Illinois Corporation Llc Form

What is the Illinois Corporation LLC

The Illinois Corporation LLC is a legal entity that combines the benefits of a corporation and a limited liability company (LLC). This structure allows business owners to enjoy limited liability protection while benefiting from pass-through taxation. In Illinois, forming an LLC requires filing specific documents with the Secretary of State, ensuring compliance with state regulations. The Illinois Corporation LLC is particularly appealing to small business owners and entrepreneurs looking for flexibility and protection in their business operations.

How to obtain the Illinois Corporation LLC

To obtain an Illinois Corporation LLC, you must follow a series of steps. First, choose a unique name for your LLC that complies with Illinois naming requirements. Next, designate a registered agent who will receive legal documents on behalf of your LLC. After that, file the Articles of Organization with the Illinois Secretary of State, which includes essential information about your business. Additionally, you may need to create an operating agreement to outline the management structure and operating procedures of your LLC. Finally, obtain any necessary licenses or permits based on your business type and location.

Steps to complete the Illinois Corporation LLC

Completing the Illinois Corporation LLC involves several key steps:

- Choose a unique name for your LLC that meets Illinois naming regulations.

- Appoint a registered agent who has a physical address in Illinois.

- Prepare and file the Articles of Organization with the Illinois Secretary of State.

- Create an operating agreement to define the management and operational structure.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

- Register for any state and local business licenses or permits.

Legal use of the Illinois Corporation LLC

The legal use of the Illinois Corporation LLC is governed by state laws that provide guidelines for its formation and operation. This structure allows members to limit their personal liability for business debts and obligations. Additionally, an LLC can enter into contracts, sue or be sued, and own property in its name. It is crucial for LLC members to adhere to state regulations and maintain proper records to ensure that the entity retains its limited liability protection.

Key elements of the Illinois Corporation LLC

Key elements of the Illinois Corporation LLC include:

- Limited Liability Protection: Members are not personally liable for the debts of the LLC.

- Pass-Through Taxation: Profits and losses can be reported on members' personal tax returns.

- Flexible Management Structure: Members can choose to manage the LLC themselves or appoint managers.

- Compliance Requirements: LLCs must adhere to state regulations, including filing annual reports and maintaining a registered agent.

Filing Deadlines / Important Dates

When forming an Illinois Corporation LLC, it is essential to be aware of important deadlines. The Articles of Organization should be filed with the Illinois Secretary of State as soon as you decide to establish your LLC. Additionally, Illinois requires LLCs to file an annual report by the first day of the month in which the LLC was formed. Keeping track of these deadlines helps maintain good standing and compliance with state regulations.

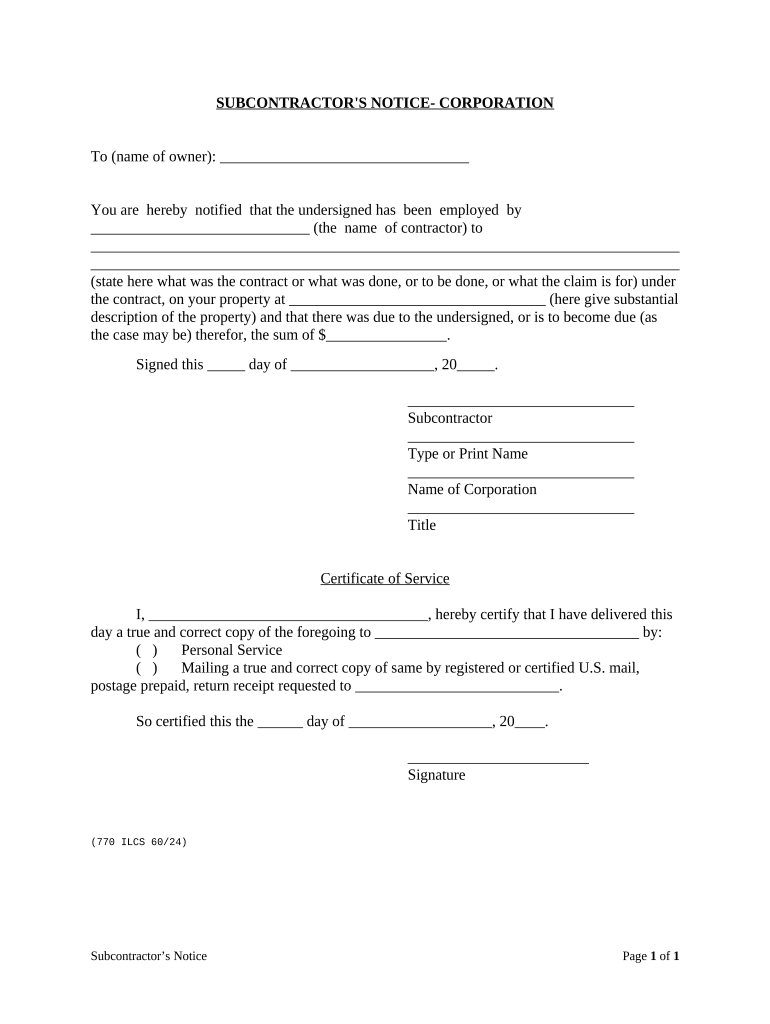

Quick guide on how to complete illinois corporation llc

Effortlessly Prepare Illinois Corporation Llc on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly and seamlessly. Manage Illinois Corporation Llc on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The Easiest Method to Modify and eSign Illinois Corporation Llc with Ease

- Find Illinois Corporation Llc and click Get Form to begin.

- Use the available tools to fill out your form.

- Highlight important parts of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all entered information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether through email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign Illinois Corporation Llc and ensure effective communication at every step of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois corporation LLC and how does it work?

An Illinois corporation LLC, or Limited Liability Company, is a business structure that combines the benefits of both a corporation and a partnership. This means that members enjoy limited liability protection while also receiving pass-through taxation. Setting up an Illinois corporation LLC can be done quickly and efficiently through platforms like airSlate SignNow.

-

How much does it cost to set up an Illinois corporation LLC?

The costs associated with setting up an Illinois corporation LLC can vary based on several factors, including state filing fees and additional services. Typically, you can expect to pay between $100 to $200 for state fees, while airSlate SignNow offers affordable solutions to streamline the process. Overall, our platform helps you save both time and money in establishing your LLC.

-

What features does airSlate SignNow provide for an Illinois corporation LLC?

airSlate SignNow provides a robust set of features for managing documents for an Illinois corporation LLC, including eSigning, document sharing, and templates. Our platform is designed to enhance workflow efficiency, ensuring that you can easily manage all necessary paperwork associated with your LLC formation and operations. Additionally, security features help protect sensitive information.

-

What are the benefits of using airSlate SignNow for an Illinois corporation LLC?

The primary benefits of using airSlate SignNow for your Illinois corporation LLC include ease of use, cost-effectiveness, and enhanced collaboration. By utilizing our platform, you can streamline the signing process, reduce turnaround time, and minimize paperwork errors. These benefits ultimately help your LLC operate more efficiently.

-

Can I integrate airSlate SignNow with other tools for my Illinois corporation LLC?

Yes, airSlate SignNow offers integrations with a variety of popular tools and platforms that can benefit your Illinois corporation LLC. This includes CRM systems, cloud storage solutions, and project management software. These integrations provide a seamless user experience, allowing you to manage documents and workflows effectively within your existing systems.

-

Is airSlate SignNow suitable for all types of Illinois corporation LLCs?

Absolutely! airSlate SignNow is designed to cater to all types of Illinois corporation LLCs, whether you're a startup, a small business, or a larger enterprise. Our versatile platform can accommodate various business needs, making it an ideal choice for any level of organization looking to simplify their document management and signing processes.

-

How secure is airSlate SignNow for an Illinois corporation LLC?

Security is a top priority at airSlate SignNow, especially for an Illinois corporation LLC. Our platform implements advanced encryption and complies with industry-standard security regulations to protect your sensitive data. You can trust that your documents and information are safe while using our eSigning services.

Get more for Illinois Corporation Llc

Find out other Illinois Corporation Llc

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe