Quitclaim Deed from Corporation to Husband and Wife Illinois Form

What is the Quitclaim Deed From Corporation To Husband And Wife Illinois

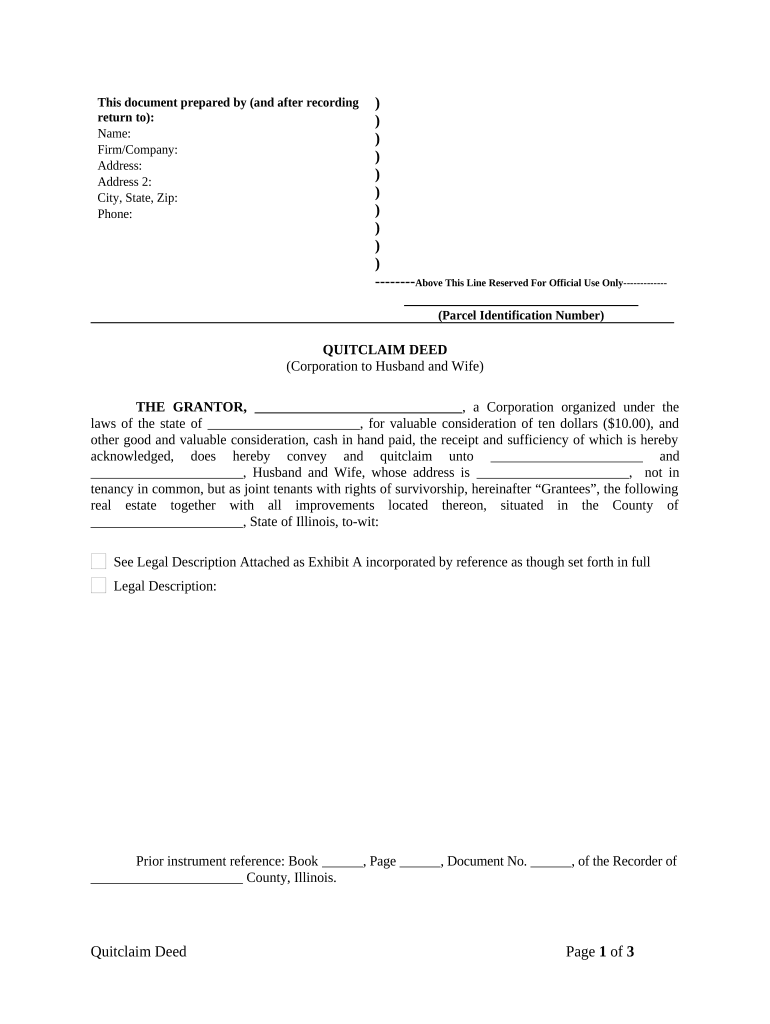

A quitclaim deed from a corporation to a husband and wife in Illinois is a legal document that allows a corporation to transfer its interest in a property to a married couple. This type of deed does not guarantee that the corporation holds clear title to the property; rather, it conveys whatever interest the corporation may have. It is often used in situations where property ownership needs to be simplified or transferred without the complexities of a warranty deed.

Steps to Complete the Quitclaim Deed From Corporation To Husband And Wife Illinois

Completing a quitclaim deed from a corporation to a husband and wife involves several key steps:

- Identify the property: Clearly describe the property being transferred, including its legal description.

- Gather necessary information: Collect the names of the corporation, the husband, and the wife, along with their addresses.

- Draft the deed: Use a standard quitclaim deed format, ensuring all required elements are included.

- Sign the deed: Authorized representatives of the corporation must sign the deed in the presence of a notary public.

- File the deed: Submit the completed quitclaim deed to the appropriate county recorder's office for recording.

Key Elements of the Quitclaim Deed From Corporation To Husband And Wife Illinois

Several essential elements must be included in a quitclaim deed for it to be valid in Illinois:

- Grantor and Grantee Information: The names and addresses of the corporation (grantor) and the husband and wife (grantees) must be clearly stated.

- Legal Description: A precise legal description of the property being transferred is necessary to avoid any ambiguity.

- Consideration: Although not always required, stating the consideration (value exchanged) can add clarity.

- Signatures: The deed must be signed by an authorized representative of the corporation and notarized.

- Recording Information: The deed should include details about where it will be recorded.

Legal Use of the Quitclaim Deed From Corporation To Husband And Wife Illinois

The quitclaim deed serves a specific legal purpose in Illinois. It is primarily used to transfer property ownership without providing warranties about the title. This type of deed is often utilized in divorce settlements, estate planning, or when a corporation wishes to simplify property ownership among family members. It is important to note that while a quitclaim deed conveys the interest of the grantor, it does not protect the grantees against any claims or liens on the property.

State-Specific Rules for the Quitclaim Deed From Corporation To Husband And Wife Illinois

Illinois has specific regulations governing quitclaim deeds. Key rules include:

- The deed must be executed by an authorized officer of the corporation.

- It must be notarized to be valid.

- Recording the deed with the county recorder is essential for it to take effect against third parties.

- Illinois law requires that the property description be clear and precise to avoid disputes.

How to Obtain the Quitclaim Deed From Corporation To Husband And Wife Illinois

Obtaining a quitclaim deed in Illinois can be done through several methods:

- Online Resources: Many legal websites provide templates for quitclaim deeds that can be customized.

- Legal Professionals: Consulting with an attorney can ensure that the deed is drafted correctly and complies with state laws.

- County Recorder's Office: Local county offices may have forms available and can provide guidance on the necessary steps for filing.

Quick guide on how to complete quitclaim deed from corporation to husband and wife illinois

Effortlessly prepare Quitclaim Deed From Corporation To Husband And Wife Illinois on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Quitclaim Deed From Corporation To Husband And Wife Illinois on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Quitclaim Deed From Corporation To Husband And Wife Illinois with ease

- Locate Quitclaim Deed From Corporation To Husband And Wife Illinois and then click Get Form to begin.

- Use the tools available to fill out your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Quitclaim Deed From Corporation To Husband And Wife Illinois and guarantee excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To Husband And Wife in Illinois?

A Quitclaim Deed From Corporation To Husband And Wife in Illinois is a legal document that allows a corporation to transfer its ownership interest in a property to a married couple. This type of deed does not guarantee that the property is free of any liens or claims. It's important to understand the implications of this transfer before proceeding.

-

How do I create a Quitclaim Deed From Corporation To Husband And Wife in Illinois?

Creating a Quitclaim Deed From Corporation To Husband And Wife in Illinois is straightforward with airSlate SignNow. Our platform provides templates that simplify the process, allowing users to easily enter the necessary information and eSign the document. This ensures that the deed is legally binding and compliant with state requirements.

-

What are the costs associated with a Quitclaim Deed From Corporation To Husband And Wife in Illinois?

The costs for filing a Quitclaim Deed From Corporation To Husband And Wife in Illinois generally include recording fees, which vary by county. With airSlate SignNow, you can access a cost-effective solution for preparing your quitclaim deed without the need for expensive legal services. Always check local regulations for exact filing fees.

-

What features does airSlate SignNow offer for managing quitclaim deeds?

AirSlate SignNow offers a range of features for managing Quitclaim Deed From Corporation To Husband And Wife in Illinois, including customizable templates and secure electronic signatures. Our platform also allows for easy document tracking and storage, making it simple to manage multiple transactions efficiently.

-

Is the Quitclaim Deed From Corporation To Husband And Wife legally binding?

Yes, a Quitclaim Deed From Corporation To Husband And Wife in Illinois is a legally binding document once it is properly executed and recorded with the county clerk's office. Using airSlate SignNow ensures that your quitclaim deed meets all legal requirements, providing peace of mind regarding the validity of your transfer.

-

Can I edit my Quitclaim Deed From Corporation To Husband And Wife after signing?

Once a Quitclaim Deed From Corporation To Husband And Wife in Illinois has been signed and executed, it cannot be edited. However, with airSlate SignNow, you can create a draft and make changes before finalizing. This flexibility allows you to ensure all information is accurate and up-to-date before signing.

-

How does airSlate SignNow enhance the eSigning process for quitclaim deeds?

AirSlate SignNow enhances the eSigning process for Quitclaim Deed From Corporation To Husband And Wife in Illinois by providing a user-friendly interface that simplifies document preparation and signature collection. Our platform also ensures that every transaction is secure and legally compliant, streamlining the overall process for users.

Get more for Quitclaim Deed From Corporation To Husband And Wife Illinois

Find out other Quitclaim Deed From Corporation To Husband And Wife Illinois

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe