Ia Trust Form

What is the Ia Trust

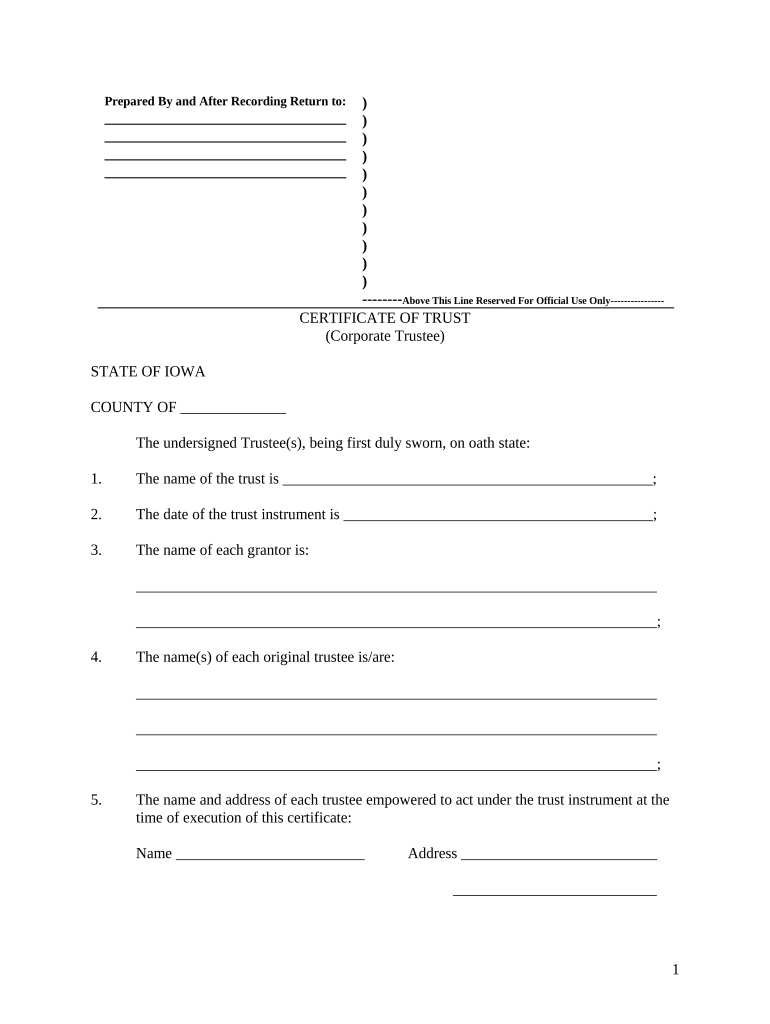

The Ia Trust is a legal document that establishes a trust arrangement, allowing individuals to manage and distribute their assets according to specific terms. This form is commonly used in estate planning, enabling the trustor to outline how their assets should be handled during their lifetime and after their passing. The Ia Trust can provide benefits such as avoiding probate, ensuring privacy, and potentially reducing estate taxes.

How to use the Ia Trust

Using the Ia Trust involves several key steps. First, the trustor must clearly define the assets to be included in the trust. Next, the trustor designates a trustee, who will be responsible for managing the trust according to the specified terms. The trustor must then complete the Ia Trust form, ensuring that all required information is accurately provided. Once executed, the trustor should fund the trust by transferring ownership of the designated assets to the trust. Regular reviews and updates to the trust may be necessary to reflect any changes in circumstances or intentions.

Steps to complete the Ia Trust

Completing the Ia Trust involves a systematic approach:

- Gather necessary information about the assets and beneficiaries.

- Choose a reliable trustee who will manage the trust.

- Fill out the Ia Trust form, ensuring all details are correct.

- Sign the document in the presence of a notary public to ensure legal validity.

- Transfer assets into the trust, which may include real estate, bank accounts, and investments.

- Keep copies of the completed form and any related documents for personal records.

Legal use of the Ia Trust

The Ia Trust is legally recognized when it meets specific requirements set forth by state law. To ensure its legality, the trustor must execute the document in accordance with state regulations, which may include signing in front of a notary and having witnesses present. Additionally, the trust should comply with relevant federal and state tax laws to avoid complications during asset distribution. Properly executed, the Ia Trust can provide a secure framework for asset management and distribution.

Key elements of the Ia Trust

Several key elements define the Ia Trust, including:

- Trustor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust.

- Beneficiaries: Individuals or entities that will benefit from the trust assets.

- Terms of the Trust: Specific instructions on how the assets should be managed and distributed.

- Revocability: Whether the trust can be altered or revoked by the trustor during their lifetime.

Required Documents

To complete the Ia Trust, several documents may be required, including:

- Proof of identity for the trustor and trustee.

- Documentation of the assets being transferred into the trust.

- The completed Ia Trust form, signed and notarized.

- Any additional documents that may be necessary depending on state requirements.

Quick guide on how to complete ia trust

Complete Ia Trust seamlessly on any device

Managing documents online has gained immense popularity among businesses and individuals. It offers a flawless eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents rapidly without delays. Handle Ia Trust on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest method to edit and eSign Ia Trust effortlessly

- Obtain Ia Trust and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Ia Trust and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is ia trust and how does it relate to airSlate SignNow?

ia trust refers to the confidence businesses can have in airSlate SignNow's ability to securely manage electronic signatures and documents. This trust is built on comprehensive security features, compliance with industry standards, and user-friendly technology that ensures the integrity of your documents.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes ia trust through robust encryption protocols, multi-factor authentication, and regular security audits. These measures help protect your sensitive information and provide peace of mind when sending and signing documents online.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows potential users to experience the benefits of eSigning and document management with full functionality, fostering ia trust. This trial period enables you to assess how well the platform meets your business needs before committing to a subscription.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers several pricing plans to accommodate varying business needs, designed to enhance ia trust by providing value at every level. These plans include different features, and you can choose one based on your team's size and operational requirements.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, enabling you to streamline workflows and enhance productivity. This capability further bolsters ia trust, as it fosters a cohesive work environment where all systems can function together effortlessly.

-

What key features does airSlate SignNow offer?

Key features of airSlate SignNow include customizable templates, advanced reporting, and mobile access, all designed to facilitate efficient document management. These features not only enhance user experience but also reinforce ia trust by ensuring that you can complete tasks more efficiently and securely.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, you can save time and reduce costs associated with traditional document signing methods. The platform fosters ia trust by ensuring faster turnaround times and providing a legally binding solution that businesses can rely on for their document management.

Get more for Ia Trust

- Statement of service template australia form

- Download claim form new india health insurance

- Sergemate 4350d form

- Expatriate contract of employment template form

- Mobile crane lift plan form

- Warranty deed statutory short form bradford publishing

- Transcript request form 800 977 8449 251 981 377

- Get the state of new york c 105 fillable form labor ny

Find out other Ia Trust

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document