Individual Credit Application Indiana Form

What is the Individual Credit Application Indiana

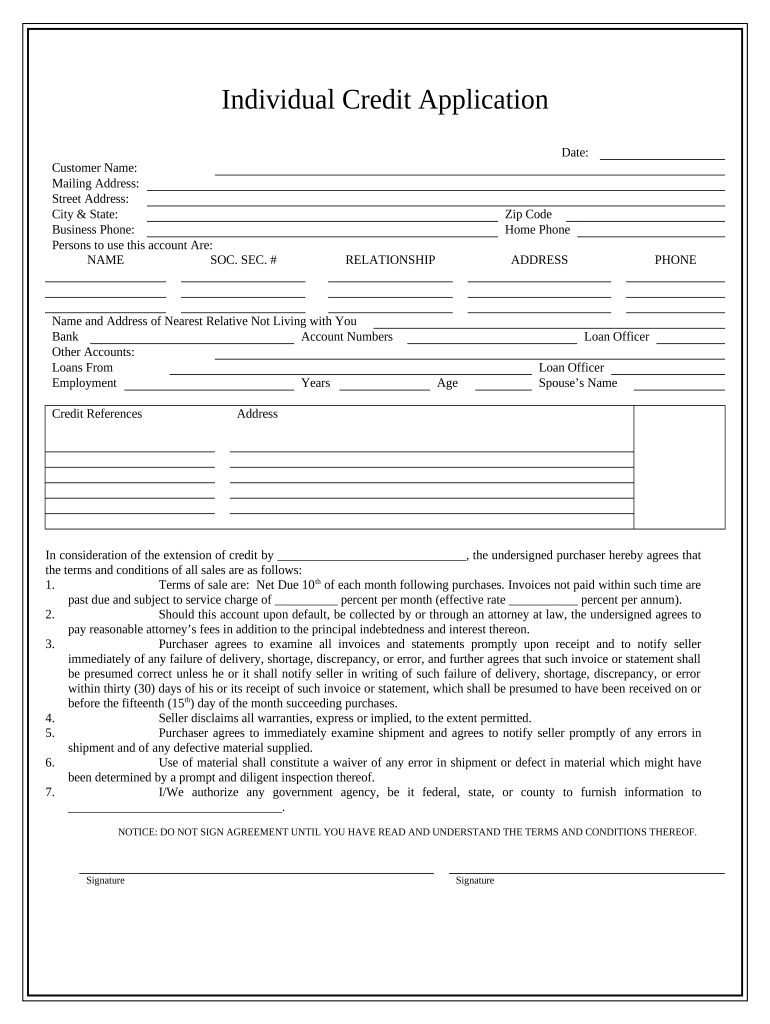

The Individual Credit Application Indiana is a formal document used by individuals seeking credit from financial institutions in Indiana. This application collects essential personal and financial information to assess the applicant's creditworthiness. It typically includes details such as the applicant's name, address, social security number, employment information, income, and any existing debts. Understanding the purpose of this form is crucial for anyone looking to secure loans or credit lines in the state.

Steps to complete the Individual Credit Application Indiana

Completing the Individual Credit Application Indiana involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and financial information, including identification and income documentation. Next, fill out the application form carefully, providing truthful and complete information. It is important to review the application for any errors or omissions before submission. Finally, sign the application electronically or physically, depending on the submission method chosen.

Legal use of the Individual Credit Application Indiana

The Individual Credit Application Indiana is legally binding when completed according to state and federal regulations. To ensure its validity, applicants must comply with the stipulations set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws recognize electronic signatures and documents as legally enforceable, provided that the signer intends to sign and the signature is associated with the document.

How to use the Individual Credit Application Indiana

Using the Individual Credit Application Indiana involves several steps that facilitate the credit application process. Begin by accessing the form through a reliable source, such as a financial institution's website. Fill out the form with accurate information, ensuring that all required fields are completed. After submitting the application, keep a copy for personal records. This documentation can be useful for tracking the application status and for future reference.

Key elements of the Individual Credit Application Indiana

Several key elements are essential to the Individual Credit Application Indiana. These include personal identification details, employment history, income verification, and existing debt information. Additionally, the application may require consent for credit checks and disclosures regarding the applicant's rights under consumer protection laws. Each of these components plays a vital role in determining the applicant's eligibility for credit.

Eligibility Criteria

Eligibility for the Individual Credit Application Indiana typically depends on several factors. Applicants must be legal residents of Indiana and meet minimum age requirements, usually eighteen years old. Financial institutions may also consider the applicant's credit history, income level, and existing debt obligations. Meeting these criteria is essential for a successful credit application process.

Form Submission Methods (Online / Mail / In-Person)

The Individual Credit Application Indiana can be submitted through various methods, providing flexibility for applicants. Many financial institutions offer online submission options, allowing for quick and convenient processing. Alternatively, applicants may choose to mail their completed forms or submit them in person at a local branch. Each method has its own advantages, and applicants should choose the one that best suits their needs and circumstances.

Quick guide on how to complete individual credit application indiana

Complete Individual Credit Application Indiana effortlessly on any device

Online document handling has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, alter, and eSign your documents rapidly without holdups. Manage Individual Credit Application Indiana on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to modify and eSign Individual Credit Application Indiana with ease

- Obtain Individual Credit Application Indiana and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select relevant sections of the documents or obscure confidential information with the tools specifically offered by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Put aside misplaced or lost files, cumbersome form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Individual Credit Application Indiana and ensure exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Individual Credit Application Indiana?

An Individual Credit Application Indiana is a specific form designed for individuals seeking credit within the state of Indiana. It typically requires personal information, financial details, and may include consent for credit checks. This application helps lenders assess the creditworthiness of potential borrowers according to Indiana state regulations.

-

How much does it cost to process an Individual Credit Application Indiana?

The cost to process an Individual Credit Application Indiana can vary depending on the lender's policies. Some lenders may charge a nominal fee for processing, while others might offer this service for free. It's best to check with individual lenders to understand their specific pricing structures regarding credit applications.

-

What features does airSlate SignNow offer for Individual Credit Application Indiana?

airSlate SignNow provides a range of features for an Individual Credit Application Indiana, including electronic signatures, document tracking, and customizable templates. With its user-friendly interface, you can easily complete and send the application without the need for paper. Additionally, it ensures secure storage and compliance with state regulations.

-

What are the benefits of using airSlate SignNow for my Individual Credit Application Indiana?

Using airSlate SignNow for your Individual Credit Application Indiana streamlines the application process, making it faster and more efficient. The electronic signature feature allows for quick approval, reducing turnaround time. Moreover, the platform enhances organization and accessibility, ensuring that all documents are securely stored in one place.

-

Can I integrate airSlate SignNow with other software for my Individual Credit Application Indiana?

Yes, airSlate SignNow offers various integrations with popular software solutions such as CRM and accounting systems. This allows for a seamless workflow when you manage an Individual Credit Application Indiana within your existing applications. You can easily sync data and documents, enhancing the efficiency of your processes.

-

Is airSlate SignNow compliant with Indiana state regulations for credit applications?

Yes, airSlate SignNow is designed to meet compliance standards required for financial documents, including the Individual Credit Application Indiana. The platform adheres to electronic signature laws and privacy regulations, ensuring that your document's integrity and confidentiality are maintained throughout the process.

-

How long does it take to complete an Individual Credit Application Indiana using airSlate SignNow?

Completing an Individual Credit Application Indiana using airSlate SignNow can often be done in just a few minutes. Thanks to the intuitive interface and electronic signature capabilities, applicants can fill out and submit their applications quickly. This efficiency signNowly reduces waiting times compared to traditional paper applications.

Get more for Individual Credit Application Indiana

- Massage therapy waiver and consent form

- Minnesota abbreviation form

- Mail forwarding canada post form

- Medaille college transcript request form

- Brokers market analysis 100116919 form

- Mcps form 335 74 46846338

- Business registration application for form

- Ncbrbusiness registration application forincome t form

Find out other Individual Credit Application Indiana

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT