Partial Release of Property from Deed of Trust for Corporation Idaho Form

What is the Partial Release Of Property From Deed Of Trust For Corporation Idaho

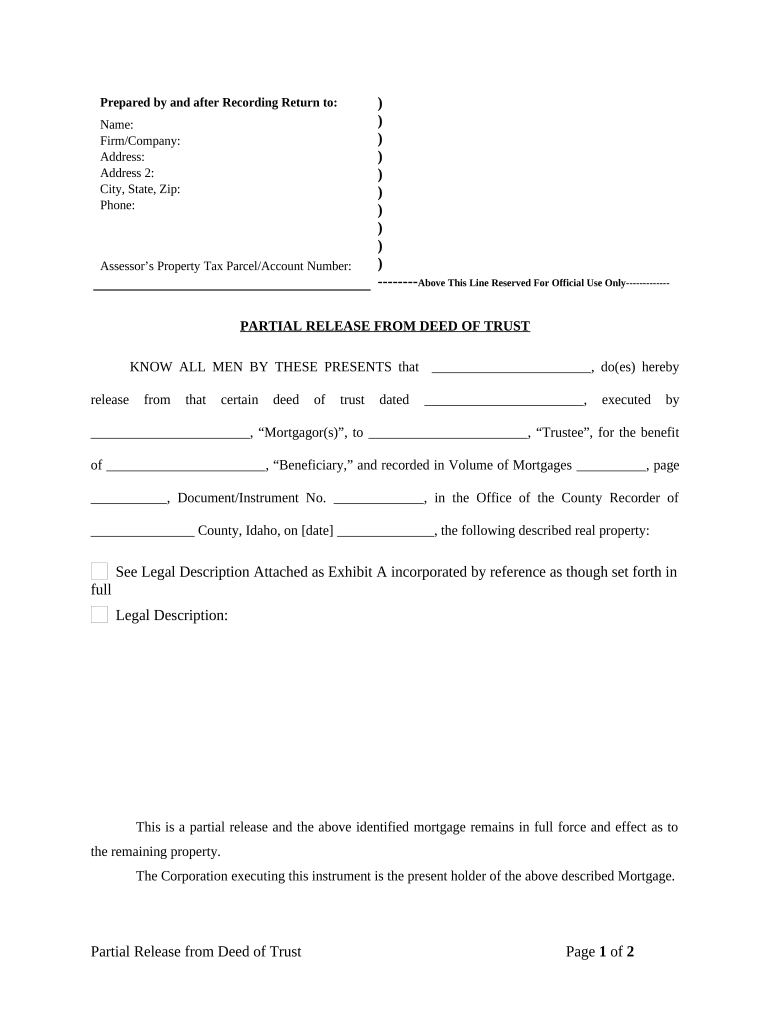

The Partial Release Of Property From Deed Of Trust For Corporation Idaho is a legal document that allows a corporation to release a portion of the property secured by a deed of trust while retaining the remaining interest. This process is often necessary when a corporation wishes to sell or refinance part of its property without affecting the entire deed of trust. The document must clearly specify the property being released, ensuring that all parties involved understand which assets are affected.

Steps to Complete the Partial Release Of Property From Deed Of Trust For Corporation Idaho

Completing the Partial Release Of Property From Deed Of Trust For Corporation Idaho involves several key steps:

- Identify the property to be released and ensure it is clearly defined in the document.

- Gather necessary information, including the original deed of trust and any amendments.

- Complete the form, ensuring all required fields are filled out accurately.

- Obtain signatures from authorized representatives of the corporation and any other necessary parties.

- File the completed document with the appropriate county recorder's office to ensure it is legally recognized.

Key Elements of the Partial Release Of Property From Deed Of Trust For Corporation Idaho

Several key elements must be included in the Partial Release Of Property From Deed Of Trust For Corporation Idaho to ensure its validity:

- Identification of Parties: Clearly state the names and addresses of the corporation and the lender.

- Description of Property: Provide a detailed description of the property being released, including legal descriptions.

- Reference to Original Deed: Include information about the original deed of trust, such as the date it was executed and the recording number.

- Signatures: Ensure that all necessary parties sign the document, including authorized representatives of the corporation.

- Notarization: Depending on state requirements, notarization may be necessary to validate the document.

Legal Use of the Partial Release Of Property From Deed Of Trust For Corporation Idaho

The legal use of the Partial Release Of Property From Deed Of Trust For Corporation Idaho is crucial for ensuring that the release is enforceable. It is important to follow state laws and regulations governing real estate transactions. The document must be executed properly and filed with the appropriate authorities to be recognized legally. Failure to comply with these requirements may result in disputes or challenges regarding the release.

How to Obtain the Partial Release Of Property From Deed Of Trust For Corporation Idaho

To obtain the Partial Release Of Property From Deed Of Trust For Corporation Idaho, corporations typically need to request the form from their legal counsel or a real estate professional. It may also be available through local government offices or online legal resources. Ensuring that the form is up-to-date and complies with Idaho state laws is essential for its validity.

State-Specific Rules for the Partial Release Of Property From Deed Of Trust For Corporation Idaho

Idaho has specific rules governing the Partial Release Of Property From Deed Of Trust. These include requirements for the content of the document, the necessity of notarization, and the filing process with the county recorder's office. Corporations must be aware of these regulations to ensure compliance and avoid potential legal issues. Consulting with a legal professional familiar with Idaho real estate law can provide valuable guidance.

Quick guide on how to complete partial release of property from deed of trust for corporation idaho

Complete Partial Release Of Property From Deed Of Trust For Corporation Idaho effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any holdups. Manage Partial Release Of Property From Deed Of Trust For Corporation Idaho on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and electronically sign Partial Release Of Property From Deed Of Trust For Corporation Idaho without stress

- Find Partial Release Of Property From Deed Of Trust For Corporation Idaho and then click Get Form to begin.

- Make use of the tools available to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow has specifically developed for such purposes.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Partial Release Of Property From Deed Of Trust For Corporation Idaho and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Partial Release Of Property From Deed Of Trust For Corporation Idaho?

A Partial Release Of Property From Deed Of Trust For Corporation Idaho allows corporations to release certain properties from a deed of trust without affecting the entire agreement. This legal process can simplify asset management and enhance financial flexibility for corporations operating within Idaho.

-

How does airSlate SignNow facilitate the Partial Release Of Property From Deed Of Trust For Corporation Idaho?

airSlate SignNow provides an efficient platform for corporations to draft, send, and eSign documents related to a Partial Release Of Property From Deed Of Trust For Corporation Idaho. With user-friendly features, businesses can ensure that their documents are processed quickly and accurately, adhering to Idaho regulations.

-

What are the benefits of using airSlate SignNow for this process?

Utilizing airSlate SignNow for a Partial Release Of Property From Deed Of Trust For Corporation Idaho offers several advantages, including improved turnaround time and enhanced document tracking. Additionally, corporations can enjoy greater accuracy and compliance with legal requirements, minimizing the risk of errors in important documents.

-

Is airSlate SignNow cost-effective for managing deed releases?

Yes, airSlate SignNow is a cost-effective solution for managing a Partial Release Of Property From Deed Of Trust For Corporation Idaho. With competitive pricing plans tailored for businesses, customers can access all necessary tools to streamline their document processes without breaking the bank.

-

What types of documents can be managed with airSlate SignNow relating to deed releases?

airSlate SignNow allows corporations to manage various documents related to the Partial Release Of Property From Deed Of Trust For Corporation Idaho, including release forms, affidavits, and any accompanying legal documentation. This comprehensive approach ensures that all documentation is efficiently handled.

-

Can airSlate SignNow integrate with other business applications for deed processing?

Absolutely! airSlate SignNow offers seamless integrations with multiple business applications, enhancing the process of handling a Partial Release Of Property From Deed Of Trust For Corporation Idaho. This connectivity allows corporations to work more efficiently by synchronizing data across their preferred platforms.

-

What support options are available for airSlate SignNow users?

airSlate SignNow provides robust support options for users navigating the complexities of a Partial Release Of Property From Deed Of Trust For Corporation Idaho. Customers can access a comprehensive knowledge base, detailed FAQs, and signNow out to dedicated support staff whenever assistance is required.

Get more for Partial Release Of Property From Deed Of Trust For Corporation Idaho

- Tabe test answers key form

- Form 2b high school record

- Employee availability form 13637195

- Vetco intake form

- Iantd student medical form doc

- Record of master calendar pre trial appearance and order form

- Seller transferor is not as of the date of transfer a resident of the state of maine form

- Certification of lock in for purposes of the form

Find out other Partial Release Of Property From Deed Of Trust For Corporation Idaho

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship