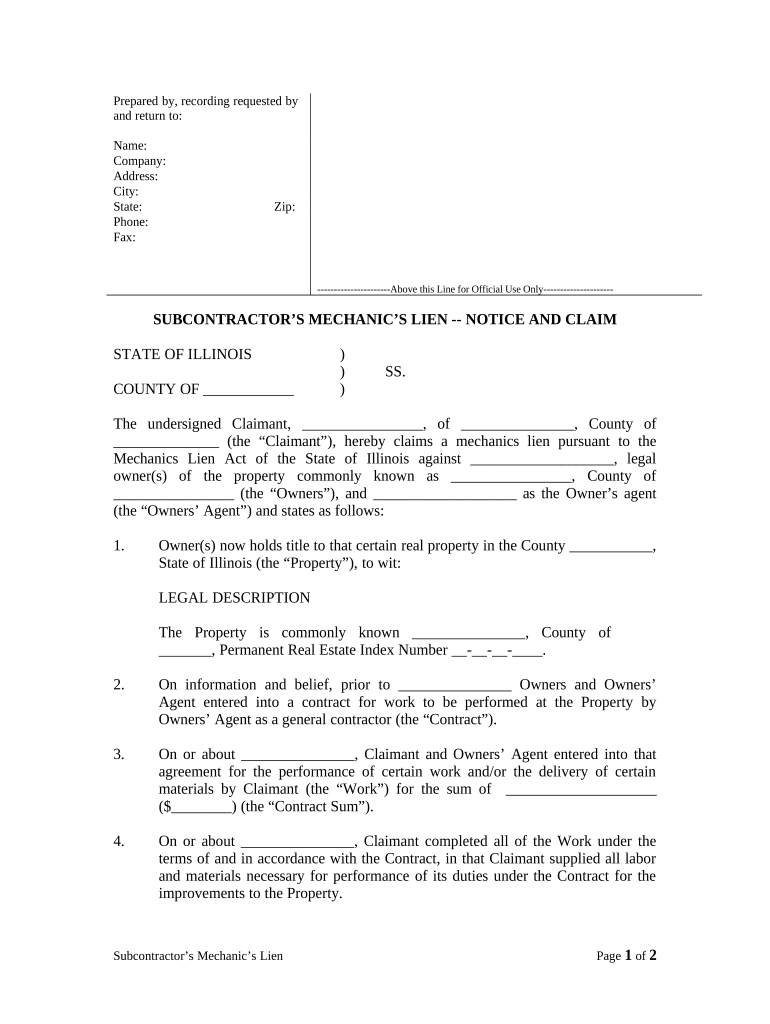

Illinois Lien Form

What is the Illinois Lien

The Illinois lien is a legal claim against a property or asset that secures the payment of a debt or obligation. It can arise from various circumstances, including unpaid taxes, loans, or judgments. Understanding the nature of the lien is crucial for property owners and creditors alike, as it can affect property ownership and financial transactions. In Illinois, liens can be placed by government entities, contractors, or other creditors, and they must be properly filed to be enforceable.

How to use the Illinois Lien

Using the Illinois lien involves several steps to ensure compliance with state regulations. Initially, a creditor must determine the basis for the lien, such as an unpaid debt. Following this, the creditor must file the lien with the appropriate county recorder's office. This filing serves as public notice of the lien, informing potential buyers or lenders of the existing claim. Once filed, the lien can be enforced if the debt remains unpaid, potentially leading to property foreclosure or other legal actions.

Steps to complete the Illinois Lien

Completing the Illinois lien process requires careful attention to detail. Here are the essential steps:

- Identify the debt that warrants the lien.

- Gather necessary documentation, including contracts or invoices.

- Complete the Illinois lien form, ensuring all required fields are filled accurately.

- File the completed form with the county recorder's office, along with any applicable fees.

- Serve notice to the property owner, if required by law.

Following these steps helps ensure that the lien is legally valid and enforceable.

Legal use of the Illinois Lien

The legal use of the Illinois lien is governed by state laws that dictate how and when a lien can be placed. Creditors must adhere to specific procedures, including proper notification to the debtor and timely filing with the appropriate authorities. Failure to comply with these regulations can result in the lien being deemed invalid. It is essential for creditors to understand their rights and responsibilities under Illinois law to effectively utilize liens as a collection tool.

Key elements of the Illinois Lien

Several key elements define the Illinois lien, making it essential for both creditors and property owners to understand:

- Filing Requirements: The lien must be filed with the county recorder's office to be enforceable.

- Notice: Creditors may be required to notify property owners of the lien.

- Duration: Liens in Illinois have specific time limits for enforcement, typically lasting for several years.

- Priority: The order of lien priority can affect the rights of creditors in case of foreclosure.

Understanding these elements is vital for navigating the lien process effectively.

Who Issues the Form

The form for the Illinois lien is typically issued by the county recorder's office where the property is located. This office is responsible for maintaining public records and ensuring that all filings comply with state regulations. Creditors seeking to file a lien must obtain the appropriate form from this office, which may also provide guidance on completing and submitting the form correctly.

Quick guide on how to complete illinois lien 497306110

Complete Illinois Lien effortlessly on any device

Online document management has become widely embraced by businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Handle Illinois Lien on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The most efficient way to modify and eSign Illinois Lien effortlessly

- Find Illinois Lien and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specially provides for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and carries the same legal standing as a traditional hand-written signature.

- Verify all the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign Illinois Lien and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois lien?

An Illinois lien is a legal claim against a property or assets in Illinois, typically to secure the payment of a debt. Understanding how Illinois liens work is crucial for businesses and individuals involved in real estate, finance, and legal processes. airSlate SignNow provides tools to help manage documentation related to Illinois liens efficiently.

-

How can airSlate SignNow help with Illinois lien documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to Illinois liens. With our easy-to-use platform, users can create templates for lien documents, making it quicker to send and eSign them. This streamlines the workflow, ensuring that all necessary steps for managing Illinois liens are efficiently handled.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Different tiers are available, providing features specifically tailored for handling documents, including those related to Illinois liens. Each plan is designed to be cost-effective, ensuring you get the best value for your investment.

-

Are there any specific features for managing Illinois liens with airSlate SignNow?

Yes, airSlate SignNow includes features such as customizable templates for Illinois lien documents, secure cloud storage, and real-time notifications for document status. These features enhance the user experience and ensure that all information related to Illinois liens is securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other tools for handling Illinois liens?

Absolutely! airSlate SignNow offers seamless integrations with various applications that can help manage Illinois liens. Whether you use CRM systems, project management tools, or accounting software, our platform connects easily, allowing for a streamlined approach to lien management.

-

What benefits does airSlate SignNow provide for Illinois lien management?

With airSlate SignNow, businesses can experience signNow time savings and improved accuracy in managing Illinois liens. Our platform enables fast electronic signatures, reduces paperwork, and minimizes errors. This allows teams to focus on more critical aspects of their projects while ensuring compliance with lien regulations.

-

Is airSlate SignNow secure for handling sensitive Illinois lien documents?

Yes, security is a top priority for airSlate SignNow. We employ industry-standard encryption and security protocols to protect all documents, including those related to Illinois liens. We ensure that your sensitive information remains confidential and secure throughout the signing process.

Get more for Illinois Lien

Find out other Illinois Lien

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure