Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate Illinois Form

What is the Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois

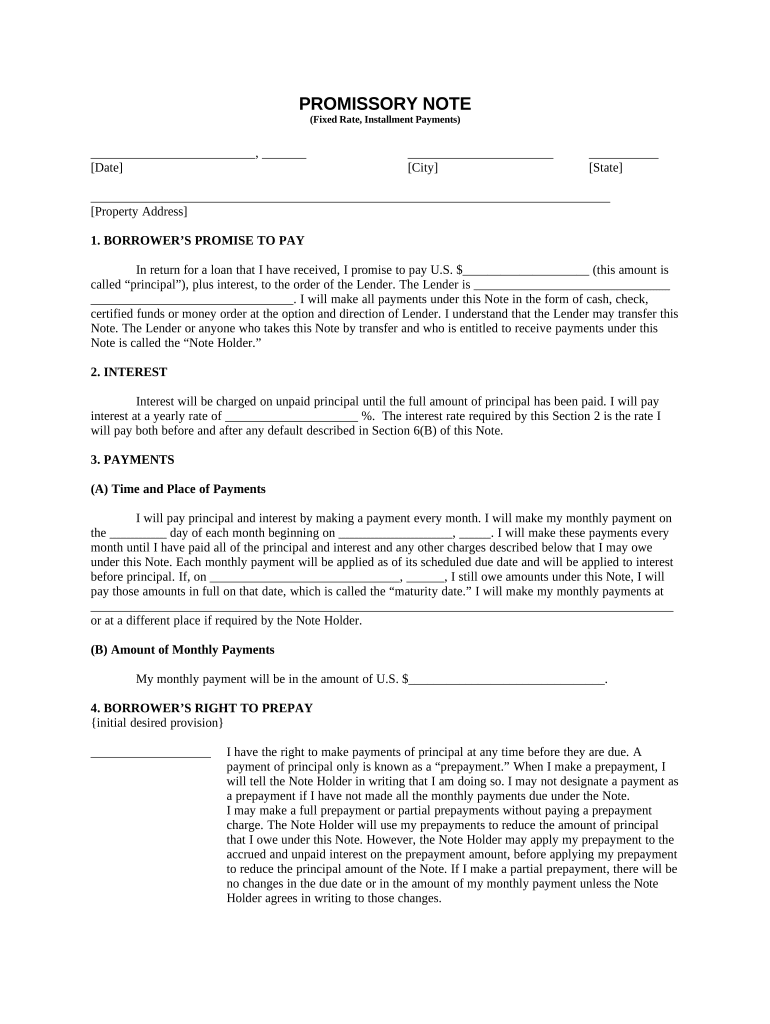

The Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines the terms of a loan secured by residential property in Illinois. This note specifies the borrower's obligation to repay the loan amount in fixed installments over a predetermined period. It is an essential tool for lenders seeking to secure their investment while providing borrowers with a structured repayment plan. The document includes critical details such as the loan amount, interest rate, payment schedule, and any applicable fees or penalties for late payment.

How to use the Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois

Using the Illinois Installments Fixed Rate Promissory Note involves several key steps to ensure that both parties understand their rights and obligations. First, the lender and borrower should agree on the loan terms, including the interest rate and repayment schedule. Next, the borrower must complete the note by providing their personal information and signing the document. Once signed, the lender retains a copy for their records, while the borrower should keep a copy for their reference. It is advisable to consult with a legal professional to ensure compliance with state laws and regulations.

Steps to complete the Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois

Completing the Illinois Installments Fixed Rate Promissory Note requires careful attention to detail. Follow these steps:

- Gather necessary information, including the names and addresses of both parties involved.

- Determine the loan amount and interest rate, ensuring both parties agree.

- Outline the repayment schedule, specifying the frequency of payments and the total duration of the loan.

- Include any additional terms, such as late payment penalties or prepayment options.

- Have both parties sign and date the document in the presence of a witness or notary, if required.

- Distribute copies to all parties involved for their records.

Legal use of the Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois

The legal use of the Illinois Installments Fixed Rate Promissory Note is governed by state laws that dictate how such documents must be executed and enforced. To be legally binding, the note must be signed by both parties and include all relevant terms. It is crucial to comply with the Illinois Uniform Commercial Code, which provides guidelines on promissory notes. Additionally, ensuring that the note is properly secured by the residential property is essential for the lender's protection in case of default.

Key elements of the Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois

Several key elements must be included in the Illinois Installments Fixed Rate Promissory Note to ensure its validity and enforceability:

- Borrower and lender information: Full names and addresses of both parties.

- Loan amount: The total amount being borrowed.

- Interest rate: The fixed rate applied to the loan.

- Payment schedule: Details on how and when payments will be made.

- Secured property: A description of the residential real estate that secures the loan.

- Default terms: Conditions under which the borrower would be considered in default.

State-specific rules for the Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois

Illinois has specific rules governing the use of promissory notes, particularly those secured by real estate. These rules include requirements for notarization, the necessity of a clear description of the secured property, and adherence to interest rate limits set by state law. It is important for both lenders and borrowers to familiarize themselves with these regulations to avoid legal issues. Consulting a legal expert can help ensure compliance with all applicable laws and protect the interests of both parties.

Quick guide on how to complete illinois installments fixed rate promissory note secured by residential real estate illinois

Prepare Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any hold-ups. Handle Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois on any device through airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois with ease

- Obtain Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize crucial sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form searches, or errors requiring new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois?

An Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois is a financial instrument that outlines a borrower's promise to repay a loan through fixed, regular payments. This note is secured by residential real estate, ensuring that the lender has a claim to the property if the borrower defaults. It's ideal for individuals seeking structured repayment plans.

-

How does the pricing work for an Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois?

Pricing for an Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois can vary based on the loan amount and the terms agreed upon. Generally, you will be informed of the total interest and fees at the outset of the agreement. This ensures transparency and helps borrowers make informed decisions.

-

What are the benefits of using an Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois?

The primary benefits of an Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois include predictable payments and the security of the real estate asset. Borrowers can plan their finances better with fixed monthly payments, alleviating the pressure of fluctuating interest rates typically associated with other loans.

-

Can I customize my Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois?

Yes, an Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois can often be customized to fit the needs of both the borrower and lender. You can negotiate terms such as the interest rate, repayment schedule, and duration of the note. This flexibility is essential in tailoring the agreement to meet specific financial situations.

-

What types of residential real estate can secure an Illinois Installments Fixed Rate Promissory Note?

Typically, any type of residential real estate, including single-family homes, condominiums, and multi-family units, can secure an Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois. It's crucial that the property adheres to local regulations and that it's properly appraised to determine its value.

-

Is eSigning available for my Illinois Installments Fixed Rate Promissory Note?

Absolutely! With airSlate SignNow, you can easily eSign your Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois. This feature streamlines the signing process, ensuring you can finalize your agreements quickly and securely, without the need for printing or scanning documents.

-

How long does it take to finalize an Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois?

The timeline to finalize an Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois can vary. However, with airSlate SignNow’s efficient eSign features, the process can often be completed within a day, depending on the complexity of the document and the responsiveness of both parties involved.

Get more for Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois

- Form sh 13 filled sample

- Consent form for ecmo

- 470 0829 iowa department of human services dhs iowa form

- Fillable durable power of attorney form

- Bbb hot dog eating contest registration rules and waiver form

- Affidavit for duplicate license plates sticker pmd form

- Loudoncoactivepps pdf form

- Tangible personal property handbook tn gov form

Find out other Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate Illinois

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form