Assignment Mortgage Corporate Form

What is the Assignment Mortgage Corporate

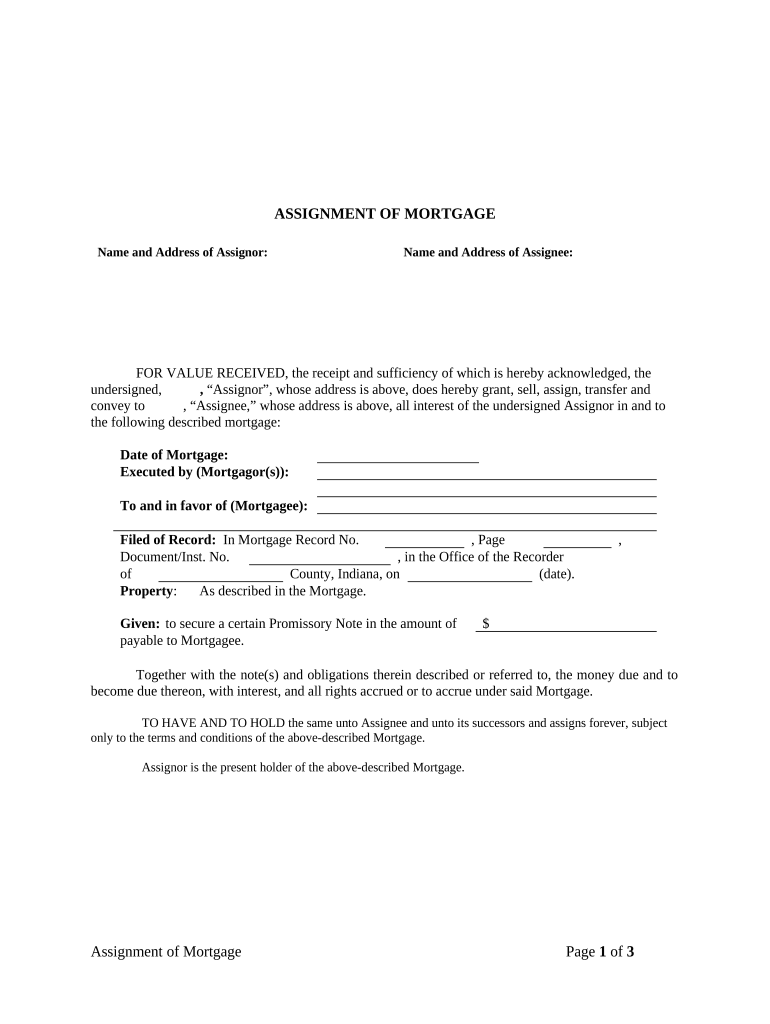

The assignment mortgage corporate is a legal document that facilitates the transfer of mortgage rights and obligations from one entity to another within a corporate context. This form is essential for businesses looking to manage their real estate holdings effectively, allowing them to assign their mortgage responsibilities to another party. Understanding this document is crucial for corporate entities involved in real estate transactions, as it outlines the terms under which the mortgage is assigned, including rights, obligations, and any conditions that must be met.

How to Use the Assignment Mortgage Corporate

Using the assignment mortgage corporate involves several key steps. First, the assigning party must ensure that they have the legal authority to transfer the mortgage. Next, the form must be filled out accurately, detailing the parties involved, the mortgage being assigned, and any relevant terms. After completing the form, both parties should review it to ensure clarity and agreement on the terms. Finally, the document must be signed by all parties involved, ideally using a secure digital signature solution to enhance the legal validity of the assignment.

Steps to Complete the Assignment Mortgage Corporate

Completing the assignment mortgage corporate requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the mortgage and the parties involved.

- Fill out the form with accurate details, including the mortgage account number and the names of the assignor and assignee.

- Review the terms of the assignment, ensuring all parties understand their rights and responsibilities.

- Sign the document electronically, ensuring compliance with relevant eSignature laws.

- Distribute copies of the signed document to all parties for their records.

Legal Use of the Assignment Mortgage Corporate

The assignment mortgage corporate must adhere to specific legal standards to be considered valid. In the United States, it is essential that the document complies with the Electronic Signatures in Global and National Commerce Act (ESIGN), the Uniform Electronic Transactions Act (UETA), and other relevant state laws. These regulations ensure that electronic signatures are legally binding and that the document can be enforced in a court of law. Proper execution of the assignment mortgage corporate protects the interests of all parties involved and ensures that the transfer of mortgage rights is recognized legally.

Key Elements of the Assignment Mortgage Corporate

Several key elements must be included in the assignment mortgage corporate to ensure its validity:

- Identifying Information: Names and addresses of the assignor and assignee.

- Mortgage Details: Description of the mortgage being assigned, including the loan number and property address.

- Terms of Assignment: Specific conditions under which the assignment is made, including any obligations of the assignee.

- Signatures: Signatures of all parties involved, ideally using a secure digital signature solution.

- Date of Execution: The date when the assignment is signed and executed.

Examples of Using the Assignment Mortgage Corporate

There are various scenarios in which an assignment mortgage corporate may be utilized. For instance, a corporation may sell a property but wish to retain the mortgage. In this case, they can assign the mortgage to the buyer, allowing the buyer to take over the mortgage payments. Another example is when a company restructures its debt and needs to transfer its mortgage obligations to a subsidiary. Each of these situations highlights the flexibility and utility of the assignment mortgage corporate in corporate real estate transactions.

Quick guide on how to complete assignment mortgage corporate 497306909

Complete Assignment Mortgage Corporate effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, alter, and eSign your documents promptly without holdups. Handle Assignment Mortgage Corporate on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The simplest way to modify and eSign Assignment Mortgage Corporate without any hassle

- Obtain Assignment Mortgage Corporate and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Assignment Mortgage Corporate and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an assignment mortgage corporate?

An assignment mortgage corporate is a financial instrument that enables businesses to transfer their mortgage obligations to another entity. This can be particularly useful for companies looking to optimize their financial structures. Understanding the nuances of assignment mortgage corporate can help businesses make informed decisions.

-

How does airSlate SignNow facilitate assignment mortgage corporate processes?

airSlate SignNow simplifies the assignment mortgage corporate process by providing a user-friendly platform for eSigning and managing documents. Businesses can easily create, send, and track documents related to their mortgage assignments with the seamless integration of our tool. This not only saves time but also enhances operational efficiency.

-

What are the pricing plans for airSlate SignNow focusing on assignment mortgage corporate?

airSlate SignNow offers flexible pricing plans tailored to meet the diverse needs of businesses dealing with assignment mortgage corporate transactions. These plans are designed to provide value and scalability, ensuring that companies of all sizes can access our eSigning capabilities. For specific details, visit our pricing page.

-

What features does airSlate SignNow provide for handling assignment mortgage corporate?

The platform includes key features such as customizable templates, in-app analytics, and secure document storage, all tailored for assignment mortgage corporate. These features enhance the efficiency and security of managing mortgage assignments. Additionally, our advanced workflow capabilities further streamline the entire process.

-

How can assignment mortgage corporate benefit my business?

Leveraging assignment mortgage corporate can improve cash flow and financial flexibility for businesses. By transferring mortgage obligations, companies can free up capital for other investments. Furthermore, utilizing tools like airSlate SignNow ensures a swift and secure handling of these transactions.

-

Are there integrations available with airSlate SignNow for assignment mortgage corporate?

Yes, airSlate SignNow offers various integrations that can support your assignment mortgage corporate needs. Seamless connectivity with tools like CRM systems and document management platforms enhances workflow efficiency. This helps businesses manage their mortgage assignments more effectively.

-

Is airSlate SignNow compliant with legal requirements for assignment mortgage corporate?

Absolutely, airSlate SignNow is designed to comply with all legal requirements surrounding assignment mortgage corporate transactions. We ensure that all eSignatures are legally binding and secure, providing peace of mind for businesses. Regular updates keep our platform aligned with current regulations.

Get more for Assignment Mortgage Corporate

Find out other Assignment Mortgage Corporate

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now