Form L 4175 632 Personal Property Statement Michigan 2024

Understanding the Form L-4175 632 Personal Property Statement in Michigan

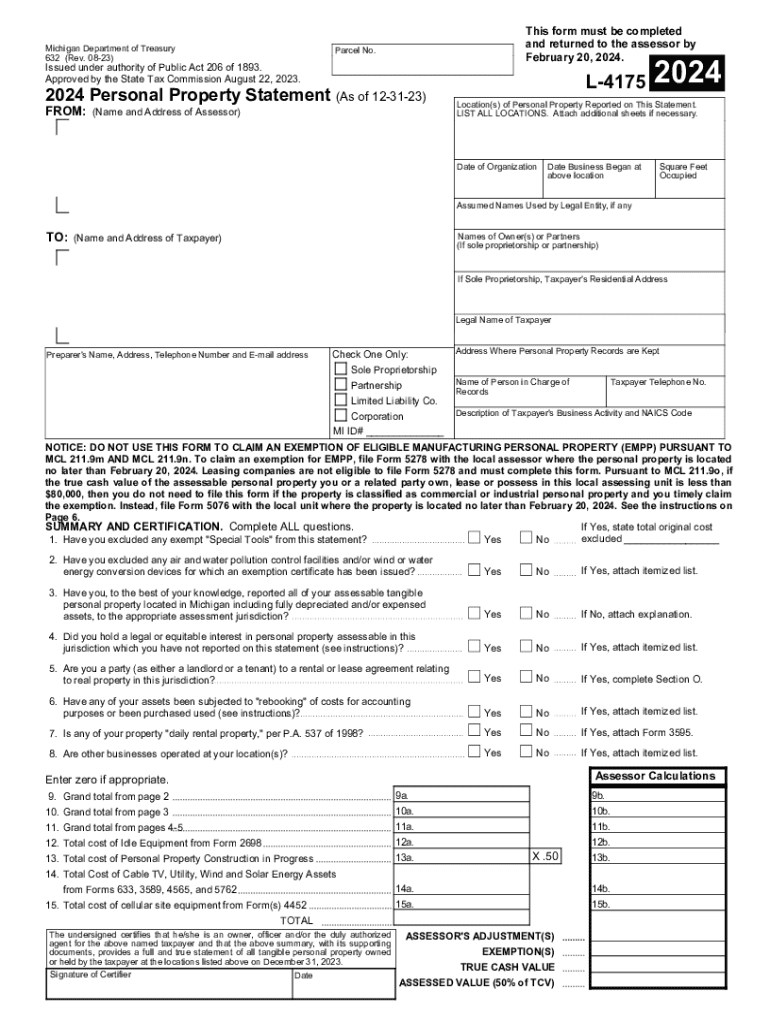

The Form L-4175 632 Personal Property Statement is a crucial document for individuals and businesses in Michigan. It is used to report personal property owned by a business, which is essential for tax assessment purposes. This form helps local assessors determine the value of personal property for taxation, ensuring that businesses are accurately taxed based on their assets. Understanding this form is vital for compliance and to avoid potential penalties.

Steps to Complete the Form L-4175 632 Personal Property Statement

Completing the Form L-4175 632 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary information regarding your personal property, including equipment, furniture, and any other assets.

- Fill out the form accurately, ensuring that each section is completed to reflect the current value of your assets.

- Double-check your entries for any errors or omissions that could lead to issues with your tax assessment.

- Submit the completed form by the deadline to avoid penalties. The due date is typically February 20 of each year.

Obtaining the Form L-4175 632 Personal Property Statement

The Form L-4175 632 can be obtained from the Michigan Department of Treasury website or through your local assessor's office. It is important to ensure you have the most current version of the form, as updates may occur. Additionally, many local offices may provide physical copies or assistance in completing the form if needed.

Legal Use of the Form L-4175 632 Personal Property Statement

The legal use of the Form L-4175 632 is to report personal property for tax assessment in Michigan. Businesses are required by law to file this form annually to ensure compliance with state tax regulations. Failure to submit the form can result in penalties, including estimated assessments or fines. Understanding the legal implications of this form helps businesses maintain compliance and avoid unnecessary complications.

Filing Deadlines for the Form L-4175 632 Personal Property Statement

Timely filing of the Form L-4175 632 is essential to avoid penalties. The deadline for submission is February 20 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to submit the form well in advance of the deadline to ensure that any potential issues can be addressed.

Key Elements of the Form L-4175 632 Personal Property Statement

Key elements of the Form L-4175 632 include sections for reporting the type and value of personal property, as well as any exemptions that may apply. Accurate reporting of these elements is critical for determining the correct tax liability. Additionally, the form may require information about the business entity, including its structure and ownership details.

Create this form in 5 minutes or less

Find and fill out the correct form l 4175 632 personal property statement michigan

Create this form in 5 minutes!

How to create an eSignature for the form l 4175 632 personal property statement michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to treasury management?

airSlate SignNow is a digital solution that empowers businesses to send and eSign documents efficiently. In the context of treasury management, it streamlines the process of handling financial documents, ensuring that treasury operations are both secure and compliant.

-

How can airSlate SignNow improve my treasury operations?

By utilizing airSlate SignNow, treasury teams can automate document workflows, reducing the time spent on manual processes. This efficiency allows treasury professionals to focus on strategic initiatives rather than administrative tasks, ultimately enhancing productivity.

-

What are the pricing options for airSlate SignNow for treasury departments?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of treasury departments of all sizes. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing the essential features for effective treasury management.

-

What features does airSlate SignNow offer that benefit treasury functions?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These tools are particularly beneficial for treasury functions, as they enhance accuracy and speed in managing financial agreements and contracts.

-

Can airSlate SignNow integrate with other treasury management systems?

Yes, airSlate SignNow seamlessly integrates with various treasury management systems and financial software. This integration capability ensures that your treasury operations remain cohesive and that data flows smoothly between platforms, enhancing overall efficiency.

-

Is airSlate SignNow secure for handling sensitive treasury documents?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive treasury documents. This commitment to security ensures that your financial data remains confidential and secure throughout the signing process.

-

How does airSlate SignNow enhance collaboration within treasury teams?

airSlate SignNow facilitates collaboration by allowing multiple users to access and sign documents simultaneously. This feature is particularly useful for treasury teams that need to work together on financial agreements, ensuring that all stakeholders are aligned and informed.

Get more for Form L 4175 632 Personal Property Statement Michigan

Find out other Form L 4175 632 Personal Property Statement Michigan

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast