Idaho Unsecured Installment Payment Promissory Note for Fixed Rate Idaho Form

What is the Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho

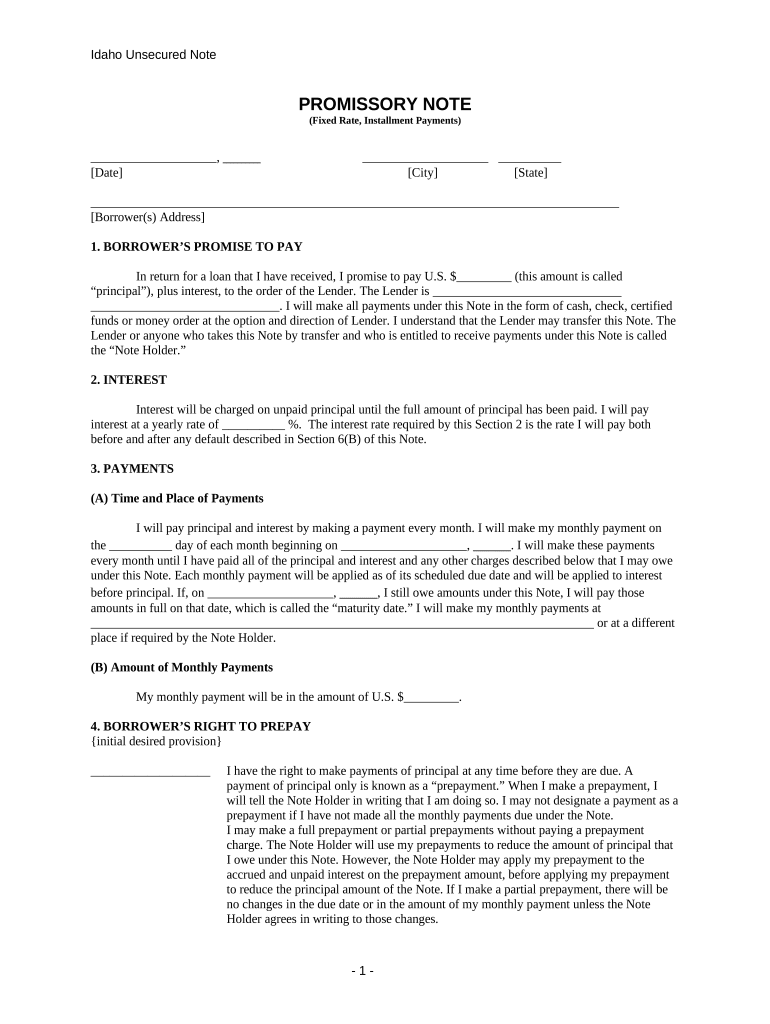

The Idaho Unsecured Installment Payment Promissory Note for Fixed Rate Idaho is a legal document that outlines the terms of a loan between a borrower and a lender. This note is unsecured, meaning it is not backed by collateral, and it specifies a fixed interest rate that remains constant throughout the loan term. The document serves as a formal agreement, detailing the repayment schedule, interest rate, and consequences of default. It is essential for both parties to understand their rights and obligations under this agreement.

How to use the Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho

To use the Idaho Unsecured Installment Payment Promissory Note, both the borrower and lender must fill out the form accurately. The borrower should provide personal information, the loan amount, and the agreed-upon interest rate. The lender must also include their details and any specific terms regarding repayment. Once completed, both parties should sign the document to make it legally binding. Utilizing a digital platform for this process can streamline the signing and storage of the document, ensuring easy access and compliance with legal standards.

Steps to complete the Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho

Completing the Idaho Unsecured Installment Payment Promissory Note involves several key steps:

- Gather necessary information, including borrower and lender details, loan amount, and interest rate.

- Fill out the note, ensuring all fields are completed accurately.

- Review the document for any errors or omissions.

- Both parties should sign the note, either physically or electronically, to validate the agreement.

- Keep a copy of the signed document for personal records and future reference.

Key elements of the Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho

Several key elements must be included in the Idaho Unsecured Installment Payment Promissory Note to ensure its effectiveness:

- Borrower and Lender Information: Full names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate applicable to the loan.

- Repayment Schedule: Specific dates and amounts for repayment installments.

- Default Terms: Conditions under which the borrower would be considered in default.

Legal use of the Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho

The legal use of the Idaho Unsecured Installment Payment Promissory Note is crucial for both parties involved. This document must comply with state laws to be enforceable in a court of law. It is essential for the lender to ensure that the terms are clear and unambiguous, as this can prevent disputes. Additionally, both parties should retain copies of the signed note, as this serves as evidence of the agreement and can be referenced in case of any legal issues.

State-specific rules for the Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho

Idaho has specific regulations governing the use of promissory notes, including the Idaho Unsecured Installment Payment Promissory Note. These rules dictate the necessary components of the document, such as required disclosures and the format of the agreement. It is important for both the borrower and lender to familiarize themselves with these state-specific rules to ensure compliance and protect their interests. Consulting with a legal professional can provide additional guidance on adhering to Idaho's laws regarding unsecured loans.

Quick guide on how to complete idaho unsecured installment payment promissory note for fixed rate idaho

Easily Prepare Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to quickly create, modify, and eSign your documents without delays. Manage Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho Effortlessly

- Obtain Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or disorganized documents, tedious form searches, or mistakes that require new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho?

An Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho is a legal document that outlines the terms for a loan that does not require collateral. This note specifies the repayment schedule, interest rate, and penalties for default. It serves as a binding agreement between the borrower and the lender, ensuring clarity and security in the transaction.

-

How can I create an Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho using airSlate SignNow?

You can easily create an Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho using airSlate SignNow's user-friendly interface. Simply select a template for the promissory note, fill in the necessary details, and customize it to suit your specific needs. Once completed, you can save and eSign the document seamlessly.

-

What are the benefits of using an Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho?

The primary benefits of using an Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho include flexibility and accessibility for borrowers who may not have collateral. Additionally, it clarifies payment terms, which helps to prevent disputes. It also facilitates easy tracking of payment schedules for both parties.

-

Are there any costs associated with generating an Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho on airSlate SignNow?

airSlate SignNow offers competitive pricing that includes creating an Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho. The pricing structure is transparent, and you can choose a plan that fits your business needs. Regularly check airSlate’s website for any offers or discounts.

-

Can I customize the terms in an Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho?

Yes, airSlate SignNow allows you to customize the terms in an Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho. You can adjust the repayment schedule, interest rate, and any other specific conditions to tailor the document to your requirements. This flexibility ensures that both parties are satisfied with the agreement.

-

Is it legally binding to use an Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho?

Yes, an Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho is legally binding, provided that it is properly executed by both parties. It becomes enforceable once signed and dated by the borrower and lender. This legal enforceability brings protection to both parties involved in the transaction.

-

What integrations does airSlate SignNow offer for managing Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho?

airSlate SignNow offers various integrations with popular applications that enhance the management of your Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho. You can integrate with CRM platforms, cloud storage solutions, and accounting software to streamline your document workflow. This ensures that you have all the tools you need within one ecosystem.

Get more for Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho

Find out other Idaho Unsecured Installment Payment Promissory Note For Fixed Rate Idaho

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History