Income and Expense Statement of Plaintiff You Hawaii Form

What is the income and expense statement of plaintiff you Hawaii?

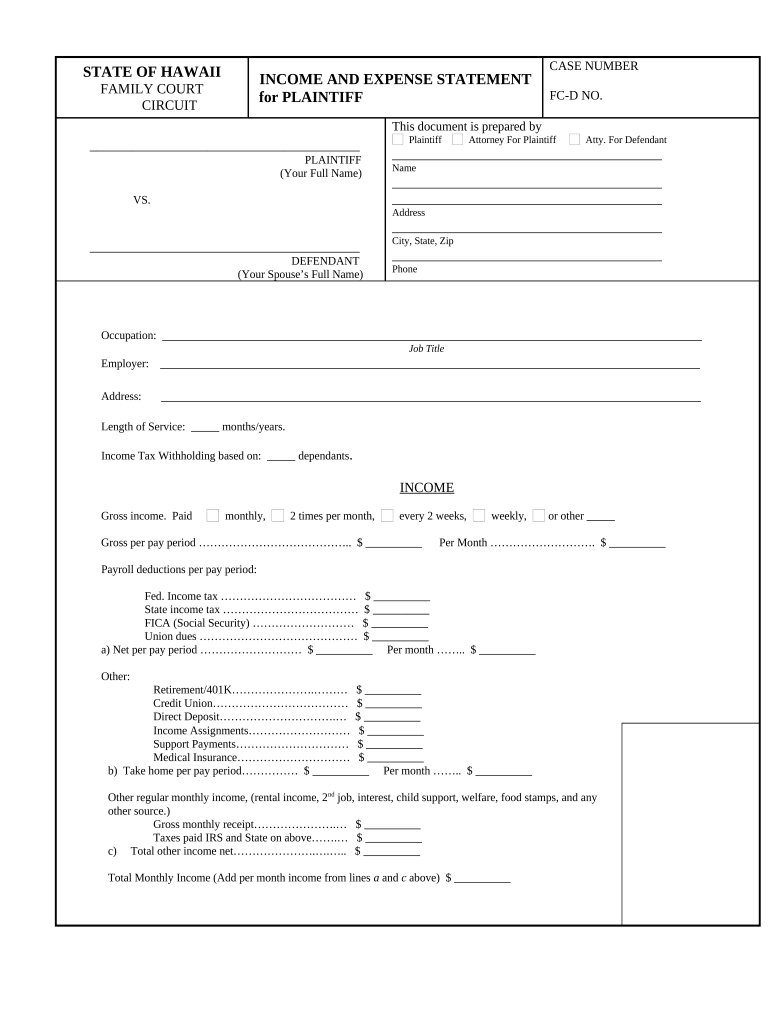

The income and expense statement of plaintiff you Hawaii is a legal document that outlines an individual's financial situation, specifically detailing their income and expenses. This form is often used in legal proceedings, such as family law cases, to provide the court with a clear picture of a party's financial status. It is essential for determining matters like child support, alimony, and other financial obligations. The statement typically includes various sources of income, such as wages, rental income, and any other earnings, alongside a comprehensive list of monthly expenses, including housing costs, utilities, and personal expenditures.

Steps to complete the income and expense statement of plaintiff you Hawaii

Completing the income and expense statement of plaintiff you Hawaii involves several key steps:

- Gather necessary financial documents, including pay stubs, bank statements, and bills.

- List all sources of income, ensuring to include regular and irregular earnings.

- Detail monthly expenses, categorizing them into fixed and variable costs.

- Calculate total income and total expenses to determine the net financial position.

- Review the completed form for accuracy and completeness before submission.

Legal use of the income and expense statement of plaintiff you Hawaii

The income and expense statement of plaintiff you Hawaii serves a critical role in legal contexts, particularly in family law matters. Courts use this document to assess a party's financial capabilities when making decisions regarding support obligations and asset division. It is important that the information provided is accurate and truthful, as discrepancies can lead to legal consequences. Additionally, this statement may be subject to verification through supporting documents, reinforcing the need for diligent record-keeping.

Key elements of the income and expense statement of plaintiff you Hawaii

Key elements of the income and expense statement of plaintiff you Hawaii include:

- Income Section: Details of all income sources, including employment wages, self-employment income, and any other earnings.

- Expense Section: A comprehensive list of monthly expenses, such as housing, utilities, transportation, and personal costs.

- Net Income Calculation: A summary that subtracts total expenses from total income to show the net financial position.

- Signature Section: A place for the individual to sign, affirming that the information provided is accurate.

How to use the income and expense statement of plaintiff you Hawaii

Using the income and expense statement of plaintiff you Hawaii effectively requires understanding its purpose and context. After completing the form, it should be submitted to the relevant court or legal authority as part of a legal proceeding. This document can also be used in negotiations regarding financial matters, providing a clear overview of one’s financial obligations and capabilities. It is advisable to keep a copy for personal records and future reference.

State-specific rules for the income and expense statement of plaintiff you Hawaii

In Hawaii, specific rules govern the use and submission of the income and expense statement of plaintiff you Hawaii. These rules may include deadlines for submission, required documentation to accompany the form, and guidelines on how to report income and expenses accurately. Familiarity with these regulations is essential to ensure compliance and avoid potential legal issues. It is recommended to consult with a legal professional or refer to state resources for the most current requirements.

Quick guide on how to complete income and expense statement of plaintiff you hawaii

Complete Income And Expense Statement Of Plaintiff You Hawaii effortlessly on any device

Online document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly option to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without unnecessary delays. Handle Income And Expense Statement Of Plaintiff You Hawaii on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Income And Expense Statement Of Plaintiff You Hawaii effortlessly

- Find Income And Expense Statement Of Plaintiff You Hawaii and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Income And Expense Statement Of Plaintiff You Hawaii and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an income and expense statement for businesses in Hawaii?

An income and expense statement is a financial document that summarizes a business's revenues and expenses over a specific period. In Hawaii, this statement is crucial for understanding profitability and making informed financial decisions. Businesses can use it to evaluate their financial health and prepare for tax obligations.

-

How can I create an income and expense statement in Hawaii using airSlate SignNow?

Creating an income and expense statement in Hawaii with airSlate SignNow is straightforward. You can easily create custom templates, fill in the necessary financial information, and electronically sign the document. This process not only saves time but also ensures compliance with local regulations.

-

What features does airSlate SignNow offer for managing income and expense statements in Hawaii?

airSlate SignNow provides features tailored for managing income and expense statements in Hawaii, including customizable templates, audit trails, and secure eSigning options. These features make it easy for businesses to maintain accurate financial records and streamline document management.

-

Is airSlate SignNow cost-effective for small businesses in Hawaii handling income and expense statements?

Yes, airSlate SignNow is a cost-effective solution for small businesses in Hawaii that need to handle income and expense statements. With flexible pricing plans, businesses can choose a package that fits their budget while still accessing powerful tools for document management and eSigning.

-

Can I integrate airSlate SignNow with other accounting software for handling income and expense statements in Hawaii?

Absolutely! airSlate SignNow can be seamlessly integrated with various accounting software applications, making it easier to manage income and expense statements in Hawaii. This integration allows for automatic data synchronization, reducing the risk of errors and saving time in financial reporting.

-

What are the benefits of using airSlate SignNow for income and expense statements in Hawaii?

Using airSlate SignNow for income and expense statements in Hawaii offers numerous benefits, including enhanced efficiency, improved accuracy, and better collaboration. The platform allows multiple users to review and sign documents electronically, making the process faster and more secure.

-

How secure is the data when I use airSlate SignNow to manage my income and expense statements in Hawaii?

Security is a top priority for airSlate SignNow, especially when it comes to handling sensitive income and expense statements in Hawaii. The platform uses advanced encryption standards and secure data storage solutions to protect your financial information from unauthorized access.

Get more for Income And Expense Statement Of Plaintiff You Hawaii

Find out other Income And Expense Statement Of Plaintiff You Hawaii

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself