Quitclaim Deed Mineral Rights from Individual to Three Individuals Transfer Kansas Form

Understanding the Quitclaim Deed for Mineral Rights in Kansas

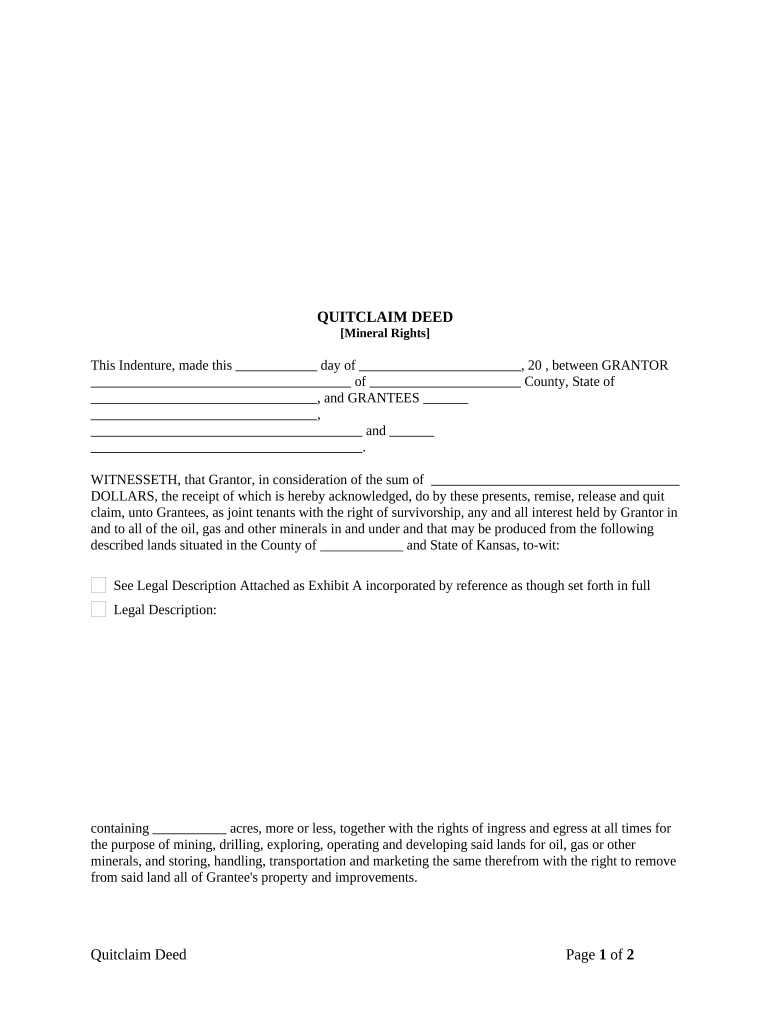

A quitclaim deed is a legal document used to transfer ownership of mineral rights from one individual to another. In Kansas, this type of deed is particularly relevant for those looking to convey mineral rights to multiple parties. Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor has clear title to the property; they simply transfer whatever interest the grantor has in the mineral rights. This makes it essential for both parties involved to understand the implications of the transfer, especially regarding potential liabilities and rights associated with the minerals.

Steps to Complete the Quitclaim Deed for Mineral Rights in Kansas

Completing a quitclaim deed for mineral rights involves several key steps to ensure the transfer is legally binding and recognized. Here is a simplified process:

- Gather necessary information, including the names of the grantor and grantee, the legal description of the property, and the specific mineral rights being transferred.

- Obtain a quitclaim deed form, which can typically be found online or through legal resources.

- Fill out the form accurately, ensuring all details are correct and complete.

- Sign the deed in the presence of a notary public to validate the document.

- File the completed deed with the appropriate county office to officially record the transfer.

Legal Use of the Quitclaim Deed for Mineral Rights in Kansas

The quitclaim deed is legally recognized in Kansas for the transfer of mineral rights. It is important to note that while this deed transfers ownership, it does not guarantee that the grantor has clear title to the mineral rights. Therefore, potential buyers or recipients should conduct thorough due diligence to understand the extent of the rights being transferred and any encumbrances that may exist. Legal advice is often recommended to navigate the complexities of mineral rights and ensure compliance with state regulations.

Key Elements of the Quitclaim Deed for Mineral Rights in Kansas

When preparing a quitclaim deed for mineral rights in Kansas, several key elements must be included to ensure its validity:

- Grantor and Grantee Information: Full names and addresses of both parties involved in the transaction.

- Legal Description: A precise legal description of the property associated with the mineral rights.

- Consideration: The amount paid for the transfer, if applicable, or a statement indicating it is a gift.

- Signature and Notarization: The grantor must sign the deed in front of a notary public to authenticate the document.

- Recording Information: Details on where the deed will be filed to make the transfer public record.

State-Specific Rules for the Quitclaim Deed in Kansas

Kansas has specific regulations governing the use of quitclaim deeds for mineral rights. These rules dictate how the deed must be executed, including notarization and recording requirements. It is crucial to adhere to these state-specific guidelines to avoid potential legal disputes or challenges to the transfer. Additionally, understanding local laws regarding mineral rights can help ensure that all parties are fully informed about their rights and responsibilities following the transfer.

Obtaining the Quitclaim Deed for Mineral Rights in Kansas

To obtain a quitclaim deed for mineral rights in Kansas, individuals can access various resources. Many legal websites provide templates and forms that can be customized for specific transactions. Additionally, local county clerk offices often have official forms available. It is advisable to consult with a legal professional to ensure that the deed meets all legal requirements and accurately reflects the intentions of the parties involved.

Quick guide on how to complete quitclaim deed mineral rights from individual to three individuals transfer kansas

Effortlessly Complete Quitclaim Deed Mineral Rights From Individual To Three Individuals Transfer Kansas on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documentation, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly, without delays. Manage Quitclaim Deed Mineral Rights From Individual To Three Individuals Transfer Kansas on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Quitclaim Deed Mineral Rights From Individual To Three Individuals Transfer Kansas with minimal effort

- Find Quitclaim Deed Mineral Rights From Individual To Three Individuals Transfer Kansas and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you select. Alter and eSign Quitclaim Deed Mineral Rights From Individual To Three Individuals Transfer Kansas and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are kansas mineral rights?

Kansas mineral rights refer to the legal rights to extract minerals from beneath the land in Kansas. These rights can include valuable resources such as oil, gas, coal, and other minerals. Understanding your kansas mineral rights is essential for any landowner involved in mineral exploration or extraction.

-

How can airSlate SignNow help with kansas mineral rights documentation?

With airSlate SignNow, you can easily create, send, and eSign all necessary documents related to kansas mineral rights. Our platform allows you to streamline the signing process, making it faster and more efficient. This is particularly beneficial when dealing with complex agreements and contracts associated with mineral transactions.

-

What features does airSlate SignNow offer for managing kansas mineral rights agreements?

airSlate SignNow offers features such as customizable templates, document tracking, and secure cloud storage tailored for managing kansas mineral rights agreements. Our intuitive interface makes it easy to collaborate with others involved in the transaction, ensuring all parties have access to important documents when needed.

-

Is airSlate SignNow cost-effective for kansas mineral rights transactions?

Yes, airSlate SignNow provides a cost-effective solution for managing kansas mineral rights transactions. Our flexible pricing plans cater to businesses of all sizes, ensuring you only pay for what you need. This can provide signNow cost savings, particularly for frequent document signing and management.

-

Can I integrate airSlate SignNow with other tools for kansas mineral rights management?

Absolutely! airSlate SignNow offers integrations with various business tools, enhancing your workflow related to kansas mineral rights management. Whether you need to connect with your CRM or document storage solutions, our platform easily integrates to keep all your resources connected and organized.

-

What are the benefits of using airSlate SignNow for kansas mineral rights agreements?

The main benefits of using airSlate SignNow for kansas mineral rights agreements include increased efficiency, reduced turnaround time for signatures, and enhanced security. Our platform ensures that sensitive documents are handled securely while making the entire process user-friendly for all parties involved.

-

How can I ensure compliance when managing kansas mineral rights with airSlate SignNow?

airSlate SignNow helps ensure compliance by offering legally binding eSignature capabilities and audit trails for all documents signed. When handling kansas mineral rights paperwork, it's crucial to maintain compliance with state regulations, and our platform is designed to support these requirements seamlessly.

Get more for Quitclaim Deed Mineral Rights From Individual To Three Individuals Transfer Kansas

- Name approval form

- Legalisation study project questionnaire page 1 form

- Annexure ii affidavit by parentguardian srm university srmuniversity ac form

- Abstract of judgement form texas

- Florida state fair record book form

- Traveler profile form accent on travel

- Medicare enrolment form ms004 732791762

- Expires 02282027 form

Find out other Quitclaim Deed Mineral Rights From Individual To Three Individuals Transfer Kansas

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later