Illinois Lien Form

What is the Illinois Lien

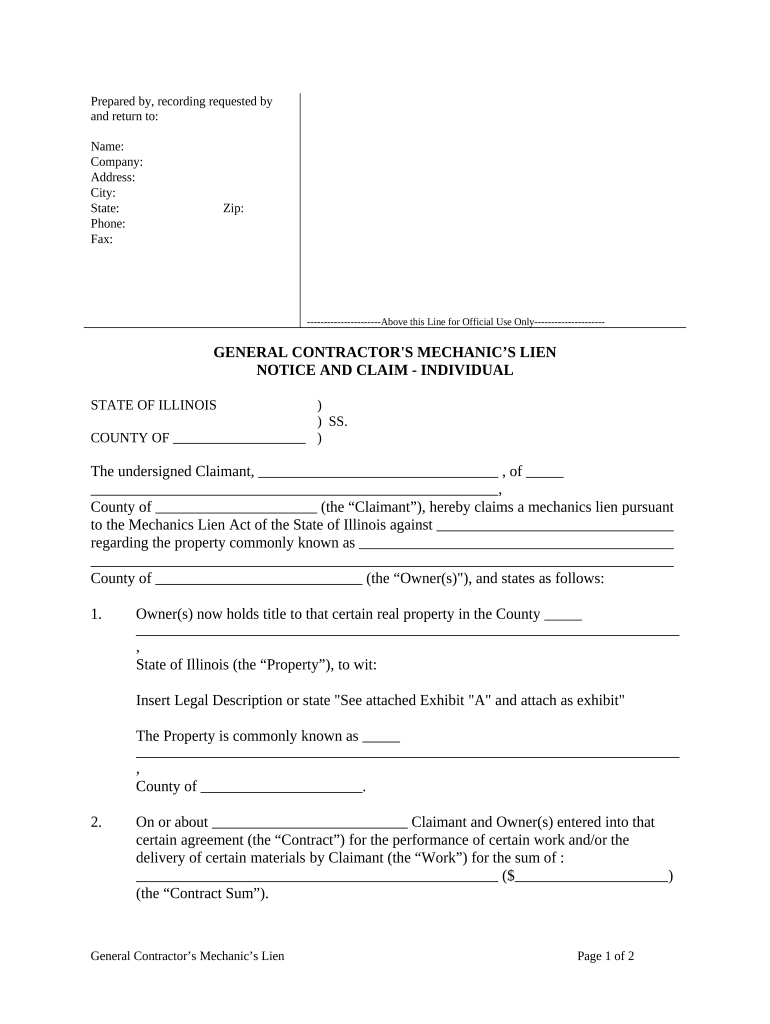

The Illinois lien is a legal claim against a property or asset that secures the payment of a debt or obligation. This type of lien can arise from various situations, including unpaid taxes, loans, or contractor services. When a lien is placed on a property, it can affect the owner's ability to sell or refinance the asset until the debt is settled. Understanding the nature and implications of an Illinois lien is crucial for both property owners and creditors.

How to use the Illinois Lien

Using the Illinois lien involves several steps to ensure that it is properly documented and enforceable. First, identify the type of lien applicable to your situation, such as a tax lien or a mechanic's lien. Next, gather all necessary documentation that supports the claim, including contracts, invoices, or tax records. Once the documentation is ready, file the lien with the appropriate county recorder's office to officially register it. This step is vital for establishing the lien's legal standing and priority over other claims.

Steps to complete the Illinois Lien

Completing the Illinois lien process requires attention to detail and adherence to legal requirements. Follow these steps:

- Determine the type of lien you need to file.

- Collect supporting documents, such as contracts or payment records.

- Fill out the appropriate lien form, ensuring all information is accurate.

- File the completed form with the county recorder's office.

- Pay any required filing fees.

- Notify the property owner of the lien filing, if applicable.

Legal use of the Illinois Lien

The legal use of the Illinois lien is governed by state laws that define how liens can be established and enforced. It is essential to comply with these regulations to ensure that the lien is valid. This includes adhering to specific filing deadlines, providing proper notice to affected parties, and following any additional state-specific requirements. Failure to comply with these legal standards may result in the lien being deemed unenforceable.

Key elements of the Illinois Lien

Several key elements must be present for an Illinois lien to be considered valid. These include:

- A clear statement of the debt or obligation.

- Identification of the property or asset subject to the lien.

- Proper documentation supporting the claim.

- Timely filing with the appropriate authorities.

- Notification to the property owner, if required.

Filing Deadlines / Important Dates

Filing deadlines for an Illinois lien can vary based on the type of lien being filed. For instance, mechanic's liens typically have a deadline of four months from the date of last work performed or materials supplied. Tax liens may have different timelines based on local regulations. It is crucial to be aware of these deadlines to avoid losing the right to file a lien. Keeping track of important dates can help ensure compliance and protect your interests.

Required Documents

To file an Illinois lien, certain documents are required to substantiate the claim. These may include:

- Completed lien form.

- Contracts or agreements related to the debt.

- Invoices or proof of unpaid amounts.

- Any relevant correspondence with the debtor.

- Payment records or receipts.

Quick guide on how to complete illinois lien 497306092

Prepare Illinois Lien seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Handle Illinois Lien on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Illinois Lien with ease

- Find Illinois Lien and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Illinois Lien while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois lien and how can it affect my property?

An Illinois lien is a legal claim against your property, often resulting from unpaid debts or obligations. It can affect your ability to sell or refinance your property, as potential buyers may be deterred by existing liens. Understanding Illinois liens is crucial for managing your assets effectively.

-

How can airSlate SignNow help me manage Illinois liens?

airSlate SignNow provides a streamlined solution for signing and managing documents related to Illinois liens. By using airSlate SignNow, you can efficiently eSign lien release forms and related documents, ensuring compliance and expediting the process. This improves your overall management of liens and helps you maintain clear records.

-

What are the pricing options available with airSlate SignNow for managing Illinois liens?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes, allowing you to choose the best fit for managing Illinois liens. The plans include features that support document signing, storage, and collaboration. You can start with a free trial to explore how it can meet your needs for handling liens.

-

Can airSlate SignNow integrate with other tools to help manage Illinois liens?

Yes, airSlate SignNow seamlessly integrates with numerous applications, enhancing your ability to manage Illinois liens. Integrations with CRM and project management tools enable you to automate workflows and keep your documents organized. This functionality signNowly improves the handling of lien-related tasks.

-

What features does airSlate SignNow offer for handling Illinois lien documents?

airSlate SignNow offers features such as eSigning, document templates, and secure cloud storage, all of which are vital for managing Illinois lien documents. Its user-friendly interface allows for easy access and management of your lien-related files, facilitating faster workflows. These features are designed to simplify the process of endorsement and compliance with state laws.

-

How does airSlate SignNow ensure the security of documents related to Illinois liens?

airSlate SignNow prioritizes the security of your documents, including those related to Illinois liens. The platform employs bank-grade encryption and secure access controls to protect sensitive information. Regular security audits further ensure compliance with data protection standards.

-

What benefits can I expect from using airSlate SignNow for Illinois lien management?

Using airSlate SignNow for Illinois lien management can save you time and reduce paperwork. The efficient eSigning process allows for quicker turnaround times, enabling timely releases and filings. Additionally, the platform's organization and security features help you maintain clear control over lien documents.

Get more for Illinois Lien

- Dma instructions for pcs pact form

- Behold your god workbook pdf form

- Social work confidentiality agreement template form

- Form us 864lt

- Poor person relief form

- Ia 8453 ind iowa individual income tax declaration for an e file return form

- 68 0192 questionnaire for determining status of worker form

- Iowa retail permit application for cigarettetobacconicotine form

Find out other Illinois Lien

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking