Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate Indiana Form

What is the Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana

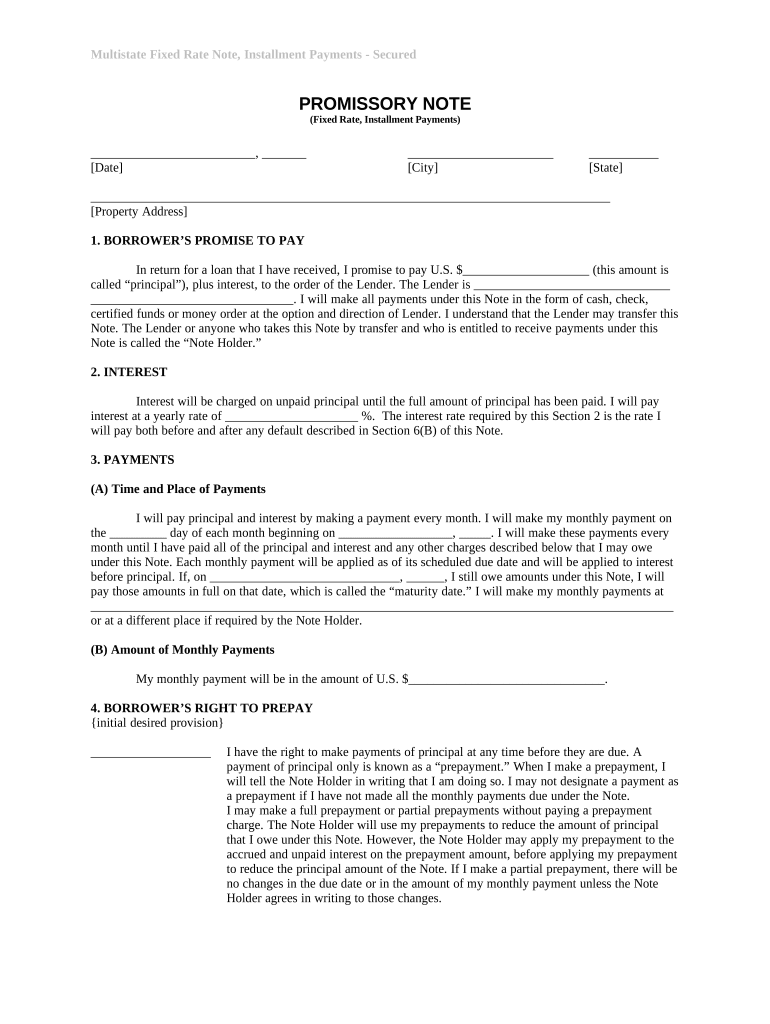

The Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a borrower's promise to repay a loan in fixed installments over a specified period. This note is secured by residential real estate, meaning that the property serves as collateral for the loan. In the event of default, the lender has the right to take possession of the property to recover the owed amount. This type of promissory note is commonly used in real estate transactions and provides clarity on payment terms, interest rates, and the responsibilities of both parties involved.

Key Elements of the Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana

Several key elements must be included in the Indiana Installments Fixed Rate Promissory Note to ensure its validity and enforceability. These elements include:

- Borrower and Lender Information: Full names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate applied to the loan.

- Payment Schedule: Details on how often payments are due, such as monthly or quarterly.

- Maturity Date: The date by which the loan must be fully repaid.

- Collateral Description: A detailed description of the residential real estate securing the loan.

- Default Terms: Conditions under which the borrower would be considered in default.

Steps to Complete the Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana

Completing the Indiana Installments Fixed Rate Promissory Note involves several important steps to ensure accuracy and compliance. Follow these steps:

- Gather Information: Collect necessary details about the borrower, lender, loan amount, interest rate, and property.

- Fill Out the Form: Enter the gathered information into the promissory note template, ensuring all fields are completed accurately.

- Review Terms: Carefully review the payment schedule, maturity date, and default terms for clarity.

- Sign the Document: Both parties must sign the document to indicate agreement to the terms.

- Secure the Note: Store the signed note in a safe place, as it serves as a legal record of the loan agreement.

Legal Use of the Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana

The legal use of the Indiana Installments Fixed Rate Promissory Note is governed by state laws. It serves as a binding contract between the borrower and lender, outlining the terms of the loan. To be legally enforceable, the note must meet specific requirements, such as being signed by both parties and including all essential elements. Additionally, the note must comply with federal and state regulations regarding lending practices to ensure that both parties are protected under the law.

How to Use the Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana

Using the Indiana Installments Fixed Rate Promissory Note is straightforward. Once the document is completed and signed, it serves as a reference for both parties regarding their obligations. The borrower must make payments according to the agreed schedule, while the lender should keep accurate records of all transactions. If any issues arise, such as missed payments, both parties can refer to the note to clarify their rights and responsibilities. This document is essential for maintaining transparency and accountability throughout the loan period.

State-Specific Rules for the Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana

Indiana has specific rules and regulations governing promissory notes secured by real estate. These include requirements for notarization, interest rate limits, and disclosure obligations. It is important for both borrowers and lenders to be aware of these state-specific rules to ensure compliance. Additionally, understanding the legal framework helps protect both parties in case of disputes. Consulting with a legal professional familiar with Indiana real estate law can provide further guidance on these regulations.

Quick guide on how to complete indiana installments fixed rate promissory note secured by residential real estate indiana

Prepare Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana with ease on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana effortlessly

- Obtain Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Select how you prefer to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana?

An Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana is a legal document that outlines a borrower's promise to repay a loan in installments, secured by residential real estate. This type of note provides clarity on repayment terms and protects the lender’s interests through collateral.

-

What are the benefits of using an Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana?

The primary benefits of an Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana include predictable payments due to the fixed interest rate and enhanced security for lenders. Additionally, this arrangement can help borrowers manage their budgets more effectively over time.

-

How does pricing work for Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana?

Pricing for Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana typically involves interest rates and any associated fees. These costs can vary based on the financial institution, the borrower's creditworthiness, and specific loan terms.

-

Are there any specific requirements for drafting an Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana?

Yes, there are specific requirements for drafting an Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana. It must include details like the loan amount, interest rate, payment schedule, borrower and lender information, and property details being used as security.

-

Can I customize the terms of my Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana?

Absolutely! An Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana can be customized to fit the needs of both the borrower and the lender. This includes adjusting interest rates, payment schedules, and loan amounts as mutually agreed upon.

-

How can airSlate SignNow assist in creating an Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana?

airSlate SignNow empowers businesses to easily create and manage documents, including an Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana. With user-friendly interfaces and e-signature capabilities, you can streamline the entire process efficiently.

-

What integrations are available with airSlate SignNow for managing Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana?

airSlate SignNow offers several integrations with popular platforms like Google Drive, Dropbox, and major CRM systems. These integrations allow for smoother document management related to your Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana.

Get more for Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana

- Nashua high school north transcript request form

- Dd form 2796

- Trf global contribution form

- Ing zakelijke rekening opheffen form

- Frat laboratory test form iliad neurosciences inc

- Name aa na meeting attendance sheet dsps wi form

- Photo release form for good and valuable consideration the

- Consuelo staton state resource mothers program form

Find out other Indiana Installments Fixed Rate Promissory Note Secured By Residential Real Estate Indiana

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online