IRS Offer in Compromise Forms and OIC Checklist

Understanding the California FTB Offer in Compromise

The California Franchise Tax Board (FTB) offers an Offer in Compromise (OIC) program that allows taxpayers to settle their tax liabilities for less than the full amount owed. This program is designed for individuals who cannot pay their tax debts or who would face financial hardship if required to pay the full amount. The OIC process involves submitting a formal proposal to the FTB, which must include detailed financial information to support the claim for a reduced payment.

Eligibility Criteria for the FTB Offer in Compromise

To qualify for the California FTB Offer in Compromise, taxpayers must meet specific eligibility criteria. These include:

- Demonstrating an inability to pay the full tax liability.

- Providing accurate financial information, including income, expenses, and assets.

- Being current with all tax filings.

- Not being in an active bankruptcy proceeding.

Taxpayers should carefully assess their financial situation before applying to ensure they meet these requirements.

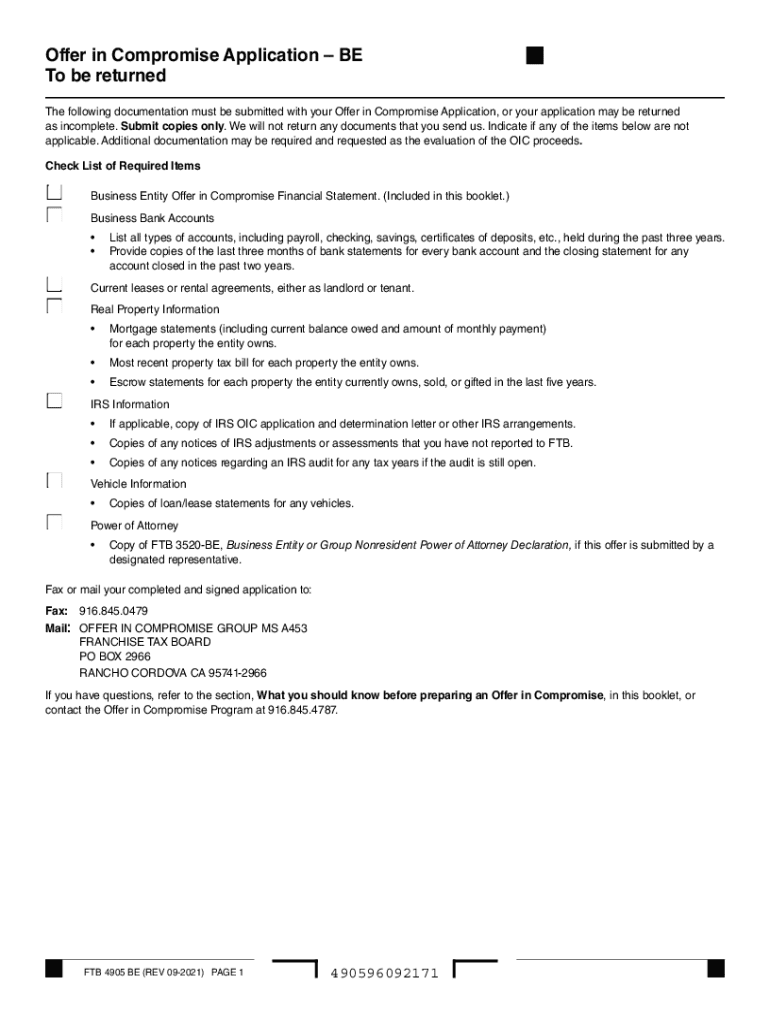

Required Documents for the OIC Submission

Submitting an Offer in Compromise requires several key documents to support the request. Essential documents include:

- Completed FTB Form 4905BE, which is the Offer in Compromise form.

- Financial statements detailing income, expenses, and assets.

- Any supporting documentation that verifies claims made in the application.

Gathering these documents in advance can streamline the application process and improve the chances of approval.

Steps to Complete the FTB Offer in Compromise Form

Completing the FTB Offer in Compromise Form involves several steps:

- Download and fill out the FTB Form 4905BE accurately.

- Prepare a detailed financial statement that outlines your current financial situation.

- Compile all necessary supporting documents to accompany your application.

- Submit the completed form and documents to the FTB, either online or via mail.

Each step is crucial for ensuring that the FTB has all the information needed to assess the offer effectively.

Form Submission Methods for the FTB OIC

Taxpayers can submit their Offer in Compromise through various methods. The available submission methods include:

- Online submission via the FTB's official website.

- Mailing the completed form and documents to the designated FTB address.

- In-person submission at local FTB offices, if applicable.

Choosing the right submission method can impact the processing time and efficiency of the application.

Application Process and Approval Time for the OIC

The application process for the California FTB Offer in Compromise can take several months. After submission, the FTB will review the application, which may involve additional requests for information. Taxpayers should be prepared for a waiting period, as the approval time can vary based on the complexity of the case and the FTB's workload. Staying responsive to any inquiries from the FTB can help expedite the process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs offer in compromise forms and oic checklist

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a California FTB offer in compromise?

A California FTB offer in compromise is a program that allows taxpayers to settle their tax debts for less than the full amount owed. This option is available for individuals who are unable to pay their tax liabilities due to financial hardship. By submitting an offer in compromise, taxpayers can achieve a fresh start with their tax obligations.

-

How can airSlate SignNow assist with the California FTB offer in compromise process?

airSlate SignNow streamlines the process of submitting a California FTB offer in compromise by allowing users to easily create, send, and eSign necessary documents. Our platform ensures that all forms are completed accurately and submitted on time, reducing the risk of delays. This efficiency can signNowly enhance your chances of a successful compromise.

-

What are the costs associated with a California FTB offer in compromise?

The costs for a California FTB offer in compromise can vary based on the complexity of your case and the amount owed. Typically, there is a non-refundable application fee, and you may need to make an initial payment towards your offer. Utilizing airSlate SignNow can help you manage these costs effectively by simplifying document preparation and submission.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features for managing tax documents, including customizable templates, secure eSigning, and real-time tracking of document status. These features are particularly beneficial when preparing a California FTB offer in compromise, as they ensure all necessary paperwork is organized and accessible. Additionally, our platform provides a user-friendly interface that simplifies the entire process.

-

What benefits does using airSlate SignNow provide for tax professionals?

For tax professionals, using airSlate SignNow to handle California FTB offer in compromise submissions can save time and enhance client satisfaction. The platform allows for quick document preparation and secure eSigning, which can streamline workflows. Moreover, the ability to track document progress ensures that tax professionals can keep their clients informed throughout the process.

-

Can airSlate SignNow integrate with other tax software?

Yes, airSlate SignNow can integrate with various tax software solutions, making it easier to manage your California FTB offer in compromise documents alongside your other tax-related tasks. This integration allows for seamless data transfer and reduces the need for manual entry, enhancing overall efficiency. Check our integrations page for specific software compatibility.

-

How long does it take to process a California FTB offer in compromise?

The processing time for a California FTB offer in compromise can vary, but it typically takes several months for the FTB to review and respond to your application. Using airSlate SignNow can help expedite the initial submission process, ensuring that all documents are submitted correctly and promptly. Staying organized and proactive can also help reduce delays.

Get more for IRS Offer In Compromise Forms And OIC Checklist

Find out other IRS Offer In Compromise Forms And OIC Checklist

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document