Statement Non Reimbursement Form

What is the Statement Non Reimbursement

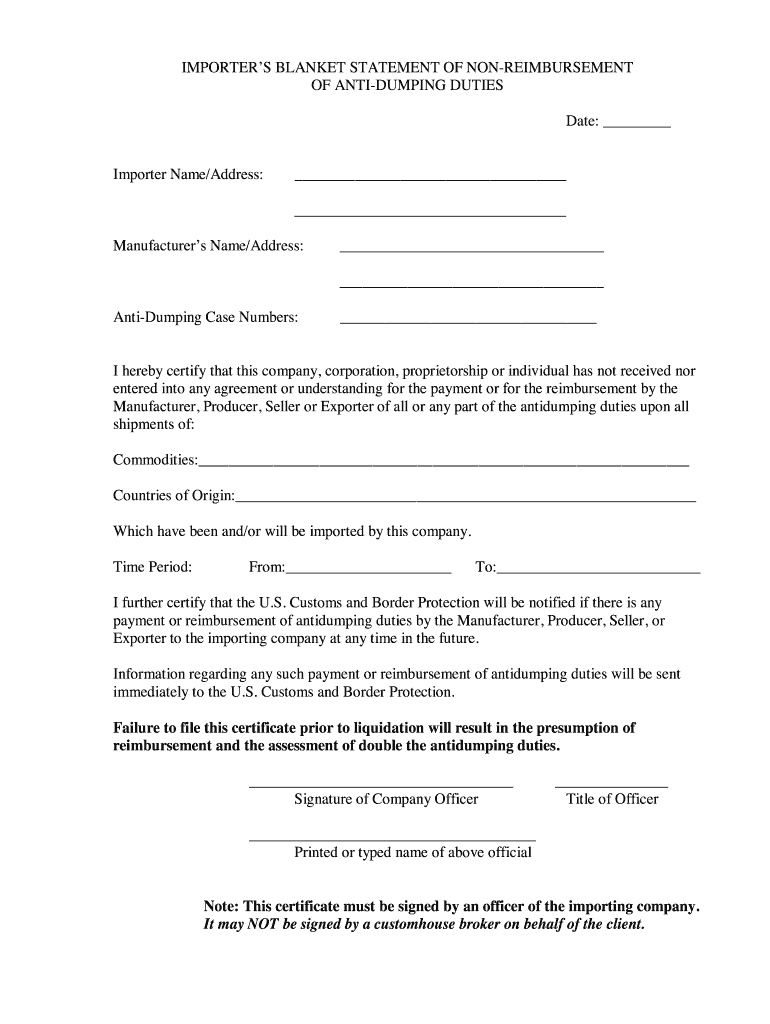

The statement non reimbursement is a formal document used primarily in the context of anti-dumping duties. It serves to declare that certain expenses incurred by importers will not be reimbursed by the government or other entities. This statement is crucial for compliance with trade regulations, ensuring that importers are transparent about their financial obligations. By clearly outlining non-reimbursable costs, the statement helps prevent misunderstandings and potential legal issues related to trade practices.

How to Use the Statement Non Reimbursement

Using the statement non reimbursement effectively involves several key steps. First, ensure that you have the correct form, which can often be downloaded as a PDF for easy access. Next, fill in the required fields accurately, including details about the transaction, the nature of the non-reimbursable expenses, and any relevant identifiers, such as invoice numbers or product codes. After completing the form, it is essential to sign it electronically or physically, depending on the submission method you choose. This ensures that the document is legally binding and recognized by regulatory authorities.

Steps to Complete the Statement Non Reimbursement

Completing the statement non reimbursement involves a clear process to ensure accuracy and compliance. Follow these steps:

- Download the statement non reimbursement PDF from a reliable source.

- Review the instructions provided with the form to understand the requirements.

- Fill in your personal and business information in the designated sections.

- Detail the specific expenses that are non-reimbursable, providing clear descriptions.

- Include any necessary supporting documentation, such as invoices or contracts.

- Sign the document electronically or in ink to validate it.

- Submit the completed form according to the guidelines provided, whether online or via mail.

Legal Use of the Statement Non Reimbursement

The legal use of the statement non reimbursement is governed by various trade regulations and laws. It is essential for importers to ensure that their statements comply with the relevant legal standards, such as the U.S. Customs and Border Protection regulations. This document must be filled out accurately to avoid penalties or disputes with regulatory agencies. Additionally, maintaining records of submitted statements is crucial for legal protection and compliance verification in case of audits or inquiries.

Key Elements of the Statement Non Reimbursement

Several key elements must be included in the statement non reimbursement to ensure its validity:

- Importer Information: Name, address, and contact details of the importer.

- Transaction Details: Description of the goods involved, including quantities and values.

- Non-Reimbursable Expenses: Clear identification of expenses that will not be reimbursed.

- Signature: An authorized signature to validate the statement.

- Date: The date on which the statement is completed and signed.

Examples of Using the Statement Non Reimbursement

Examples of when to use the statement non reimbursement include scenarios where importers incur costs related to shipping, customs fees, or handling charges that are not eligible for reimbursement. For instance, if an importer pays for additional inspections required by customs that are not covered by their agreement, they would document this expense in the statement. Another example is when an importer faces penalties for late submissions of required documentation; these costs may also be included in the statement to clarify financial responsibilities.

Quick guide on how to complete non reimbursement anti dumping form

Learn how to effortlessly navigate the Statement Non Reimbursement process with this simple guide

E-filing and electronically signNowing documents is gaining popularity and has become the preferred choice for numerous clients. It offers many advantages over conventional printed forms, such as convenience, time savings, improved precision, and security.

With tools like airSlate SignNow, you can locate, modify, signNow, enhance, and send your Statement Non Reimbursement without the hassle of endless printing and scanning. Follow this concise guide to begin and finalize your document.

Follow these steps to obtain and complete Statement Non Reimbursement

- Start by clicking the Access Form button to launch your document in our editor.

- Observe the green indicator on the left that highlights required fields so you don’t miss them.

- Utilize our advanced features to annotate, edit, sign, secure, and improve your document.

- Safeguard your document or convert it into a fillable form using the appropriate tab tools.

- Go through the document and verify it for mistakes or inconsistencies.

- Hit FINISH to complete your editing.

- Rename your document or keep it unchanged.

- Choose the storage option to retain your document, send it via USPS, or click the Download Now button to save your file.

If Statement Non Reimbursement isn’t what you needed, explore our vast library of pre-imported forms that you can complete with ease. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

How do I find out whether I belong to the OBC creamy or non-creamy layer while filling out a form?

Please go to the caste census of 2011 to find out whether you are a backward caste . Then find out from the website of Backward Classes Commission whether you fall in OBC list .Having found that , the criteria is as under -You will be in non-creamy layer if your parents’ total annual income is not more than Rs.8 lakh . Your own income , if any , is not included . Any agricultural income of your parents is also not included .

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the non reimbursement anti dumping form

How to make an electronic signature for your Non Reimbursement Anti Dumping Form online

How to create an electronic signature for the Non Reimbursement Anti Dumping Form in Chrome

How to create an electronic signature for putting it on the Non Reimbursement Anti Dumping Form in Gmail

How to generate an eSignature for the Non Reimbursement Anti Dumping Form straight from your smartphone

How to generate an eSignature for the Non Reimbursement Anti Dumping Form on iOS devices

How to create an eSignature for the Non Reimbursement Anti Dumping Form on Android OS

People also ask

-

What are statement anti dumping duties, and how do they work?

Statement anti dumping duties are tariffs imposed on imported goods that are believed to be priced below market value. This is intended to protect domestic industries from unfair competition. By understanding these duties, businesses can better navigate international trade and negotiate more favorable terms.

-

How can airSlate SignNow assist with the documentation for statement anti dumping duties?

airSlate SignNow provides a seamless way to eSign and send important documents related to statement anti dumping duties. Its user-friendly interface ensures that you can manage your paperwork efficiently, leading to faster compliance and reduced delays in your import processes.

-

Is airSlate SignNow cost-effective for handling duty statement documentation?

Yes, airSlate SignNow offers a cost-effective solution for managing statement anti dumping duties documentation. With flexible pricing plans, businesses of all sizes can benefit from a powerful tool that streamlines the eSigning process without breaking the bank. You can save time and resources while staying compliant.

-

What features does airSlate SignNow offer for managing international trade documents?

airSlate SignNow includes features like customizable templates, automatic reminders, and multi-party eSigning that are essential for managing documents related to statement anti dumping duties. These features simplify the process, allowing you to focus on growing your business rather than getting bogged down by paperwork.

-

Can airSlate SignNow integrate with other platforms for trade management?

Absolutely! airSlate SignNow can integrate with various platforms, enhancing the workflow for managing statement anti dumping duties and other trade documentation. By connecting with your existing tools, you can ensure a seamless process from document creation to signing.

-

How does using airSlate SignNow improve compliance with anti dumping regulations?

Using airSlate SignNow helps ensure compliance with statement anti dumping duties by providing a reliable platform for document management. The ability to track changes and obtain time-stamped signatures means that you can verify and validate every step of your documentation process, mitigating risks of non-compliance.

-

Is airSlate SignNow suitable for small businesses dealing with international trade?

Yes, airSlate SignNow is particularly suited for small businesses involved in international trade who need to manage statement anti dumping duties. The platform is designed to be intuitive and affordable, allowing smaller operations to benefit from professional-grade tools without a hefty investment.

Get more for Statement Non Reimbursement

Find out other Statement Non Reimbursement

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement