State of Connecticut Withholding Tables Effective 2023-2026

What is the State of Connecticut Withholding Tables?

The State of Connecticut Withholding Tables are essential tools used by employers to determine the correct amount of state income tax to withhold from employees' paychecks. These tables are updated periodically to reflect changes in tax laws and rates. They provide a systematic way to calculate withholding based on various factors, including the employee's income level and filing status. Understanding these tables is crucial for compliance with state tax regulations and ensuring employees receive accurate paychecks.

How to Use the State of Connecticut Withholding Tables

Using the Connecticut Withholding Tables involves several steps. First, employers must identify the employee's gross pay for the pay period. Next, they should refer to the appropriate withholding table, which is categorized by the employee's filing status and income bracket. By locating the employee's income range in the table, employers can determine the amount to withhold for state income tax. It is important to ensure that the correct table is used, as there are different tables for various employment types and income levels.

Filing Deadlines and Important Dates

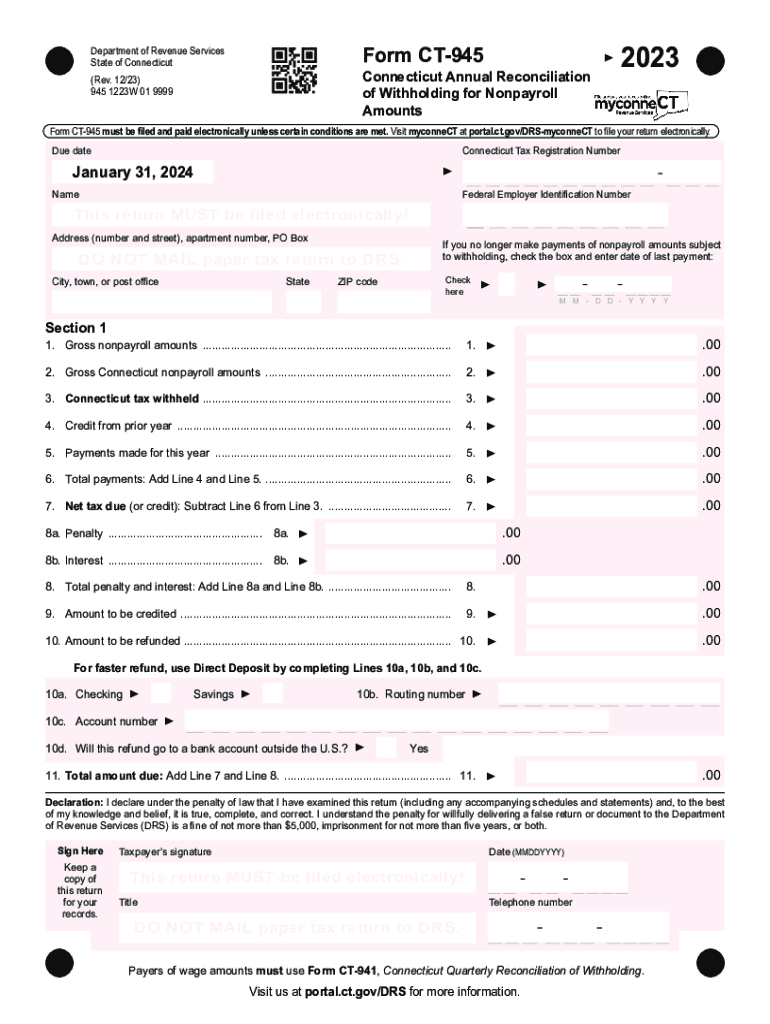

Employers must be aware of specific filing deadlines related to the Connecticut Withholding Tables. Typically, employers are required to submit withheld taxes on a monthly or quarterly basis, depending on their total tax liability. Additionally, annual reconciliation of withholding must be completed by January 31 of the following year. Staying informed about these deadlines helps businesses avoid penalties and ensures compliance with state tax laws.

Required Documents for Filing

When using the Connecticut Withholding Tables, employers need to maintain accurate records of employee wages and withholdings. Essential documents include employee W-4 forms, which indicate filing status and allowances, and payroll records that detail gross pay and withholdings. These documents are crucial for preparing annual tax filings and for audits by the Connecticut Department of Revenue Services.

Penalties for Non-Compliance

Failure to comply with the Connecticut Withholding Tables can result in significant penalties for employers. If the correct amount of state income tax is not withheld, employers may face fines and interest on unpaid taxes. Additionally, employees may experience unexpected tax liabilities, leading to dissatisfaction and potential legal issues. Understanding the importance of accurate withholding is vital for maintaining compliance and fostering a positive employer-employee relationship.

Examples of Using the State of Connecticut Withholding Tables

To illustrate the application of the Connecticut Withholding Tables, consider an employee earning $5,000 per month and filing as single with no additional allowances. By referencing the appropriate table, the employer can identify the specific withholding amount for that income level. This example highlights the practical use of the tables in determining accurate withholding, ensuring that employees are not over- or under-withheld throughout the year.

Eligibility Criteria for Withholding

Eligibility for withholding under the Connecticut Withholding Tables generally applies to all employers with employees working in the state. Employers must register with the Connecticut Department of Revenue Services and obtain a withholding account number. Additionally, employees must provide accurate information regarding their filing status and allowances to ensure correct withholding amounts. Understanding these criteria is essential for employers to maintain compliance with state regulations.

Create this form in 5 minutes or less

Find and fill out the correct state of connecticut withholding tables effective

Create this form in 5 minutes!

How to create an eSignature for the state of connecticut withholding tables effective

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 945 and how does it relate to airSlate SignNow?

Ct 945 is a specific document type that can be efficiently managed using airSlate SignNow. Our platform allows users to easily send, sign, and store ct 945 documents securely. With airSlate SignNow, you can streamline your document workflow and ensure compliance with legal standards.

-

How much does airSlate SignNow cost for managing ct 945 documents?

The pricing for airSlate SignNow varies based on the features you need for managing ct 945 documents. We offer flexible plans that cater to different business sizes and requirements. You can choose a plan that fits your budget while ensuring you have all the necessary tools for effective document management.

-

What features does airSlate SignNow offer for ct 945 document management?

AirSlate SignNow provides a range of features for ct 945 document management, including eSignature capabilities, document templates, and real-time tracking. These features help you manage your documents efficiently and ensure that all signatures are collected promptly. Additionally, our platform is user-friendly, making it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other tools for handling ct 945 documents?

Yes, airSlate SignNow offers seamless integrations with various tools and applications to enhance your workflow for ct 945 documents. You can connect with CRM systems, cloud storage services, and other productivity tools. This integration capability allows you to centralize your document management processes.

-

What are the benefits of using airSlate SignNow for ct 945 documents?

Using airSlate SignNow for ct 945 documents provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are signed and processed quickly, allowing you to focus on your core business activities. Additionally, our security measures protect sensitive information.

-

Is airSlate SignNow compliant with regulations for ct 945 documents?

Absolutely! AirSlate SignNow is designed to comply with various regulations governing ct 945 documents. We adhere to industry standards for electronic signatures and document security, ensuring that your documents are legally binding and secure. This compliance gives you peace of mind when managing important documents.

-

How can I get started with airSlate SignNow for ct 945 documents?

Getting started with airSlate SignNow for ct 945 documents is simple. You can sign up for a free trial on our website to explore the features and capabilities. Once you're ready, choose a plan that suits your needs and start managing your ct 945 documents efficiently.

Get more for State Of Connecticut Withholding Tables Effective

Find out other State Of Connecticut Withholding Tables Effective

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now