Estate Planning Questionnaire and Worksheets Hawaii Form

What is the Estate Planning Questionnaire and Worksheets Hawaii

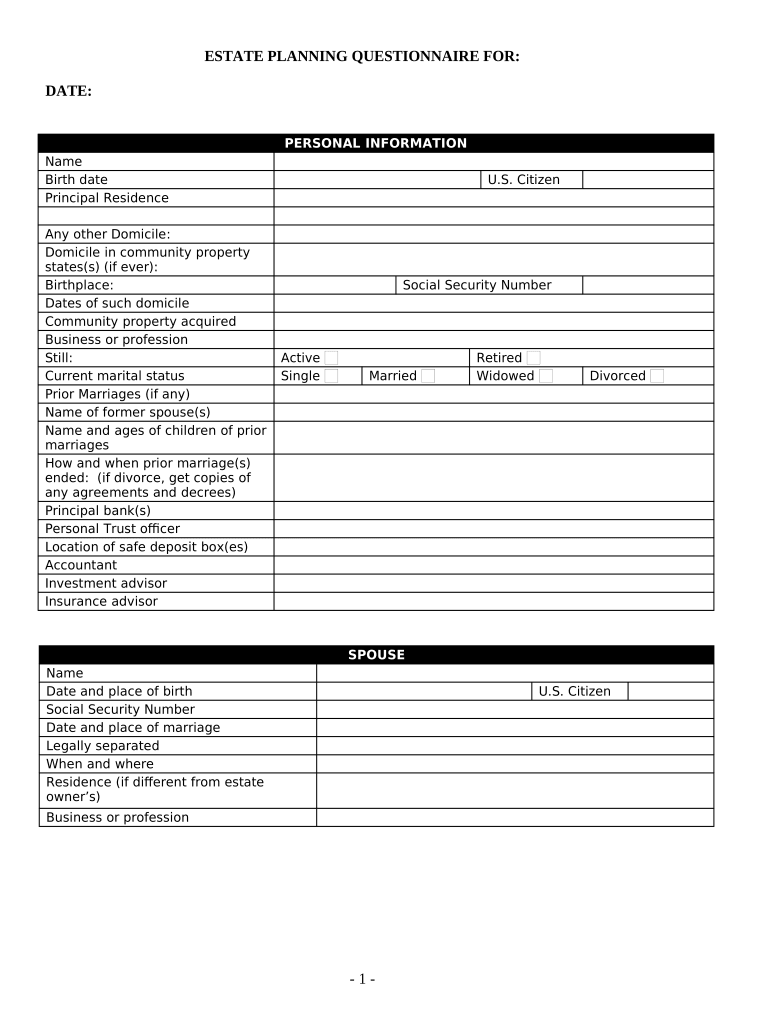

The Estate Planning Questionnaire and Worksheets Hawaii is a comprehensive document designed to assist individuals in organizing their estate planning information. This form typically includes sections for personal details, asset inventories, beneficiary designations, and wishes regarding healthcare and financial decisions. By completing this questionnaire, individuals can clarify their intentions and ensure that their wishes are respected after their passing. It serves as a foundational tool for creating wills, trusts, and other essential estate planning documents.

How to use the Estate Planning Questionnaire and Worksheets Hawaii

Using the Estate Planning Questionnaire and Worksheets Hawaii involves several straightforward steps. First, gather all necessary personal information, including details about your family, assets, and any existing legal documents. Next, carefully fill out each section of the questionnaire, ensuring that you provide accurate and thorough information. It may be helpful to consult with a legal professional to clarify any complex areas. Once completed, this document can serve as a reference for drafting formal estate planning documents, ensuring that all your wishes are documented and can be executed effectively.

Steps to complete the Estate Planning Questionnaire and Worksheets Hawaii

Completing the Estate Planning Questionnaire and Worksheets Hawaii requires a systematic approach. Start by reviewing the entire questionnaire to understand its structure. Then, follow these steps:

- Gather personal information, including names, addresses, and contact details of family members and beneficiaries.

- List all assets, including real estate, bank accounts, investments, and personal property.

- Specify your wishes regarding guardianship for minor children, healthcare decisions, and financial management.

- Review your completed questionnaire for accuracy and completeness.

After ensuring that all information is correct, retain a copy for your records and consider discussing it with a legal professional for further estate planning guidance.

Legal use of the Estate Planning Questionnaire and Worksheets Hawaii

The Estate Planning Questionnaire and Worksheets Hawaii is legally significant as it lays the groundwork for formal estate planning documents. While the questionnaire itself may not be a legally binding document, the information it contains is crucial for creating valid wills and trusts. To ensure compliance with Hawaii state laws, it is advisable to follow up the questionnaire with the appropriate legal documentation, which may require notarization or witnessing, depending on the specific requirements of the state.

State-specific rules for the Estate Planning Questionnaire and Worksheets Hawaii

Hawaii has specific regulations regarding estate planning that individuals should be aware of when completing the Estate Planning Questionnaire and Worksheets Hawaii. These rules include requirements for the execution of wills, such as the necessity for witnesses and notarization. Additionally, Hawaii law recognizes various estate planning tools, including living trusts and powers of attorney, which can be addressed in the questionnaire. Understanding these state-specific rules can help ensure that your estate planning efforts are valid and enforceable.

Key elements of the Estate Planning Questionnaire and Worksheets Hawaii

Several key elements are essential to include in the Estate Planning Questionnaire and Worksheets Hawaii. These elements typically encompass:

- Personal information: Names and contact details of the individual and beneficiaries.

- Asset inventory: A comprehensive list of all assets, including real estate and financial accounts.

- Beneficiary designations: Clear instructions on who should inherit specific assets.

- Healthcare directives: Preferences regarding medical treatment and end-of-life care.

- Guardianship wishes: Designations for the care of minor children, if applicable.

Incorporating these elements ensures that the questionnaire serves its purpose effectively, guiding the estate planning process.

Quick guide on how to complete estate planning questionnaire and worksheets hawaii

Effortlessly Prepare Estate Planning Questionnaire And Worksheets Hawaii on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the resources required to swiftly create, modify, and eSign your documents without any holdups. Manage Estate Planning Questionnaire And Worksheets Hawaii from any device using airSlate SignNow's Android or iOS applications and streamline your document-based operations today.

The easiest way to edit and eSign Estate Planning Questionnaire And Worksheets Hawaii with ease

- Locate Estate Planning Questionnaire And Worksheets Hawaii and click Get Form to begin.

- Utilize the provided tools to complete your form.

- Mark important sections of the documents or redact sensitive information using tools specially designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just moments and carries the same legal authority as a traditional handwritten signature.

- Review the information carefully and click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searching for forms, or errors that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign Estate Planning Questionnaire And Worksheets Hawaii to guarantee effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the benefits of using the Estate Planning Questionnaire And Worksheets Hawaii?

The Estate Planning Questionnaire And Worksheets Hawaii provide a comprehensive approach to understanding your estate planning needs. They help in organizing your assets and intentions, ensuring your wishes are honored. By utilizing these materials, you can streamline communication with your attorney and make the estate planning process smoother.

-

How much does the Estate Planning Questionnaire And Worksheets Hawaii cost?

The pricing for the Estate Planning Questionnaire And Worksheets Hawaii varies depending on the package you choose. Typically, you can access basic and premium versions to cater to different needs. Check our pricing page for the latest offers and find a solution that fits your budget.

-

Are the Estate Planning Questionnaire And Worksheets Hawaii easy to use?

Yes, the Estate Planning Questionnaire And Worksheets Hawaii are designed to be user-friendly and straightforward. Even if you're not familiar with estate planning, our worksheets guide you through each step of the process. With clear instructions, you’ll find it easy to complete them at your own pace.

-

Can I eSign the Estate Planning Questionnaire And Worksheets Hawaii?

Absolutely! You can easily eSign the Estate Planning Questionnaire And Worksheets Hawaii using airSlate SignNow's intuitive platform. This feature allows you to complete your documents quickly and securely, making the process of estate planning even more efficient.

-

Do the Estate Planning Questionnaire And Worksheets Hawaii integrate with other tools?

Yes, the Estate Planning Questionnaire And Worksheets Hawaii can integrate with various document management and legal software applications. This makes it easier for you to manage files and stay organized. Check our integration documentation for more details on compatible tools.

-

Is customer support available for the Estate Planning Questionnaire And Worksheets Hawaii?

Yes, we offer dedicated customer support for users of the Estate Planning Questionnaire And Worksheets Hawaii. Our team is ready to assist with any questions or issues you may encounter during your estate planning journey. You can signNow out to us via email, chat, or phone for prompt assistance.

-

How are the Estate Planning Questionnaire And Worksheets Hawaii delivered?

Once you purchase the Estate Planning Questionnaire And Worksheets Hawaii, they are delivered digitally, allowing for immediate access. You will receive them via email in a user-friendly format that you can begin filling out right away. This ensures that you can start your estate planning without delay.

Get more for Estate Planning Questionnaire And Worksheets Hawaii

Find out other Estate Planning Questionnaire And Worksheets Hawaii

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free