using airSlate SignNow for Georgia deed secure debt processing?

airSlate SignNow offers flexible pricing plans that cater to different needs, making it cost-effective for handling Georgia deed secure debt documentation. Our plans are designed to provide value without compromising on features, ensuring you can manage your transactions efficiently. For detailed pricing, visit our website and choose a plan that suits your needs.

-

What features does airSlate SignNow offer for Georgia deed secure debt management?

Key features of airSlate SignNow include customizable templates, secure eSignature capabilities, and real-time tracking of document status. These tools facilitate seamless management of Georgia deed secure debt agreements, enabling users to stay organized and compliant throughout the process. Our user-friendly interface ensures that everyone can navigate the system easily.

-

Are there any integrations available with airSlate SignNow for Georgia deed secure debt?

Yes, airSlate SignNow integrates with various popular applications to enhance your workflow for managing Georgia deed secure debt. These integrations allow for easy data sharing and enhance productivity by automating tasks. Check our integrations page for a complete list of compatible apps.

-

What are the benefits of using airSlate SignNow for Georgia deed secure debt documentation?

Using airSlate SignNow for Georgia deed secure debt documentation offers benefits like improved efficiency, reduced errors, and enhanced security for sensitive information. Our cloud-based platform ensures documents are accessible anytime and anywhere, streamlining collaboration between parties. Additionally, eSigning reduces the time needed for transactions signNowly.

-

How does airSlate SignNow ensure the security of Georgia deed secure debt documents?

airSlate SignNow employs advanced encryption technology and complies with industry standards to protect your Georgia deed secure debt documents. We prioritize the confidentiality and security of your information, ensuring unauthorized access is prevented. Trust in our platform to keep your transactions safe and secure.

Get more for Deed Secure Debt

Find out other Deed Secure Debt

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast