Puerto Rico Tax Related Hurricane Relief Form

What is the Puerto Rico Tax related Hurricane Relief

The Puerto Rico Tax related Hurricane Relief refers to specific tax provisions and assistance programs designed to support individuals and businesses affected by hurricanes in Puerto Rico. This relief aims to alleviate the financial burden caused by natural disasters, allowing taxpayers to recover more quickly. It includes various tax benefits such as deductions, credits, and extended filing deadlines to help those impacted by hurricanes.

Eligibility Criteria

To qualify for the Puerto Rico Tax related Hurricane Relief, individuals and businesses must meet certain eligibility requirements. Generally, affected taxpayers must demonstrate that they experienced significant damage or loss due to a hurricane. This can include property damage, loss of income, or other financial impacts. Additionally, specific income thresholds may apply, depending on the nature of the relief program.

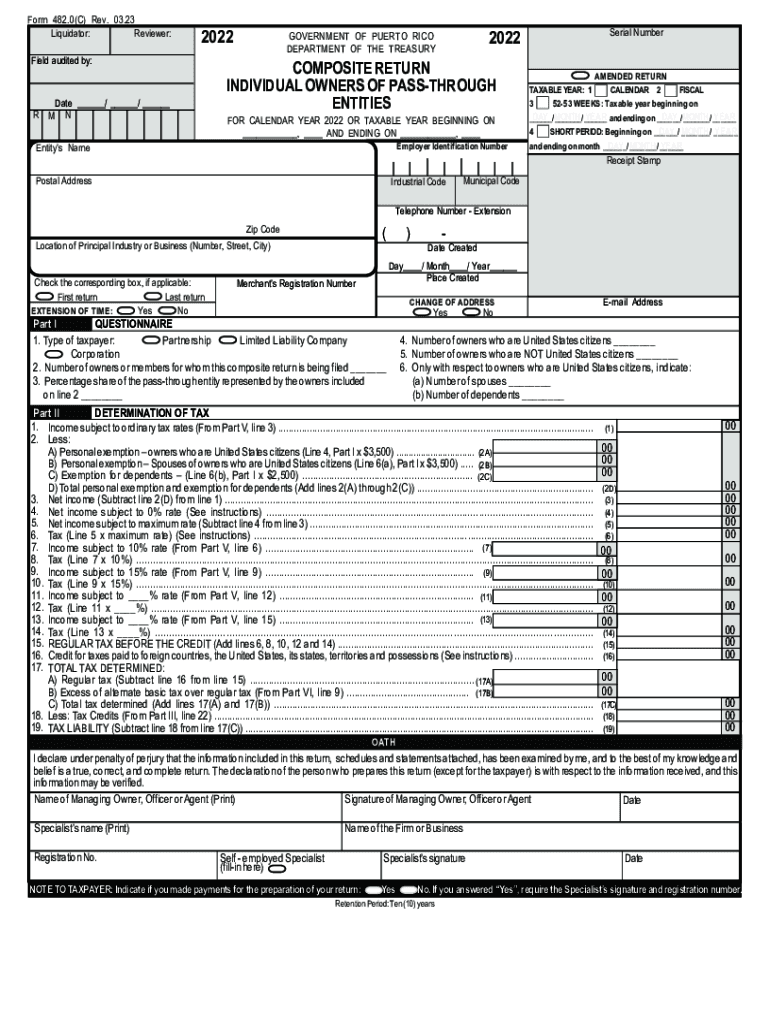

Steps to complete the Puerto Rico Tax related Hurricane Relief

Completing the Puerto Rico Tax related Hurricane Relief process involves several key steps. First, gather all necessary documentation that supports your claim, such as proof of property damage, income loss, or other relevant financial records. Next, fill out the appropriate tax forms, ensuring that you accurately report your losses and any eligible expenses. Finally, submit your completed forms to the relevant tax authority, either online or by mail, before the specified deadlines.

Required Documents

When applying for the Puerto Rico Tax related Hurricane Relief, certain documents are essential to substantiate your claim. These may include:

- Proof of identity, such as a driver's license or Social Security number.

- Documentation of property damage, including photographs and repair estimates.

- Financial records that demonstrate income loss or increased expenses due to the hurricane.

- Previous tax returns to establish income levels and tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Puerto Rico Tax related Hurricane Relief can vary based on the specific relief provisions and the timing of the hurricane. It is crucial to stay informed about these dates to ensure compliance. Generally, extensions may be granted to allow additional time for affected individuals and businesses to file their tax returns. Always check for the most current information regarding deadlines specific to your situation.

IRS Guidelines

The IRS provides specific guidelines regarding the Puerto Rico Tax related Hurricane Relief. These guidelines outline the eligibility criteria, types of relief available, and the process for claiming benefits. Taxpayers should refer to IRS publications and official announcements to understand their rights and responsibilities under these provisions. Staying informed about IRS updates can help ensure that you take full advantage of the available relief options.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the puerto rico tax related hurricane relief

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Puerto Rico Tax related Hurricane Relief?

Puerto Rico Tax related Hurricane Relief refers to the financial assistance and tax benefits provided to individuals and businesses affected by hurricanes in Puerto Rico. This relief can include tax deductions, credits, and other forms of support to help recover from the financial impact of natural disasters.

-

How can airSlate SignNow assist with Puerto Rico Tax related Hurricane Relief?

airSlate SignNow offers a streamlined solution for businesses to manage and eSign documents related to Puerto Rico Tax related Hurricane Relief. With our platform, you can easily prepare, send, and sign necessary forms, ensuring compliance and efficiency in your recovery process.

-

What features does airSlate SignNow provide for tax-related documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for handling Puerto Rico Tax related Hurricane Relief documents. These features help ensure that all necessary paperwork is completed accurately and submitted on time.

-

Is airSlate SignNow cost-effective for small businesses seeking hurricane relief?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses navigating Puerto Rico Tax related Hurricane Relief. Our pricing plans are flexible, allowing businesses to choose the option that best fits their budget while still accessing essential features.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, making it easier to manage documents related to Puerto Rico Tax related Hurricane Relief. This integration helps streamline your workflow and ensures that all your data is synchronized.

-

What are the benefits of using airSlate SignNow for hurricane relief documentation?

Using airSlate SignNow for Puerto Rico Tax related Hurricane Relief documentation offers numerous benefits, including increased efficiency, reduced paperwork errors, and enhanced security. Our platform simplifies the signing process, allowing you to focus on recovery rather than administrative tasks.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive documents related to Puerto Rico Tax related Hurricane Relief. You can trust that your information is safe while using our platform for eSigning and document management.

Get more for Puerto Rico Tax related Hurricane Relief

- Blank construction contract 100095537 form

- Printable enneagram test form

- Resolucion corporativa 100111251 form

- Mechanics of materials 10th edition solutions chapter 1 form

- Career counselling form

- Molina prior authorization form 35123108

- Apply for general relief online fresno ca form

- Starter checklist instructions for employers this form

Find out other Puerto Rico Tax related Hurricane Relief

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure