Centerpoint Energy W9 Form 2004-2026

What is the Centerpoint Energy W-9 Form

The Centerpoint Energy W-9 form is an official document used by businesses and individuals to provide their taxpayer identification information to Centerpoint Energy. This form is crucial for tax reporting purposes, as it ensures that the company has accurate information for issuing tax documents, such as the 1099 form, to contractors and vendors. The W-9 form requires the individual or business to disclose their name, business name (if applicable), address, and taxpayer identification number (TIN), which can be either a Social Security number (SSN) or an Employer Identification Number (EIN).

How to use the Centerpoint Energy W-9 Form

Using the Centerpoint Energy W-9 form involves a straightforward process. First, download the form from a reliable source. Next, fill out the required fields accurately, ensuring that all information matches your official documents. Once completed, the form should be submitted to Centerpoint Energy, either electronically or via mail, depending on their submission guidelines. It is important to keep a copy of the completed form for your records, as it may be needed for future tax filings or verification purposes.

Steps to complete the Centerpoint Energy W-9 Form

Completing the Centerpoint Energy W-9 form requires careful attention to detail. Follow these steps:

- Download the W-9 form from the Centerpoint Energy website or another trusted source.

- Provide your name as it appears on your tax return.

- If applicable, enter your business name or disregarded entity name.

- Fill in your address, ensuring it is current and matches your tax records.

- Indicate your taxpayer identification number, either your SSN or EIN.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Centerpoint Energy W-9 Form

The legal use of the Centerpoint Energy W-9 form is governed by IRS regulations. This form is used to certify that the taxpayer is not subject to backup withholding and to provide the correct TIN to the requester. It is important to ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or issues with tax reporting. The form should be used solely for its intended purpose, which is to facilitate proper tax reporting and compliance.

Key elements of the Centerpoint Energy W-9 Form

The key elements of the Centerpoint Energy W-9 form include:

- Taxpayer Name: The legal name of the individual or business.

- Business Name: If applicable, the name under which the business operates.

- Address: The current mailing address for the taxpayer.

- Taxpayer Identification Number: Either the SSN or EIN.

- Certification: A signature and date confirming the accuracy of the information.

Form Submission Methods

The Centerpoint Energy W-9 form can be submitted through various methods, depending on the preferences of the requester. Common submission methods include:

- Online Submission: Some businesses may allow electronic submission of the W-9 form through secure portals.

- Mail: The completed form can be printed and mailed to the designated address provided by Centerpoint Energy.

- In-Person: In certain cases, individuals may choose to deliver the form in person to a Centerpoint Energy office.

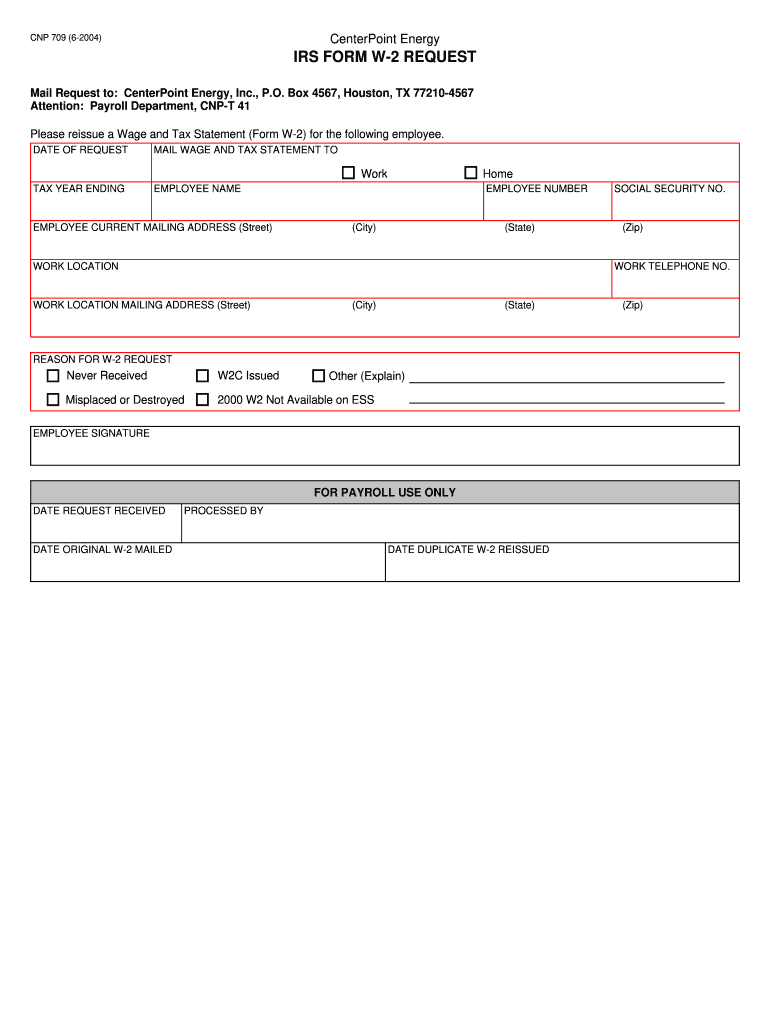

Quick guide on how to complete irs form w 2 request centerpoint energy

Explore how to effortlessly navigate the Centerpoint Energy W9 Form completion with this simple guide

eFiling and signNowing documents over the internet is increasingly favored and serves as the preferred choice for a diverse range of users. It offers many benefits compared to conventional printed documents, such as convenience, time-saving, improved accuracy, and enhanced security.

With platforms like airSlate SignNow, you can find, modify, sign, and share your Centerpoint Energy W9 Form without the hassle of constant printing and scanning. Follow this concise guide to initiate and finish your document.

Implement these steps to obtain and complete Centerpoint Energy W9 Form

- Begin by clicking the Get Form button to access your form in our editor.

- Pay attention to the green label on the left indicating required fields to ensure you don’t miss any.

- Utilize our advanced tools to comment, edit, sign, secure, and enhance your form.

- Protect your document or convert it into a fillable form using the appropriate tab tools.

- Review the form and inspect it for mistakes or inconsistencies.

- Select DONE to complete the editing process.

- Rename your document or retain its current name.

- Choose the storage option where you wish to save your form, send it via USPS, or click the Download Now button to get your form.

If Centerpoint Energy W9 Form isn’t what you had in mind, you can explore our extensive library of pre-existing forms that you can complete with ease. Check out our service today!

Create this form in 5 minutes or less

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

Create this form in 5 minutes!

How to create an eSignature for the irs form w 2 request centerpoint energy

How to generate an eSignature for the Irs Form W 2 Request Centerpoint Energy in the online mode

How to create an electronic signature for the Irs Form W 2 Request Centerpoint Energy in Chrome

How to generate an electronic signature for putting it on the Irs Form W 2 Request Centerpoint Energy in Gmail

How to generate an eSignature for the Irs Form W 2 Request Centerpoint Energy from your smart phone

How to create an eSignature for the Irs Form W 2 Request Centerpoint Energy on iOS devices

How to make an electronic signature for the Irs Form W 2 Request Centerpoint Energy on Android OS

People also ask

-

What is a CenterPoint Energy W9 form?

The CenterPoint Energy W9 form is a tax identification document used to provide necessary information to the IRS. It is crucial for businesses and freelancers to fill out this form accurately to ensure proper tax reporting. By using airSlate SignNow, you can easily complete and eSign your CenterPoint Energy W9 form securely online.

-

How can airSlate SignNow help with my CenterPoint Energy W9?

AirSlate SignNow simplifies the process of signing and sending your CenterPoint Energy W9. With our user-friendly platform, you can quickly upload the form, fill it out, and eSign it in just a few clicks. This streamlines your workflow, making tax documentation more efficient.

-

Is there a cost associated with using airSlate SignNow for the CenterPoint Energy W9?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While we provide a free trial, ongoing use for services like the CenterPoint Energy W9 will require a subscription. This investment allows you to manage and eSign documents without hassle.

-

Can I store my completed CenterPoint Energy W9 using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to securely store your completed CenterPoint Energy W9 and other documents in the cloud. This feature ensures that your important tax forms are easily accessible whenever you need them.

-

Does airSlate SignNow integrate with other software for handling the CenterPoint Energy W9?

Yes, airSlate SignNow offers integrations with popular software platforms that enhance your document management process. Whether it's accounting software or project management tools, integrating with airSlate SignNow helps streamline the handling of your CenterPoint Energy W9 and other essential documents.

-

How can I ensure my CenterPoint Energy W9 is secure with airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement advanced encryption and secure access controls to protect your CenterPoint Energy W9 and other sensitive documents. You can confidently eSign and send forms knowing they're safeguarded against unauthorized access.

-

Can I track the status of my CenterPoint Energy W9 with airSlate SignNow?

Yes! AirSlate SignNow provides real-time status tracking for your documents, including the CenterPoint Energy W9. You will receive notifications on when it has been signed, viewed, and completed, ensuring transparency throughout the process.

Get more for Centerpoint Energy W9 Form

Find out other Centerpoint Energy W9 Form

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement