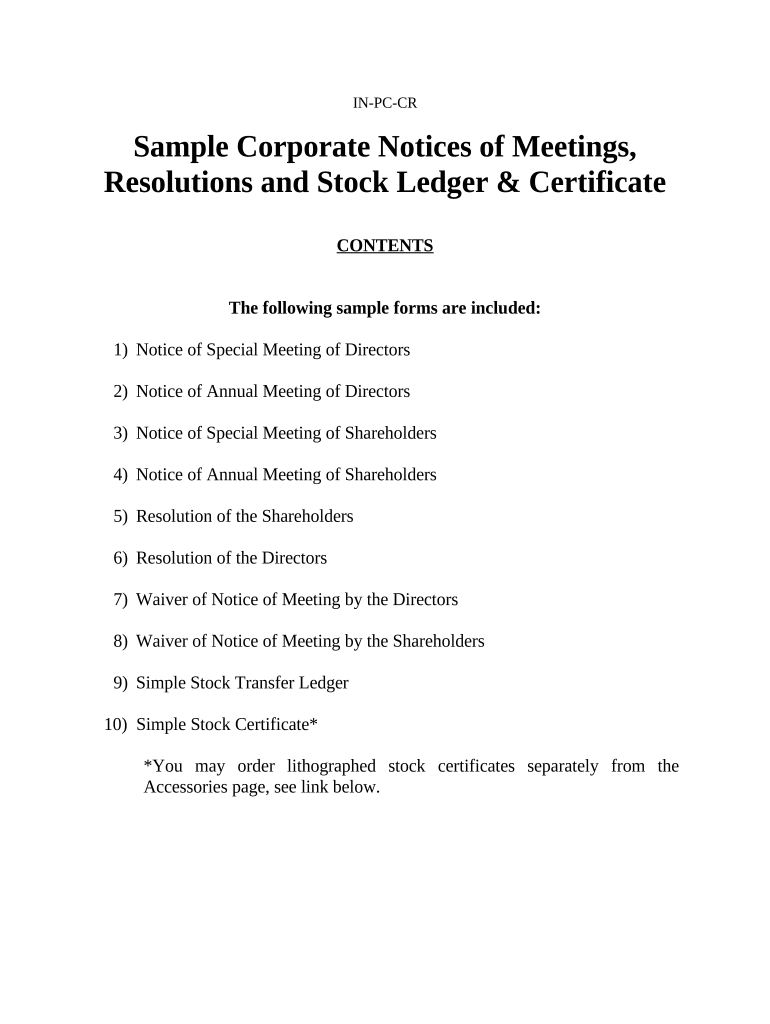

In Corporation Form

What is the In Corporation Form

The in corporation form is a legal document used to establish a corporation in the United States. This form outlines essential information about the business, including its name, purpose, and structure. By filing this form, individuals can create a distinct legal entity that separates personal assets from business liabilities. This separation provides limited liability protection to the owners, meaning their personal assets are generally shielded from business debts and legal actions.

Steps to Complete the In Corporation Form

Completing the in corporation form involves several key steps to ensure accurate and compliant submission. Begin by gathering necessary information, including the corporation's name, address, and details about the registered agent. Next, specify the type of corporation, whether it is a professional corporation or a standard business corporation. After filling out the required sections, review the form for accuracy and completeness. Finally, submit the form to the appropriate state agency, along with any required fees. Ensuring that all information is correct is crucial, as mistakes can lead to delays or rejections.

Legal Use of the In Corporation Form

The in corporation form serves a vital legal purpose by formally establishing a corporation. This document must comply with state-specific regulations, which can vary significantly across the United States. Once filed, the corporation gains legal recognition, allowing it to conduct business, enter contracts, and open bank accounts under its name. Additionally, the form must be completed accurately to meet the legal requirements set forth by the state, ensuring that the corporation operates within the law.

Key Elements of the In Corporation Form

Several key elements are essential to the in corporation form. These include:

- Corporation Name: The proposed name must be unique and comply with state naming conventions.

- Business Purpose: A brief description of the business activities the corporation will engage in.

- Registered Agent: The individual or entity designated to receive legal documents on behalf of the corporation.

- Incorporators: Names and addresses of the individuals responsible for filing the form.

- Stock Information: Details about the stock structure, including the number of shares and their par value.

How to Obtain the In Corporation Form

The in corporation form can typically be obtained from the website of the Secretary of State or the relevant state agency responsible for business registrations. Many states offer the form as a downloadable PDF, which can be filled out electronically or printed for manual completion. Additionally, some states may provide online filing options, allowing for a more streamlined submission process. It is important to ensure that you are using the most current version of the form, as requirements may change.

Filing Deadlines / Important Dates

Filing deadlines for the in corporation form can vary by state and may depend on the type of corporation being established. Generally, it is advisable to file the form as soon as possible to avoid any potential penalties or complications. Some states may have specific deadlines related to annual reports or renewals that must be adhered to after the initial filing. It is essential to check with the state agency for any important dates related to the incorporation process.

Quick guide on how to complete in corporation form

Complete In Corporation Form effortlessly on any device

Online document handling has gained popularity with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the correct template and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage In Corporation Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign In Corporation Form without breaking a sweat

- Find In Corporation Form and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your document, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign In Corporation Form and ensure outstanding communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an in corporation form, and why is it important?

An in corporation form is a legal document that establishes a corporation and outlines its structure. This form is crucial as it defines the roles, responsibilities, and governance of the company, ensuring legal compliance and protecting personal assets.

-

How does airSlate SignNow simplify the process of completing an in corporation form?

airSlate SignNow streamlines the process of completing an in corporation form by allowing users to fill out, eSign, and manage documents online. The platform's intuitive interface and template features ensure that you can easily navigate the complexities of incorporation paperwork.

-

What are the costs associated with using airSlate SignNow for my in corporation form?

Pricing for airSlate SignNow varies based on the subscription plan you choose, with options for individuals and businesses. Each plan offers features that simplify document management, including the creation and signing of in corporation forms, making it a cost-effective solution.

-

Can I integrate airSlate SignNow with other tools to manage my in corporation form?

Yes, airSlate SignNow offers integrations with various popular applications like Google Drive, Dropbox, and CRM systems. This interoperability allows you to seamlessly manage your in corporation form and other documents within your existing workflows.

-

What benefits does airSlate SignNow provide for handling an in corporation form?

Using airSlate SignNow for your in corporation form offers numerous benefits, including enhanced security, reduced turnaround time for approvals, and the convenience of having documents accessible from anywhere. The platform also helps minimize paperwork, making the incorporation process more efficient.

-

Is airSlate SignNow compliant with legal requirements when completing an in corporation form?

Absolutely. airSlate SignNow is compliant with e-signature laws such as the ESIGN Act and UETA, ensuring that your in corporation form carries the same legal standing as traditional paper signatures. This compliance provides peace of mind when managing important corporate documents.

-

How can I ensure my in corporation form is filled out correctly?

airSlate SignNow provides step-by-step guidance and pre-built templates for your in corporation form, reducing the risk of errors. Additionally, the platform includes features for collaboration, allowing multiple stakeholders to contribute and review the form before finalization.

Get more for In Corporation Form

- Riyadh zip code map form

- Download application form dr cv raman university

- Affidavit of correction kansas 389753445 form

- Vatterott tax form for

- Cleveland wheels and brakes manual form

- Nevada department of taxationaffidavit of purchase form

- Ifta 105 ifta final fuel use tax rate and rate code table 1 form

- Form st 810 new york state and local quarterly sales and use tax return for part quarterly filers revised 1124

Find out other In Corporation Form

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document