Claim of Lien by Corporation or LLC Idaho Form

What is the Claim Of Lien By Corporation Or LLC Idaho

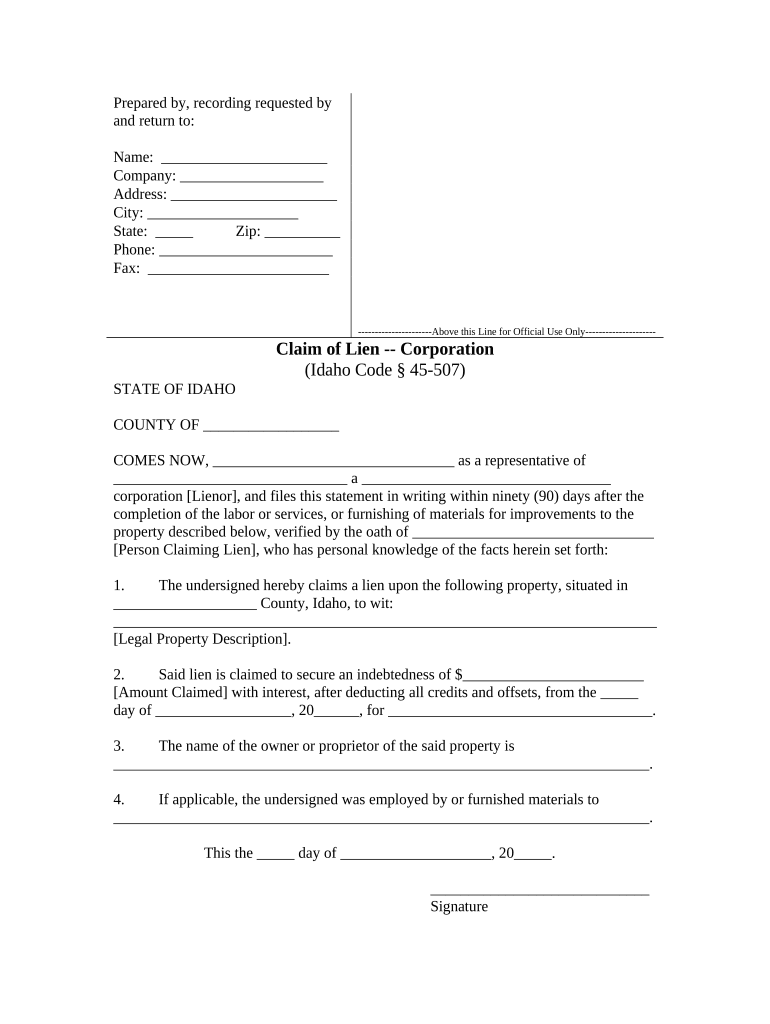

The Claim of Lien by Corporation or LLC in Idaho is a legal document that allows a corporation or limited liability company (LLC) to assert a claim against a property for unpaid debts related to services or materials provided. This form serves as a notice to the property owner and other interested parties that the corporation or LLC has a legal right to seek payment through the property if debts are not settled. It is essential for protecting the financial interests of businesses that provide goods or services on credit.

How to Use the Claim Of Lien By Corporation Or LLC Idaho

To effectively use the Claim of Lien by Corporation or LLC in Idaho, the entity must first ensure it has a valid claim against the property. This involves confirming that services or materials were provided and that payment has not been received. Once the claim is established, the form must be filled out accurately, detailing the nature of the debt, the amount owed, and the property in question. After completing the form, it should be filed with the appropriate county recorder's office to ensure it is legally recognized.

Steps to Complete the Claim Of Lien By Corporation Or LLC Idaho

Completing the Claim of Lien by Corporation or LLC in Idaho involves several key steps:

- Gather necessary information, including the debtor's details, the amount owed, and a description of the services or materials provided.

- Fill out the Claim of Lien form accurately, ensuring all required fields are completed.

- Sign the form, ensuring that the signature is from an authorized representative of the corporation or LLC.

- File the completed form with the county recorder's office in the county where the property is located.

- Keep a copy of the filed document for your records.

Key Elements of the Claim Of Lien By Corporation Or LLC Idaho

Several key elements must be included in the Claim of Lien by Corporation or LLC in Idaho to ensure its validity:

- Debtor Information: Full name and address of the property owner or debtor.

- Claim Amount: The total amount owed, including any applicable interest or fees.

- Description of Services: A detailed description of the services or materials provided that led to the claim.

- Property Description: A clear description of the property against which the lien is being claimed.

- Signature: An authorized signature from the corporation or LLC representative.

State-Specific Rules for the Claim Of Lien By Corporation Or LLC Idaho

Idaho has specific rules governing the filing and enforcement of liens. It is crucial to adhere to these regulations to ensure the claim is enforceable. For instance, the lien must be filed within a certain timeframe after the debt becomes due, typically within six months. Furthermore, the form must be filed with the appropriate county office, and it may require notarization. Understanding these state-specific rules is essential for successfully asserting a lien.

Legal Use of the Claim Of Lien By Corporation Or LLC Idaho

The legal use of the Claim of Lien by Corporation or LLC in Idaho is primarily to secure payment for services rendered or materials supplied. By filing this claim, the corporation or LLC can protect its financial interests and potentially recover debts through the sale of the property if necessary. It is important to follow all legal procedures and timelines to maintain the enforceability of the lien, as failure to comply may result in the loss of the right to collect the owed amount.

Quick guide on how to complete claim of lien by corporation or llc idaho

Effortlessly Prepare Claim Of Lien By Corporation Or LLC Idaho on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without interruptions. Manage Claim Of Lien By Corporation Or LLC Idaho on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Claim Of Lien By Corporation Or LLC Idaho with Ease

- Find Claim Of Lien By Corporation Or LLC Idaho and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of sending the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Claim Of Lien By Corporation Or LLC Idaho to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Claim Of Lien By Corporation Or LLC in Idaho?

A Claim Of Lien By Corporation Or LLC in Idaho is a legal notice that a corporation or limited liability company files to secure payment for work performed or materials supplied. This lien gives the entity the right to claim payment from the property owner's assets in the event of non-payment. Understanding this process is essential for businesses that want to ensure their interests are protected.

-

How can airSlate SignNow assist with filing a Claim Of Lien By Corporation Or LLC in Idaho?

airSlate SignNow simplifies the process of documenting and eSigning necessary files for a Claim Of Lien By Corporation Or LLC in Idaho. Our platform allows users to create and manage documents securely and efficiently, shortening the time to file a lien. With user-friendly templates, you can ensure all necessary fields are completed accurately.

-

What are the costs associated with using airSlate SignNow for a Claim Of Lien By Corporation Or LLC in Idaho?

The pricing for using airSlate SignNow varies depending on the features your business needs. We offer competitive subscription plans that provide access to our comprehensive document management system, which includes features for handling a Claim Of Lien By Corporation Or LLC in Idaho. Contact us for a detailed pricing breakdown tailored to your requirements.

-

What features does airSlate SignNow offer for managing a Claim Of Lien By Corporation Or LLC in Idaho?

airSlate SignNow provides a variety of features such as customizable templates, secure eSigning, document storage, and tracking. These capabilities make it easy for businesses to manage a Claim Of Lien By Corporation Or LLC in Idaho effectively. Our features are designed to create a smooth workflow and ensure compliance with state regulations.

-

Are there any benefits of using airSlate SignNow for a Claim Of Lien By Corporation Or LLC in Idaho?

Yes, using airSlate SignNow for your Claim Of Lien By Corporation Or LLC in Idaho offers several benefits. It streamlines the documentation process, reduces the time to execute necessary paperwork, and enhances security. Additionally, our platform enables real-time updates, keeping all stakeholders informed throughout the lien process.

-

Can airSlate SignNow integrate with other software for filing a Claim Of Lien By Corporation Or LLC in Idaho?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms, which can enhance your ability to handle a Claim Of Lien By Corporation Or LLC in Idaho. With these integrations, you can sync data and streamline workflows, making it easier to manage documentation and subsequent filing processes without any manual input.

-

Is support available for businesses dealing with a Claim Of Lien By Corporation Or LLC in Idaho?

Yes, airSlate SignNow offers dedicated customer support for businesses managing a Claim Of Lien By Corporation Or LLC in Idaho. Our team is equipped to assist with any inquiries regarding document preparation, eSigning, or workflow customization. We're here to ensure you have a smooth experience with our platform.

Get more for Claim Of Lien By Corporation Or LLC Idaho

Find out other Claim Of Lien By Corporation Or LLC Idaho

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document