Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property Hawaii Form

What is the Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii

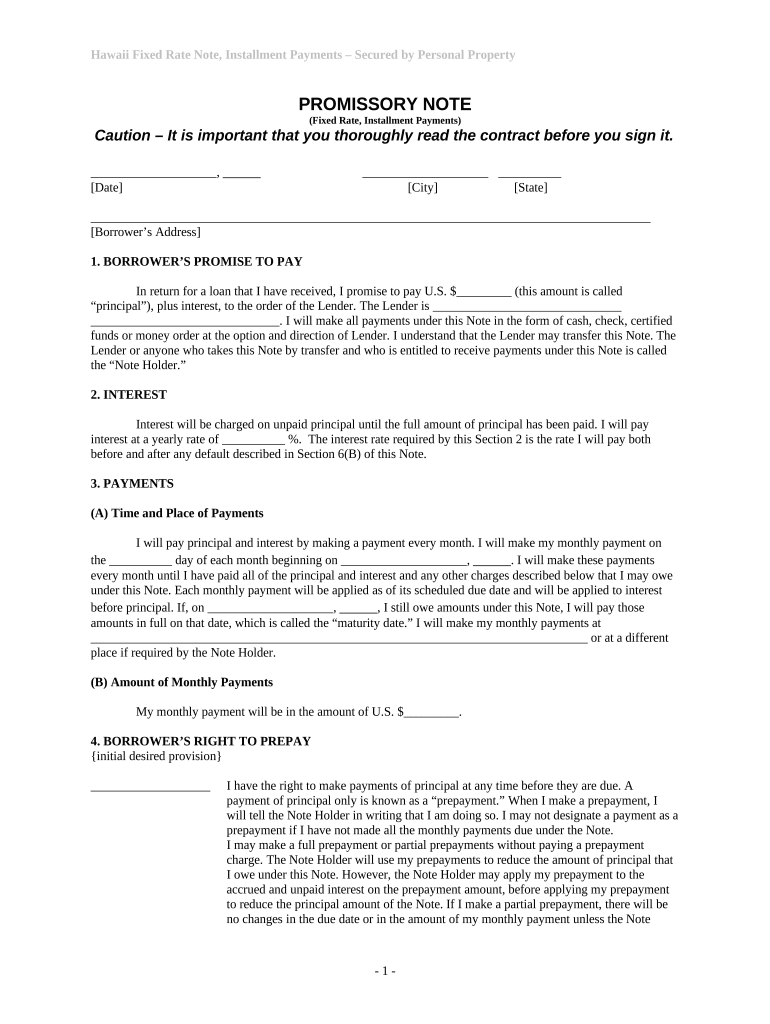

The Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property is a legal document that outlines a borrower's promise to repay a loan with fixed installment payments over a specified period. This note is secured by personal property, meaning that the borrower offers an asset as collateral to protect the lender's interests. In the event of default, the lender has the right to claim the secured property. This type of promissory note is commonly used in various lending situations, including personal loans and business financing, ensuring that both parties understand their obligations and rights.

How to use the Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii

Using the Hawaii Installments Fixed Rate Promissory Note involves several key steps. First, both the borrower and lender must agree on the loan terms, including the amount, interest rate, and repayment schedule. Once these terms are established, the borrower completes the promissory note, providing necessary details such as personal information and a description of the collateral. After both parties review the document, they must sign it to make it legally binding. It is advisable to retain copies of the signed note for future reference and to ensure compliance with the agreed terms.

Steps to complete the Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii

Completing the Hawaii Installments Fixed Rate Promissory Note requires careful attention to detail. Follow these steps:

- Gather necessary information, including borrower and lender details, loan amount, and collateral description.

- Clearly state the interest rate and repayment schedule, specifying the number of installments and due dates.

- Include terms regarding late payments and default consequences to protect both parties.

- Review the document thoroughly to ensure accuracy and clarity.

- Both parties should sign the document in the presence of a witness or notary, if required.

Legal use of the Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii

The legal use of the Hawaii Installments Fixed Rate Promissory Note is governed by state laws that dictate the enforceability of such agreements. To be legally binding, the note must include essential elements such as the names of the parties, the loan amount, interest rate, repayment terms, and a clear description of the collateral. Compliance with the Uniform Commercial Code (UCC) is also necessary, particularly concerning secured transactions. This ensures that the lender's rights are protected in case of default, allowing for the recovery of the secured property.

Key elements of the Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii

Several key elements must be included in the Hawaii Installments Fixed Rate Promissory Note to ensure its validity:

- Borrower and lender information: Names and contact details of both parties.

- Loan amount: The total amount being borrowed.

- Interest rate: The fixed rate applied to the loan.

- Repayment schedule: Details on how and when payments will be made.

- Collateral description: A clear and detailed description of the personal property securing the loan.

- Default terms: Conditions under which the lender can claim the collateral.

State-specific rules for the Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii

Hawaii has specific rules governing the use of promissory notes, particularly those secured by personal property. It is essential for both borrowers and lenders to understand these regulations to ensure compliance. For instance, the note must adhere to state laws regarding interest rates, which may be capped to prevent usury. Additionally, proper documentation and filing may be required to perfect the security interest in the collateral, ensuring that the lender's rights are enforceable in case of default. Familiarity with these state-specific rules helps avoid legal complications and protects both parties' interests.

Quick guide on how to complete hawaii installments fixed rate promissory note secured by personal property hawaii

Complete Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the proper form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii with ease

- Obtain Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii and then click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to submit your form, either by email, SMS, invitation link, or download it to your computer.

No more worries about lost or misfiled documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii?

A Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii is a legal document that outlines a borrower's agreement to repay a loan with fixed interest, secured by personal property as collateral. This note ensures that both parties understand their obligations and provides a clear repayment schedule.

-

What are the benefits of using a Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii?

Using a Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii offers multiple benefits, including predictable monthly payments and secured investment for lenders. It provides financial clarity to both the borrower and the lender, helping to manage risk effectively.

-

How can I create a Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii using airSlate SignNow?

With airSlate SignNow, you can easily create a Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii using our customizable templates. Simply input your details into our intuitive interface, and then send the document for eSignature to ensure it's legally binding.

-

Is the Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii legally binding?

Yes, a Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii becomes legally binding once signed by both parties. Utilizing airSlate SignNow ensures that all signatures are securely captured and recorded, enhancing the legal validity of your document.

-

What information is required to complete a Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii?

To complete a Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii, you will need borrower and lender information, loan amount, interest rate, repayment schedule, and details about the personal property being used as collateral. airSlate SignNow streamlines this process for you.

-

Can I modify my Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii after it's created?

Yes, you can modify your Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii after its creation using airSlate SignNow. Simply access your document, make the necessary changes, and resend it for eSignature to ensure all parties are in agreement.

-

What are the costs associated with creating a Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii through airSlate SignNow?

Creating a Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii with airSlate SignNow is cost-effective, with various pricing plans tailored to individual business needs. Our plans ensure you get essential features without unnecessary costs, allowing for budget-friendly document management.

Get more for Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii

- State of michigan praecipe case number county of stclair stclaircounty form

- 32bj dependent enrollment form

- Assignment of land contract form

- Ca dept of public health acounting section ms 1601 form

- Office discipline referral form

- Fiu veterans form

- Proof of residency maine form

- Preferred mailing address check here if mailing ad form

Find out other Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property Hawaii

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed