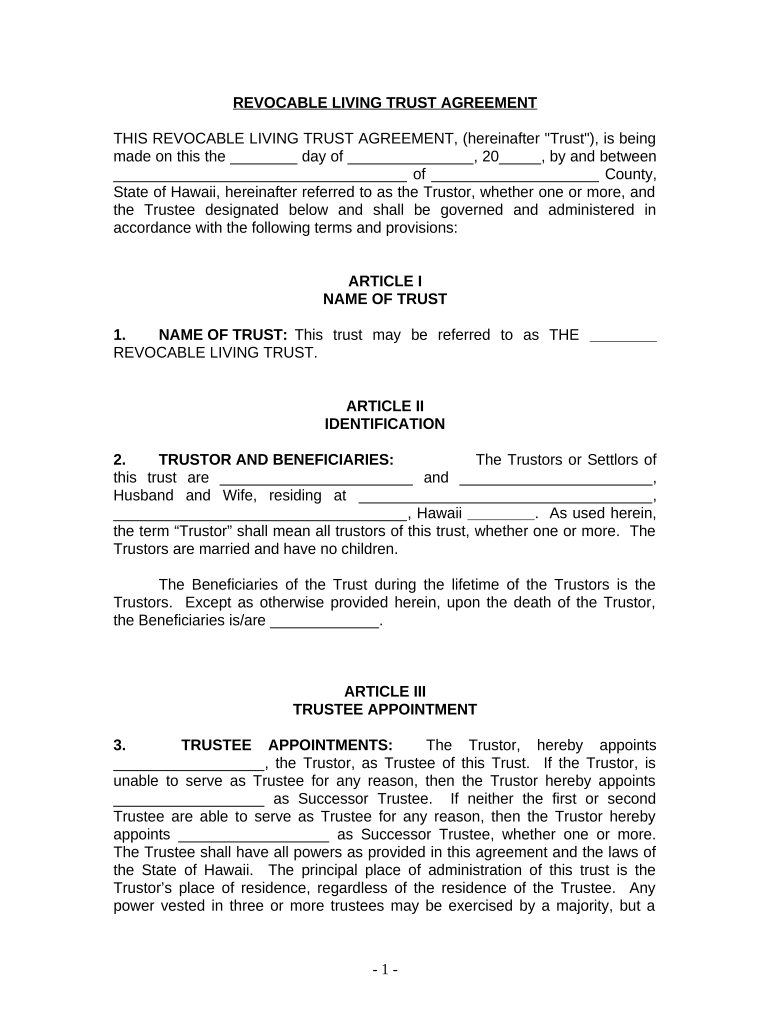

Living Trust for Husband and Wife with No Children Hawaii Form

What is the Living Trust For Husband And Wife With No Children Hawaii

A living trust for husband and wife with no children in Hawaii is a legal arrangement that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after their passing. This type of trust can simplify the estate planning process, avoiding the need for probate, which can be lengthy and costly. The trust is revocable, meaning that the couple can alter its terms or dissolve it entirely as their circumstances change.

Key Elements of the Living Trust For Husband And Wife With No Children Hawaii

Several key elements define a living trust for husband and wife with no children in Hawaii:

- Trustees: Typically, both spouses act as co-trustees, retaining control over the assets.

- Beneficiaries: The couple can designate themselves as the primary beneficiaries during their lifetime, with provisions for distribution after both have passed.

- Asset Management: The trust outlines how assets are to be managed, including real estate, bank accounts, and investments.

- Revocability: The trust can be modified or revoked at any time while both spouses are alive.

Steps to Complete the Living Trust For Husband And Wife With No Children Hawaii

Completing a living trust for husband and wife with no children in Hawaii involves several important steps:

- Consultation: Meet with an estate planning attorney to discuss your specific needs and goals.

- Drafting the Trust: The attorney will draft the trust document, incorporating your wishes regarding asset distribution.

- Funding the Trust: Transfer ownership of assets into the trust, which may include real estate, bank accounts, and other valuables.

- Review: Regularly review and update the trust as necessary, especially after major life events.

Legal Use of the Living Trust For Husband And Wife With No Children Hawaii

The living trust for husband and wife with no children in Hawaii serves several legal purposes. It allows for the seamless transfer of assets upon death, ensuring that the surviving spouse retains control without the need for probate. Additionally, it can provide privacy, as trusts are not public records like wills. The trust can also include provisions for incapacity, allowing the co-trustee to manage assets if one spouse becomes unable to do so.

State-Specific Rules for the Living Trust For Husband And Wife With No Children Hawaii

Hawaii has specific laws governing living trusts that couples should be aware of:

- Witness Requirements: The trust document must be signed in the presence of two witnesses.

- Notarization: While notarization is not mandatory, it is recommended to enhance the trust's validity.

- Asset Types: Certain assets, such as retirement accounts and life insurance, may require additional steps to be included in the trust.

How to Use the Living Trust For Husband And Wife With No Children Hawaii

Using a living trust for husband and wife with no children in Hawaii involves several practical steps:

- Accessing Assets: Both spouses can manage and use the assets held in the trust during their lifetimes.

- Distributing Assets: Upon the death of the surviving spouse, the trust assets are distributed according to the terms outlined in the trust document.

- Updating the Trust: Regularly review and update the trust to reflect any changes in circumstances or wishes.

Quick guide on how to complete living trust for husband and wife with no children hawaii

Complete Living Trust For Husband And Wife With No Children Hawaii effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and handwritten documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Living Trust For Husband And Wife With No Children Hawaii on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented operation today.

How to alter and eSign Living Trust For Husband And Wife With No Children Hawaii with ease

- Locate Living Trust For Husband And Wife With No Children Hawaii and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow has specifically for that purpose.

- Create your eSignature with the Sign function, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Living Trust For Husband And Wife With No Children Hawaii to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with No Children in Hawaii?

A Living Trust for Husband and Wife with No Children in Hawaii is a legal document that allows couples to manage their assets during their lifetime and specify their distribution after their death. This type of trust helps avoid probate, ensuring a smoother transition of property ownership following the death of one or both spouses.

-

How can a Living Trust for Husband and Wife with No Children in Hawaii benefit us?

Creating a Living Trust for Husband and Wife with No Children in Hawaii provides various benefits, including privacy, asset management, and potential tax advantages. It allows couples to maintain control over their assets and ensures their wishes are honored without the lengthy probate process.

-

What is the cost of setting up a Living Trust for Husband and Wife with No Children in Hawaii?

The cost of establishing a Living Trust for Husband and Wife with No Children in Hawaii can vary depending on factors like the complexity of the assets and the services used. On average, you may expect to pay between $1,000 to $3,000 when working with a legal professional to create a comprehensive trust.

-

Are there specific features included in a Living Trust for Husband and Wife with No Children in Hawaii?

Yes, a Living Trust for Husband and Wife with No Children in Hawaii typically includes features such as asset management, designation of a trustee, provisions for disability, and specific instructions for asset distribution. These features ensure that the couple's intentions are clearly outlined and legally protected.

-

Can we modify our Living Trust for Husband and Wife with No Children in Hawaii?

Yes, a Living Trust for Husband and Wife with No Children in Hawaii is revocable, which means you can modify it as your circumstances change. You have the flexibility to update beneficiaries, change trustees, or alter the terms of the trust at any time during your lifetime.

-

How does a Living Trust for Husband and Wife with No Children in Hawaii interact with wills?

A Living Trust for Husband and Wife with No Children in Hawaii can complement a will by covering assets that are placed in the trust while the will addresses any assets outside of the trust. Together, they ensure a comprehensive plan for asset distribution and help reduce complications after death.

-

What integrations does airSlate SignNow offer for creating a Living Trust for Husband and Wife with No Children in Hawaii?

airSlate SignNow allows easy document management and eSigning, which is beneficial for creating a Living Trust for Husband and Wife with No Children in Hawaii. The platform integrates seamlessly with various applications to simplify the workflows involved in drafting and signing your trust documents.

Get more for Living Trust For Husband And Wife With No Children Hawaii

Find out other Living Trust For Husband And Wife With No Children Hawaii

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF