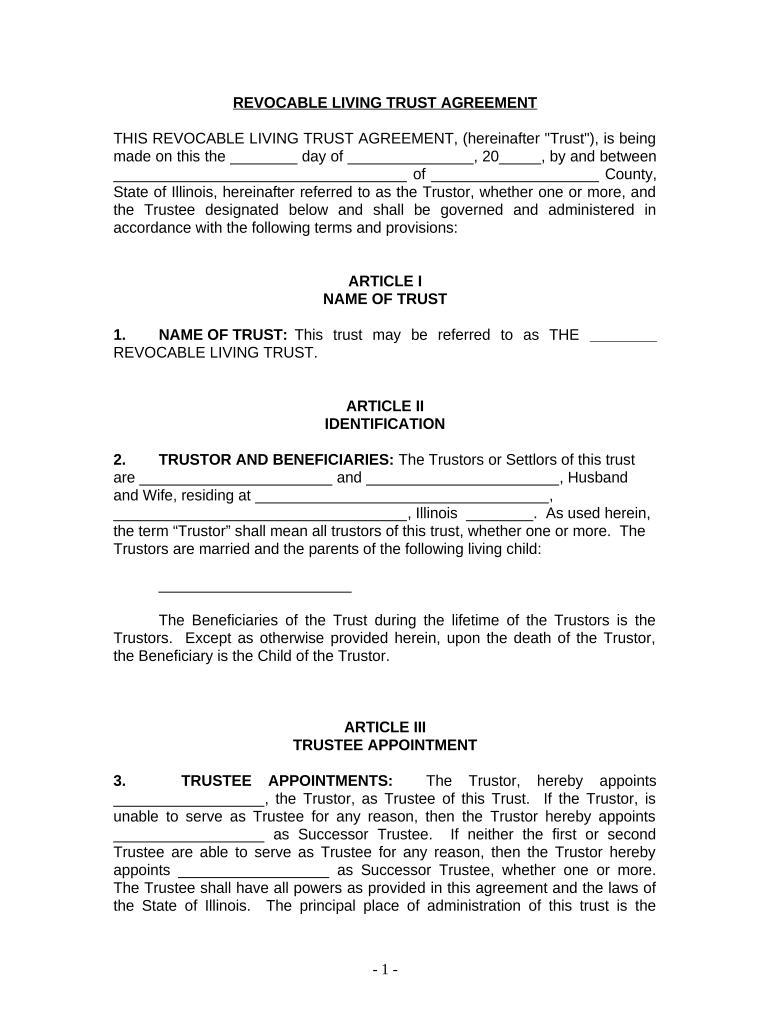

Living Trust for Husband and Wife with One Child Illinois Form

What is the Living Trust for Husband and Wife with One Child in Illinois

A living trust for husband and wife with one child in Illinois is a legal arrangement that allows a couple to manage their assets during their lifetime and designate how those assets will be distributed after their passing. This type of trust can help avoid the lengthy and often costly probate process. It allows the couple to maintain control over their assets while providing for their child in a structured manner. The trust becomes effective during the lifetime of the couple, and they can modify it as needed.

Key Elements of the Living Trust for Husband and Wife with One Child in Illinois

Several key elements define a living trust for husband and wife with one child in Illinois:

- Trustees: Typically, both spouses act as co-trustees, managing the trust assets together.

- Beneficiaries: The couple’s child is usually the primary beneficiary, with provisions for secondary beneficiaries if necessary.

- Asset Management: The trust outlines how assets are to be managed during the couple's lifetime and how they should be distributed after their death.

- Revocability: Most living trusts are revocable, meaning the couple can change the terms or dissolve the trust at any time while they are alive.

Steps to Complete the Living Trust for Husband and Wife with One Child in Illinois

Completing a living trust involves several important steps:

- Gather Information: Collect information about your assets, including property, bank accounts, and investments.

- Choose a Trustee: Decide who will manage the trust, typically both spouses.

- Draft the Trust Document: Create a legal document outlining the terms of the trust, including beneficiaries and asset distribution.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public.

- Fund the Trust: Transfer ownership of assets into the trust to ensure they are managed according to the trust's terms.

Legal Use of the Living Trust for Husband and Wife with One Child in Illinois

The legal use of a living trust in Illinois is governed by state laws that recognize the validity of such trusts. A properly executed living trust can help avoid probate, provide privacy regarding asset distribution, and allow for the seamless management of assets in case one spouse becomes incapacitated. It is essential to ensure that the trust complies with Illinois law to be enforceable in court.

State-Specific Rules for the Living Trust for Husband and Wife with One Child in Illinois

Illinois has specific rules that govern living trusts, including:

- Witness Requirements: The trust document must be signed by the grantors in the presence of a notary public.

- Asset Transfer: Assets must be formally transferred into the trust to be protected under its terms.

- Tax Implications: Understanding how the trust impacts state and federal taxes is crucial for compliance and planning.

How to Use the Living Trust for Husband and Wife with One Child in Illinois

Using a living trust effectively involves several practices. First, ensure that all assets intended for the trust are properly transferred into it. Regularly review and update the trust to reflect any changes in family circumstances, such as the birth of additional children or changes in financial status. Additionally, communicate with the child about the trust's purpose and provisions to foster understanding and transparency.

Quick guide on how to complete living trust for husband and wife with one child illinois

Finalize Living Trust For Husband And Wife With One Child Illinois effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Living Trust For Husband And Wife With One Child Illinois on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Living Trust For Husband And Wife With One Child Illinois without hassle

- Locate Living Trust For Husband And Wife With One Child Illinois and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools available from airSlate SignNow designed specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form—via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Alter and electronically sign Living Trust For Husband And Wife With One Child Illinois to ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child in Illinois?

A Living Trust For Husband And Wife With One Child in Illinois is a legal arrangement that allows couples to manage their assets for their child’s benefit during their lifetime and after their passing. This trust helps avoid probate and ensures a smooth transfer of assets. By setting up a Living Trust, couples can dictate how their assets are distributed, offering peace of mind and control over their estate.

-

What are the benefits of establishing a Living Trust For Husband And Wife With One Child in Illinois?

Establishing a Living Trust For Husband And Wife With One Child in Illinois offers several benefits, including avoiding probate, maintaining privacy regarding asset distribution, and providing clear instructions for asset management. This trust also helps in minimizing estate taxes and can be updated easily as family circumstances change. It gives couples a flexible and effective way to secure their child’s future.

-

How does a Living Trust For Husband And Wife With One Child in Illinois differ from a will?

Unlike a will, a Living Trust For Husband And Wife With One Child in Illinois takes effect immediately and allows for the management of assets during the lifetime of the couple. A will goes through probate, which can be time-consuming and costly, while a Living Trust avoids this process entirely. This trust also provides detailed instructions on managing and distributing assets, which a will may not accomplish.

-

What is the cost of setting up a Living Trust For Husband And Wife With One Child in Illinois?

The cost of setting up a Living Trust For Husband And Wife With One Child in Illinois varies based on several factors, including attorney fees and the complexity of the trust. On average, you could expect to pay between $1,000 to $3,000 for a comprehensive trust setup. However, considering the potential savings from avoiding probate and tax benefits, it can be a cost-effective solution.

-

Can I change my Living Trust For Husband And Wife With One Child in Illinois later on?

Yes, you can change your Living Trust For Husband And Wife With One Child in Illinois at any time, as it is designed to be flexible. This means you can add or remove beneficiaries, change the terms, or update any provisions as needed. Regular updates ensure that the trust reflects your current wishes and family circumstances.

-

What documents do I need for a Living Trust For Husband And Wife With One Child in Illinois?

To establish a Living Trust For Husband And Wife With One Child in Illinois, you'll need various documents including property deeds, financial statements, and any existing wills or trusts. It's also beneficial to gather personal identification and information about your assets. Consulting with a legal professional can help ensure that you have all necessary documentation in place.

-

How does airSlate SignNow facilitate the Living Trust For Husband And Wife With One Child in Illinois process?

airSlate SignNow simplifies the process of creating and managing a Living Trust For Husband And Wife With One Child in Illinois by offering easy-to-use electronic signing and document management tools. With airSlate SignNow, you can securely sign, store, and share your trust documents online. This not only saves time but also ensures that your documents are organized and easily accessible.

Get more for Living Trust For Husband And Wife With One Child Illinois

Find out other Living Trust For Husband And Wife With One Child Illinois

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation