M11AR, Fire Insurance Tax Retaliatory Schedule Form

What is the M11AR, Fire Insurance Tax Retaliatory Schedule

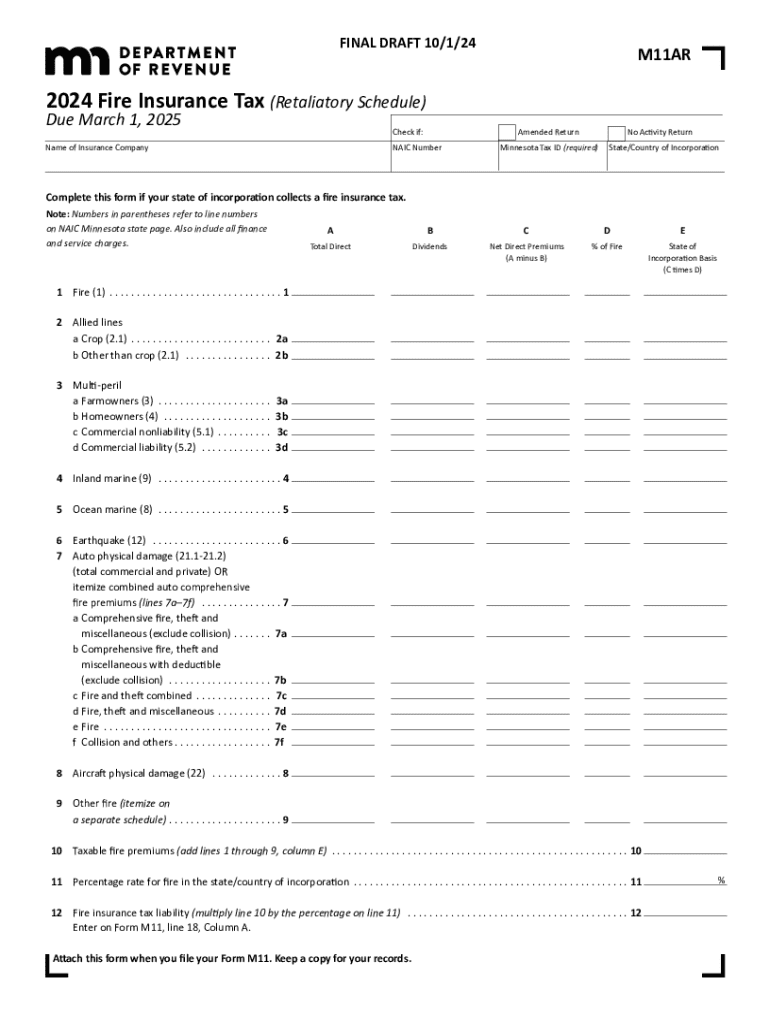

The M11AR, Fire Insurance Tax Retaliatory Schedule, is a tax form used by insurance companies operating in the United States. This form is specifically designed to report and calculate retaliatory taxes imposed by states on out-of-state insurance providers. The retaliatory tax ensures that insurance companies from other states do not gain an unfair advantage over local companies by paying lower taxes. The M11AR serves as a crucial tool for maintaining equitable tax practices among insurers, promoting fairness in the insurance market.

How to use the M11AR, Fire Insurance Tax Retaliatory Schedule

To effectively use the M11AR, Fire Insurance Tax Retaliatory Schedule, insurance companies must first gather relevant financial data, including premium income and tax liabilities from various states. The form requires detailed information about the premiums collected from policyholders and the corresponding taxes paid in each state. After compiling this data, insurers can accurately complete the M11AR to determine their retaliatory tax obligations. This form must be submitted alongside the company's annual tax filings to ensure compliance with state regulations.

Steps to complete the M11AR, Fire Insurance Tax Retaliatory Schedule

Completing the M11AR involves several key steps:

- Gather financial records, including premium income and tax payments for each state.

- Review state-specific tax rates and regulations to ensure accurate reporting.

- Fill out the M11AR form, detailing the necessary financial information.

- Calculate the retaliatory tax based on the information provided.

- Double-check all entries for accuracy before submission.

- Submit the completed form along with other required documentation to the appropriate state tax authority.

Key elements of the M11AR, Fire Insurance Tax Retaliatory Schedule

The M11AR includes several critical elements that insurers must accurately report. These elements typically encompass:

- Total premiums written in the reporting period.

- Taxes paid to each state where the insurer operates.

- Calculations for retaliatory tax based on the difference in state tax rates.

- Information about the insurance company's domicile state.

Each of these components plays a vital role in determining the overall tax liability and ensuring compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the M11AR, Fire Insurance Tax Retaliatory Schedule vary by state. Generally, insurers must submit this form annually, coinciding with their regular tax filing deadlines. It is crucial for companies to stay informed about specific due dates to avoid penalties. Insurers should also be aware of any extensions that may apply to their filings, as these can differ based on state regulations.

Penalties for Non-Compliance

Failure to comply with the requirements of the M11AR can result in significant penalties. These may include:

- Monetary fines imposed by state tax authorities.

- Interest on unpaid taxes, which can accumulate over time.

- Potential legal action for persistent non-compliance.

Insurance companies must prioritize accurate and timely submissions to avoid these consequences, ensuring they adhere to all applicable state tax laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m11ar fire insurance tax retaliatory schedule 769226330

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M11AR, Fire Insurance Tax Retaliatory Schedule?

The M11AR, Fire Insurance Tax Retaliatory Schedule is a form used by insurance companies to report their tax liabilities related to fire insurance. It helps ensure compliance with state regulations and provides a clear overview of tax obligations. Understanding this schedule is crucial for businesses in the insurance sector to avoid penalties.

-

How can airSlate SignNow assist with the M11AR, Fire Insurance Tax Retaliatory Schedule?

airSlate SignNow offers a streamlined solution for managing and eSigning documents related to the M11AR, Fire Insurance Tax Retaliatory Schedule. Our platform simplifies the process, allowing users to quickly prepare, send, and sign necessary forms. This efficiency helps businesses stay compliant and organized.

-

What are the pricing options for using airSlate SignNow for the M11AR, Fire Insurance Tax Retaliatory Schedule?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses handling the M11AR, Fire Insurance Tax Retaliatory Schedule. Our plans are designed to be cost-effective, ensuring that you only pay for the features you need. Contact us for a detailed quote based on your specific requirements.

-

What features does airSlate SignNow offer for managing the M11AR, Fire Insurance Tax Retaliatory Schedule?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning, all of which are beneficial for managing the M11AR, Fire Insurance Tax Retaliatory Schedule. These tools enhance productivity and ensure that all documents are handled efficiently and securely. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Are there any integrations available for airSlate SignNow related to the M11AR, Fire Insurance Tax Retaliatory Schedule?

Yes, airSlate SignNow integrates seamlessly with various applications that can assist in managing the M11AR, Fire Insurance Tax Retaliatory Schedule. This includes CRM systems, document management tools, and accounting software. These integrations help streamline your workflow and enhance overall efficiency.

-

What are the benefits of using airSlate SignNow for the M11AR, Fire Insurance Tax Retaliatory Schedule?

Using airSlate SignNow for the M11AR, Fire Insurance Tax Retaliatory Schedule offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows for quick document turnaround, which is essential for meeting tax deadlines. Additionally, the secure eSigning feature ensures that your documents are legally binding.

-

Is airSlate SignNow secure for handling the M11AR, Fire Insurance Tax Retaliatory Schedule?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents related to the M11AR, Fire Insurance Tax Retaliatory Schedule. Our platform is designed to keep your sensitive information safe while ensuring that you can easily access and manage your documents.

Get more for M11AR, Fire Insurance Tax Retaliatory Schedule

- Utah landlord notices for eviction unlawful detainer forms package utah

- Utah criminal form

- Checklist for victims statement in petition to expunge records utah form

- Utah expungement application form

- Victims statement for expungement request utah form

- Utah reply form

- Utah reply 497427666 form

- Response by ap utah form

Find out other M11AR, Fire Insurance Tax Retaliatory Schedule

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself