Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller Indiana Form

What is the Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller in Indiana

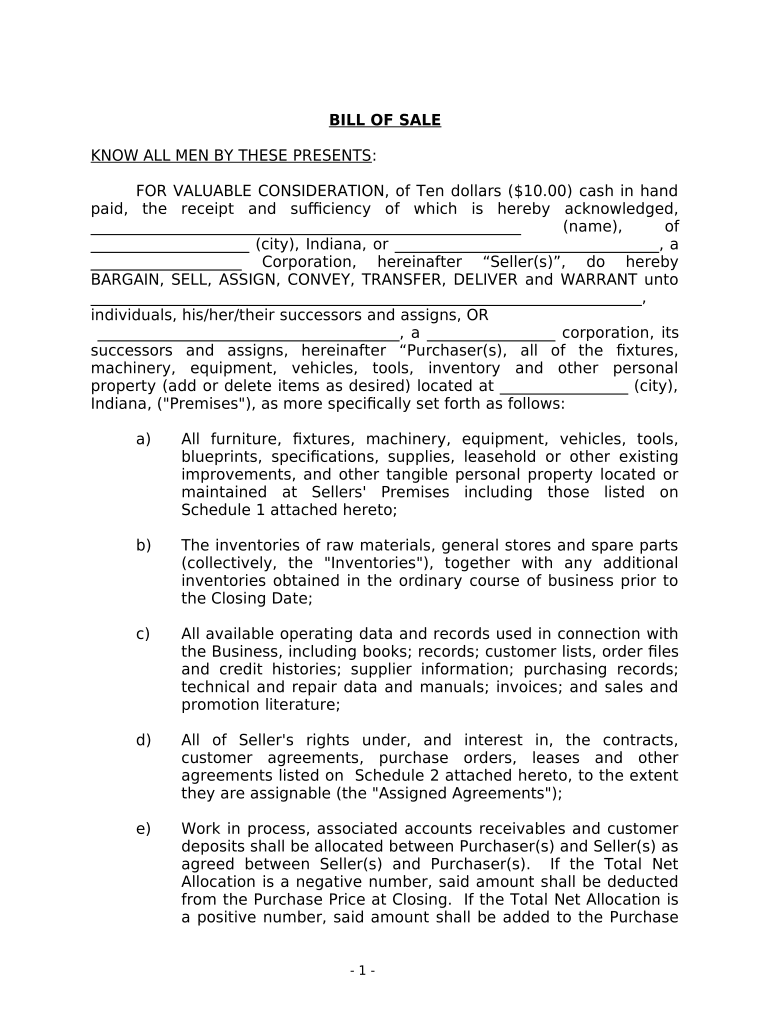

The Bill of Sale in connection with the sale of a business by an individual or corporate seller in Indiana is a legal document that outlines the transfer of ownership of a business from the seller to the buyer. This document serves as proof of the transaction and includes essential details such as the names of the parties involved, the business being sold, the sale price, and the date of the transaction. It is crucial for both parties to ensure that the bill of sale is accurately completed to avoid any future disputes regarding ownership or terms of the sale.

Key Elements of the Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller in Indiana

Several key elements must be included in the Bill of Sale to ensure its validity and effectiveness. These elements include:

- Names and Addresses: Full legal names and addresses of both the seller and the buyer.

- Description of the Business: A detailed description of the business being sold, including any assets, inventory, and liabilities.

- Sale Price: The total amount agreed upon for the sale of the business.

- Payment Terms: Information on how the payment will be made, including any deposits or financing arrangements.

- Signatures: Signatures of both parties, along with the date of signing, to validate the document.

Steps to Complete the Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller in Indiana

Completing the Bill of Sale involves several straightforward steps:

- Gather necessary information about the business, including its assets and liabilities.

- Draft the Bill of Sale, ensuring all key elements are included.

- Review the document with both parties to confirm accuracy and agreement on terms.

- Sign the Bill of Sale in the presence of a witness if required.

- Keep copies of the signed document for both the seller and the buyer for future reference.

Legal Use of the Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller in Indiana

The Bill of Sale is a legally binding document in Indiana when properly executed. It provides legal protection for both the seller and the buyer by documenting the terms of the sale and the transfer of ownership. To ensure legal compliance, it is advisable to consult with a legal professional when drafting the document, especially if the business involves complex assets or liabilities.

State-Specific Rules for the Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller in Indiana

Indiana has specific regulations governing the sale of businesses that may affect the Bill of Sale. It is essential to be aware of state laws regarding business transfers, including any required disclosures and filings. Additionally, if the business being sold is a corporation or limited liability company, there may be additional requirements under Indiana corporate law that must be adhered to for the transaction to be valid.

How to Use the Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller in Indiana

Using the Bill of Sale effectively involves understanding its purpose and the steps required to execute it properly. Once the document is completed and signed, it should be used as a formal record of the transaction. Both parties should retain copies for their records, and it may be beneficial to file the document with relevant state authorities, depending on the nature of the business and local requirements. This ensures that the transfer of ownership is recognized legally and can be referenced in future legal matters.

Quick guide on how to complete bill of sale in connection with sale of business by individual or corporate seller indiana

Prepare Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana effortlessly on any device

Online document organization has become increasingly popular with companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, since you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana effortlessly

- Locate Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana and then click Get Form to initiate.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow manages all your document organization needs in just a few clicks from any device of your preference. Edit and eSign Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana?

A Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana is a legal document that facilitates the transfer of ownership of a business from a seller to a buyer. This document outlines the terms of the sale, including the sale price and any warranties. Using this bill of sale helps ensure a smooth transition and can protect both parties' interests.

-

Why do I need a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana?

Having a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana is crucial for legal protection and clarity in the sale process. It serves as official proof of the transaction and details the rights and responsibilities of both the buyer and seller. Without this document, disputes may arise regarding the terms of the sale.

-

How much does it cost to create a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana?

The cost to create a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana varies depending on how you choose to generate it. Using airSlate SignNow, you can easily create this document at an affordable price, ensuring you get a professionally drafted bill without high legal fees. The investment is typically minor compared to the protection it offers.

-

Can I customize my Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana?

Yes, airSlate SignNow allows you to fully customize your Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana. You can add specific details, clauses, and conditions that pertain to your unique transaction. Customization ensures that the document accurately reflects your agreement and protects your interests.

-

What features does airSlate SignNow offer for creating a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana?

airSlate SignNow provides a user-friendly interface and various features such as document templates, eSignature capability, and secure storage for your Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana. Additionally, you can easily track the document's status and collaborate with others. These features streamline the process for peace of mind.

-

Is eSigning my Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana secure?

Absolutely! Using airSlate SignNow for eSigning your Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana is highly secure. The platform employs bank-level encryption and complies with industry standards to ensure your document's integrity and confidentiality. Your transactions are safe from unauthorized access.

-

Can airSlate SignNow integrate with other tools I use for business?

Yes, airSlate SignNow offers integration capabilities with various business tools and applications. This allows you to seamlessly incorporate your Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana into your existing workflows. Integration enhances efficiency and ensures that all your documents are unified in one platform.

Get more for Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana

- Form filling test doc

- Waiver edge quarry docx form

- Edward jones power of attorney form

- Casey life skills worksheets form

- State of michigan fire alarm apprentice form

- Statement of fitness for work progress certificate nt worksafe form

- Medical certificate of capacity progress form

- Dd form 3230 quotdepartment of defense controlled unclassified information cui nondisclosure agreement for president elects

Find out other Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Indiana

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors