Illinois Partial Form

What is the Illinois Partial

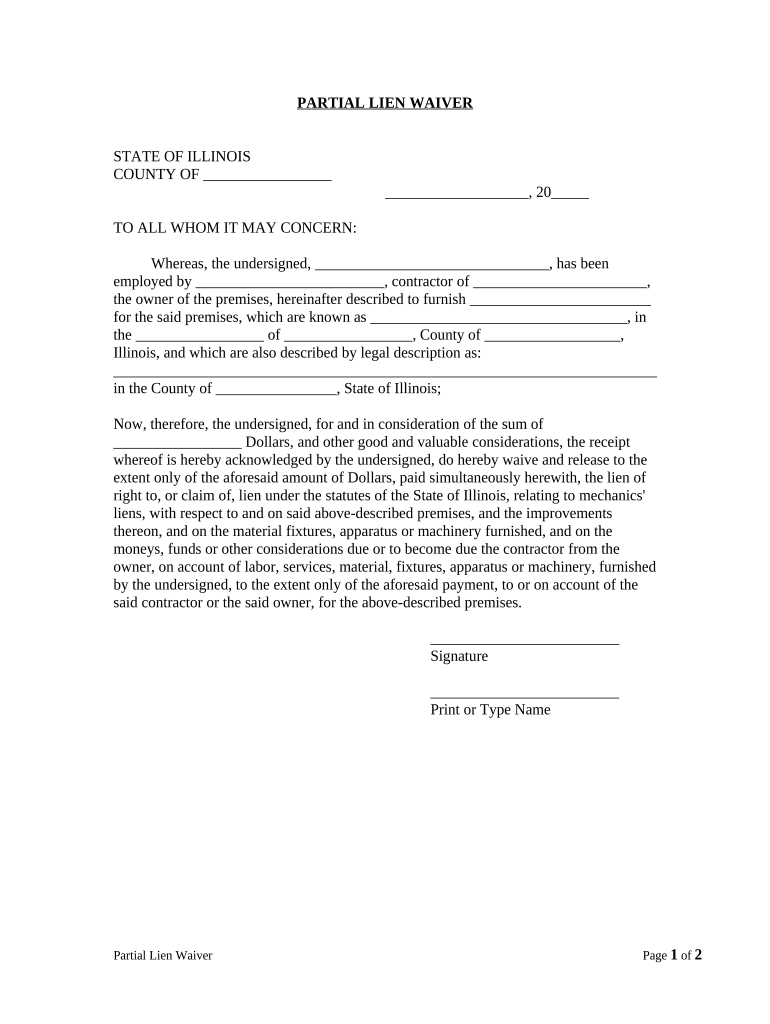

The Illinois Partial is a specific form used in the state of Illinois for various legal and administrative purposes. It typically pertains to tax filings, allowing taxpayers to report partial income or deductions. This form is essential for individuals and businesses who need to disclose only a portion of their financial information for compliance with state regulations. Understanding the Illinois Partial is crucial for ensuring accurate reporting and avoiding penalties.

How to use the Illinois Partial

Using the Illinois Partial involves several steps to ensure proper completion and submission. First, gather all necessary financial documents that pertain to the income or deductions you plan to report. Next, fill out the form accurately, providing all required information. It is important to double-check your entries for any errors. Once completed, submit the form according to the guidelines set forth by the Illinois Department of Revenue, either electronically or via mail.

Steps to complete the Illinois Partial

Completing the Illinois Partial requires careful attention to detail. Follow these steps for successful completion:

- Gather relevant financial documents, including income statements and deduction records.

- Obtain the latest version of the Illinois Partial form from the official state website.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Report your partial income or deductions accurately, ensuring all figures are correct.

- Review the completed form for accuracy and completeness.

- Submit the form through the designated method, either online or by mail.

Legal use of the Illinois Partial

The Illinois Partial is legally recognized, provided it is completed in accordance with state laws and regulations. To ensure its legality, the form must be signed and dated by the taxpayer. Additionally, it must comply with all relevant tax laws, including those set by the Illinois Department of Revenue. Using the form correctly helps prevent legal issues and potential audits.

Key elements of the Illinois Partial

Several key elements define the Illinois Partial, making it essential for accurate reporting. These include:

- Identification Information: This includes the taxpayer's name, address, and identification number.

- Income Reporting: Taxpayers must report only the income relevant to the partial filing.

- Deductions: Any deductions claimed must be clearly outlined and substantiated with documentation.

- Signature: The form must be signed by the taxpayer to validate its contents.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois Partial vary based on the taxpayer's situation. Generally, the form must be submitted by the state tax deadline, which is typically April 15 for individuals. It is important to stay informed about any changes to these dates, as extensions or specific circumstances may alter the timeline. Marking these deadlines on your calendar can help ensure timely compliance.

Who Issues the Form

The Illinois Partial is issued by the Illinois Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with tax laws. Taxpayers can obtain the form directly from the department's official website or through authorized distribution channels. It is essential to use the most current version of the form to ensure compliance with any recent updates or changes in regulations.

Quick guide on how to complete illinois partial

Effortlessly Prepare Illinois Partial on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly with no delays. Manage Illinois Partial on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and eSign Illinois Partial with Ease

- Locate Illinois Partial and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you’d like to send your form, whether by email, text message (SMS), shareable link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Illinois Partial and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the cost of using airSlate SignNow for Illinois partial documents?

airSlate SignNow offers competitive pricing plans tailored for businesses in Illinois. Whether you are handling a few documents or managing high-volume eSignatures, we have options that suit your needs. Our pricing for Illinois partial services ensures that you get the best value for a cost-effective solution.

-

What features does airSlate SignNow provide for managing Illinois partial agreements?

airSlate SignNow includes a variety of features designed to streamline the management of Illinois partial agreements. Users can enjoy customizable templates, automated workflows, and seamless send-and-sign capabilities. These features are specifically optimized for handling partial documents efficiently.

-

How can airSlate SignNow benefit businesses in Illinois?

Businesses in Illinois can signNowly benefit from airSlate SignNow by enhancing their document management processes. With our intuitive platform, companies can reduce the turnaround time for important contracts and improve overall workflow efficiency. Moreover, airSlate SignNow ensures compliance with Illinois partial regulations, providing peace of mind.

-

Is airSlate SignNow easy to integrate with other applications in Illinois?

Yes, airSlate SignNow offers robust integration capabilities with numerous applications commonly used by businesses in Illinois. Whether you're using CRM systems, project management tools, or document storage solutions, our platform integrates seamlessly. This allows for a more cohesive workflow while managing Illinois partial documents.

-

Can I use airSlate SignNow on mobile devices for Illinois partial documents?

Absolutely! airSlate SignNow is fully optimized for mobile devices, enabling you to manage Illinois partial documents on the go. With our mobile application, users can send and sign documents anytime, anywhere, ensuring that critical agreements are processed without delay.

-

How does airSlate SignNow ensure security for Illinois partial contracts?

airSlate SignNow prioritizes the security of all documents, including Illinois partial contracts. We utilize advanced encryption, secure cloud storage, and comply with industry standards. This commitment to security ensures that your sensitive data remains protected throughout the signing process.

-

What support options are available for airSlate SignNow users in Illinois?

Users in Illinois can access a variety of support options when using airSlate SignNow. We offer comprehensive resources, including a knowledge base, chat support, and email assistance, so you can get the help you need promptly. Our dedicated support team is committed to ensuring a smooth experience for all users managing Illinois partial documents.

Get more for Illinois Partial

Find out other Illinois Partial

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now