Quitclaim Deed from Corporation to Husband and Wife Kansas Form

What is the Quitclaim Deed From Corporation To Husband And Wife Kansas

A quitclaim deed from a corporation to a husband and wife in Kansas is a legal document that facilitates the transfer of property ownership from a corporate entity to a married couple. This type of deed does not guarantee that the corporation holds clear title to the property; rather, it conveys whatever interest the corporation may have in the property to the couple. It is often used in situations where a corporation wishes to transfer property to its shareholders or members who are married, simplifying the process of property ownership and ensuring that both parties have equal rights to the property.

Steps to Complete the Quitclaim Deed From Corporation To Husband And Wife Kansas

Completing a quitclaim deed from a corporation to a husband and wife involves several key steps:

- Gather necessary information, including the legal description of the property, the names of the corporation, and the names of the husband and wife.

- Obtain the quitclaim deed form, which can often be found online or through legal document providers.

- Fill out the form accurately, ensuring all names and descriptions are correct.

- Have the form signed by an authorized representative of the corporation in the presence of a notary public.

- Ensure both spouses sign the deed as well, acknowledging their acceptance of the property transfer.

- File the completed deed with the appropriate county office to make the transfer official.

Legal Use of the Quitclaim Deed From Corporation To Husband And Wife Kansas

The quitclaim deed from a corporation to a husband and wife is legally recognized in Kansas, provided it is executed correctly. It is essential that the deed includes all required elements, such as the names of the parties involved, a clear description of the property, and the signatures of all necessary parties. This deed can be used for various purposes, including transferring property for estate planning, simplifying ownership among family members, or facilitating the sale of corporate assets.

State-Specific Rules for the Quitclaim Deed From Corporation To Husband And Wife Kansas

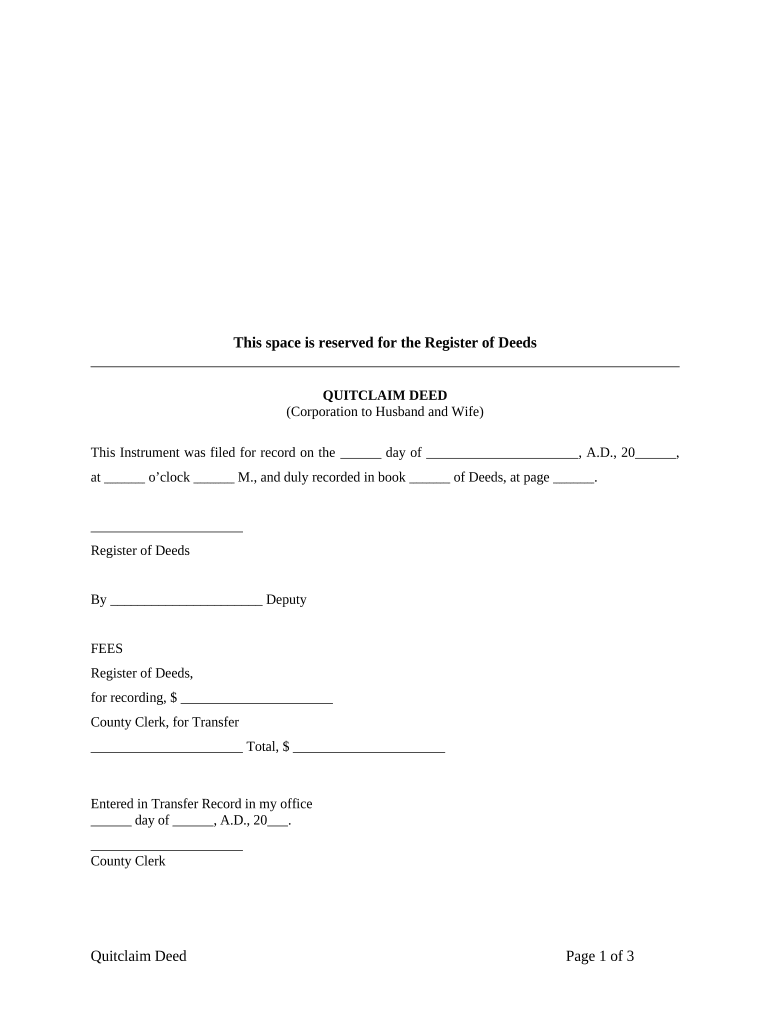

Kansas has specific rules governing the execution and recording of quitclaim deeds. These include:

- The deed must be signed by an authorized representative of the corporation.

- Notarization is required to validate the signatures on the deed.

- The completed deed must be filed with the county register of deeds where the property is located.

- There may be specific fees associated with filing the deed, which vary by county.

Key Elements of the Quitclaim Deed From Corporation To Husband And Wife Kansas

When preparing a quitclaim deed from a corporation to a husband and wife, it is vital to include several key elements:

- The full legal names of the corporation and the husband and wife.

- A detailed legal description of the property being transferred.

- The date of the transfer.

- The signatures of the authorized corporate representative and both spouses.

- A notary's acknowledgment confirming the authenticity of the signatures.

How to Obtain the Quitclaim Deed From Corporation To Husband And Wife Kansas

Obtaining a quitclaim deed from a corporation to a husband and wife can be done through various means:

- Visit the local county clerk or register of deeds office to request a blank quitclaim deed form.

- Access legal document websites that offer customizable quitclaim deed templates specific to Kansas.

- Consult with a real estate attorney who can provide guidance and ensure compliance with state laws.

Quick guide on how to complete quitclaim deed from corporation to husband and wife kansas

Complete Quitclaim Deed From Corporation To Husband And Wife Kansas effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the tools required to create, amend, and electronically sign your documents quickly without delays. Manage Quitclaim Deed From Corporation To Husband And Wife Kansas on any platform using airSlate SignNow Android or iOS applications and streamline any document-driven process today.

The easiest method to modify and eSign Quitclaim Deed From Corporation To Husband And Wife Kansas effortlessly

- Obtain Quitclaim Deed From Corporation To Husband And Wife Kansas and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature with the Sign tool, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Alter and eSign Quitclaim Deed From Corporation To Husband And Wife Kansas and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To Husband And Wife Kansas?

A Quitclaim Deed From Corporation To Husband And Wife Kansas is a legal document that allows a corporation to transfer its interest in a property to a married couple. This type of deed does not guarantee that the corporation holds clear title, but it simplifies the transfer process. It's an essential tool for couples looking to consolidate property ownership.

-

How do I create a Quitclaim Deed From Corporation To Husband And Wife Kansas?

Creating a Quitclaim Deed From Corporation To Husband And Wife Kansas can be easily done using airSlate SignNow's user-friendly platform. You can fill out the necessary information online, customize the document to fit your needs, and then eSign it securely. This process saves time and minimizes the hassle of paper documents.

-

What are the costs associated with a Quitclaim Deed From Corporation To Husband And Wife Kansas?

The cost for a Quitclaim Deed From Corporation To Husband And Wife Kansas varies depending on the service you use. With airSlate SignNow, you can access a cost-effective solution that provides templates and guidance at a competitive price. Our pricing structure is designed to meet the needs of individuals and businesses alike.

-

Are there any specific benefits to using airSlate SignNow for a Quitclaim Deed From Corporation To Husband And Wife Kansas?

Using airSlate SignNow for your Quitclaim Deed From Corporation To Husband And Wife Kansas offers numerous benefits, including ease of use, secure electronic signatures, and the ability to track document status. Our platform also allows you to integrate seamlessly with other tools, enhancing your overall document management experience.

-

Is the Quitclaim Deed From Corporation To Husband And Wife Kansas legally binding?

Yes, a Quitclaim Deed From Corporation To Husband And Wife Kansas is legally binding once it is properly executed and recorded. This means that both parties involved should understand their rights and responsibilities before signing. Using airSlate SignNow can help ensure your document meets legal standards.

-

Can I modify a Quitclaim Deed From Corporation To Husband And Wife Kansas after it's created?

Yes, modifications to a Quitclaim Deed From Corporation To Husband And Wife Kansas can be made as needed, provided both parties agree to the changes. With airSlate SignNow, you can easily edit your documents anytime, ensuring that all information remains accurate and up-to-date.

-

What integrations does airSlate SignNow offer for processing a Quitclaim Deed From Corporation To Husband And Wife Kansas?

airSlate SignNow offers a wide range of integrations that can streamline the process of handling a Quitclaim Deed From Corporation To Husband And Wife Kansas. You can connect with popular CRM systems, cloud storage solutions, and productivity tools to enhance document workflows and improve collaboration between all parties.

Get more for Quitclaim Deed From Corporation To Husband And Wife Kansas

- Ronald reagan presidential library and museum scavenger hunt form

- Shadowing verification form

- Becker cpa pdf download form

- Affidavit of non possession form

- Fillable eta form 9142

- Venue hire agreement template form

- 701b certification 16077974 form

- Pdf application for health coverage ampamp help paying costs medicaid form

Find out other Quitclaim Deed From Corporation To Husband And Wife Kansas

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word