Business Credit Application Idaho Form

What is the Business Credit Application Idaho

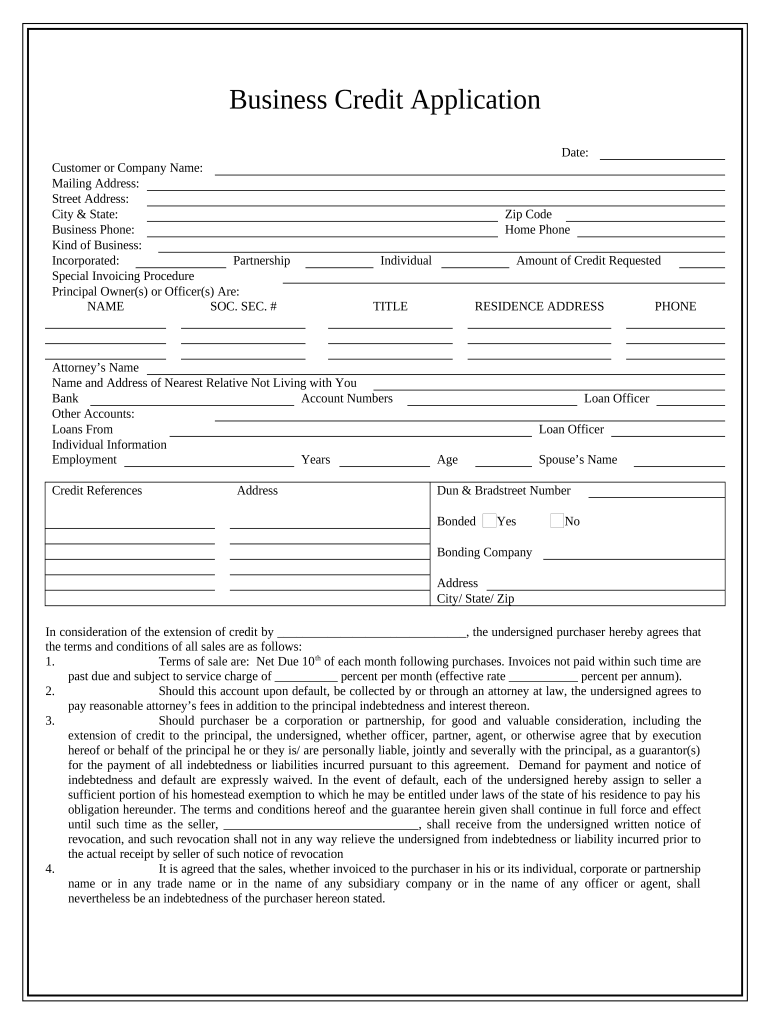

The Business Credit Application Idaho is a formal document used by businesses in Idaho to apply for credit from lenders or suppliers. This application collects essential information about the business, including its legal structure, financial history, and creditworthiness. Completing this form is crucial for businesses seeking to establish or expand credit lines, enabling them to manage cash flow and invest in growth opportunities.

Key Elements of the Business Credit Application Idaho

Understanding the key elements of the Business Credit Application Idaho is vital for successful completion. The form typically requires:

- Business Information: Legal name, address, and contact details.

- Ownership Structure: Details about the business owners and their ownership percentages.

- Financial Statements: Recent financial statements, including balance sheets and income statements.

- Credit History: Information regarding existing credit lines and payment history.

- References: Contact details of business references, such as suppliers or financial institutions.

Steps to Complete the Business Credit Application Idaho

Completing the Business Credit Application Idaho involves several steps to ensure accuracy and compliance. Here’s a straightforward process:

- Gather Necessary Information: Collect all required documents and data, including financial statements and ownership details.

- Fill Out the Application: Carefully complete each section of the application, ensuring all information is accurate and up to date.

- Review the Application: Double-check for any errors or omissions that could delay processing.

- Submit the Application: Send the completed form to the appropriate lender or supplier, following their submission guidelines.

Legal Use of the Business Credit Application Idaho

The Business Credit Application Idaho must be completed in compliance with applicable laws and regulations. It is essential to ensure that all provided information is truthful and accurate, as any discrepancies may lead to legal consequences. Additionally, businesses should be aware of the privacy laws that protect sensitive information shared within the application.

Form Submission Methods

Businesses can submit the Business Credit Application Idaho through various methods, catering to different preferences and requirements:

- Online Submission: Many lenders offer online portals for electronic submission, allowing for quicker processing times.

- Mail Submission: Hard copies of the application can be mailed to the lender's address, though this may take longer for processing.

- In-Person Submission: Some businesses may prefer to submit the application in person, providing an opportunity to discuss any questions directly with a representative.

Eligibility Criteria

To qualify for credit through the Business Credit Application Idaho, businesses typically must meet specific eligibility criteria. These may include:

- Business Structure: Must be a legally recognized entity, such as an LLC, corporation, or partnership.

- Time in Business: Many lenders require a minimum operational period, often at least one to two years.

- Creditworthiness: A satisfactory credit history and score are usually necessary to demonstrate reliability in repaying debts.

Quick guide on how to complete business credit application idaho

Process Business Credit Application Idaho effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage Business Credit Application Idaho on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Business Credit Application Idaho with ease

- Find Business Credit Application Idaho and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate issues of lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Business Credit Application Idaho while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application Idaho?

A Business Credit Application Idaho is a formal document that businesses in Idaho can use to apply for credit. This application allows companies to provide financial information and establish their creditworthiness, which lenders assess when considering credit applications. Utilizing airSlate SignNow makes submitting these applications easier and faster.

-

What features does airSlate SignNow offer for Business Credit Application Idaho?

airSlate SignNow offers features such as eSignature capabilities, document templates, and collaboration tools specifically designed for Business Credit Application Idaho. These features simplify the process of sending and signing applications, making it more efficient for businesses to manage their credit requests. Additionally, the platform provides security measures to protect sensitive financial information.

-

How does airSlate SignNow improve the Business Credit Application Idaho process?

By leveraging airSlate SignNow, the Business Credit Application Idaho process becomes streamlined through automated workflows and electronic signatures. This not only reduces paperwork but also speeds up the approval time for credit applications. With a user-friendly interface, businesses can efficiently handle applications without the usual delays associated with traditional methods.

-

What are the benefits of using airSlate SignNow for Business Credit Application Idaho?

Using airSlate SignNow for Business Credit Application Idaho offers numerous benefits such as increased efficiency, reduced costs associated with printing and mailing, and improved turnaround times. Businesses can track the status of their applications in real-time and ensure that all required documents are completed correctly. This enhances the overall experience for both businesses and lenders.

-

What pricing plans does airSlate SignNow offer for Business Credit Application Idaho?

airSlate SignNow provides flexible pricing plans tailored for businesses engaging in Business Credit Application Idaho. The plans range from basic to advanced options, allowing businesses of all sizes to choose a solution that fits their budget and needs. Each plan includes essential features to facilitate the efficient management of credit applications.

-

Can I integrate airSlate SignNow with other software for Business Credit Application Idaho?

Yes, airSlate SignNow offers integrations with various software and platforms to enhance the Business Credit Application Idaho process. This flexibility allows businesses to connect their existing workflows seamlessly and maintain consistency across their operations. Popular integrations include CRM systems and accounting software, making it easier to manage financial documents.

-

Is airSlate SignNow compliant with regulations for Business Credit Application Idaho?

Absolutely, airSlate SignNow is designed to comply with industry regulations, ensuring that your Business Credit Application Idaho is handled securely. The platform incorporates advanced security features such as document encryption and secure data storage, which meet compliance standards. This gives businesses peace of mind that their sensitive information is protected throughout the application process.

Get more for Business Credit Application Idaho

Find out other Business Credit Application Idaho

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word