Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Kansas Form

What is the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas

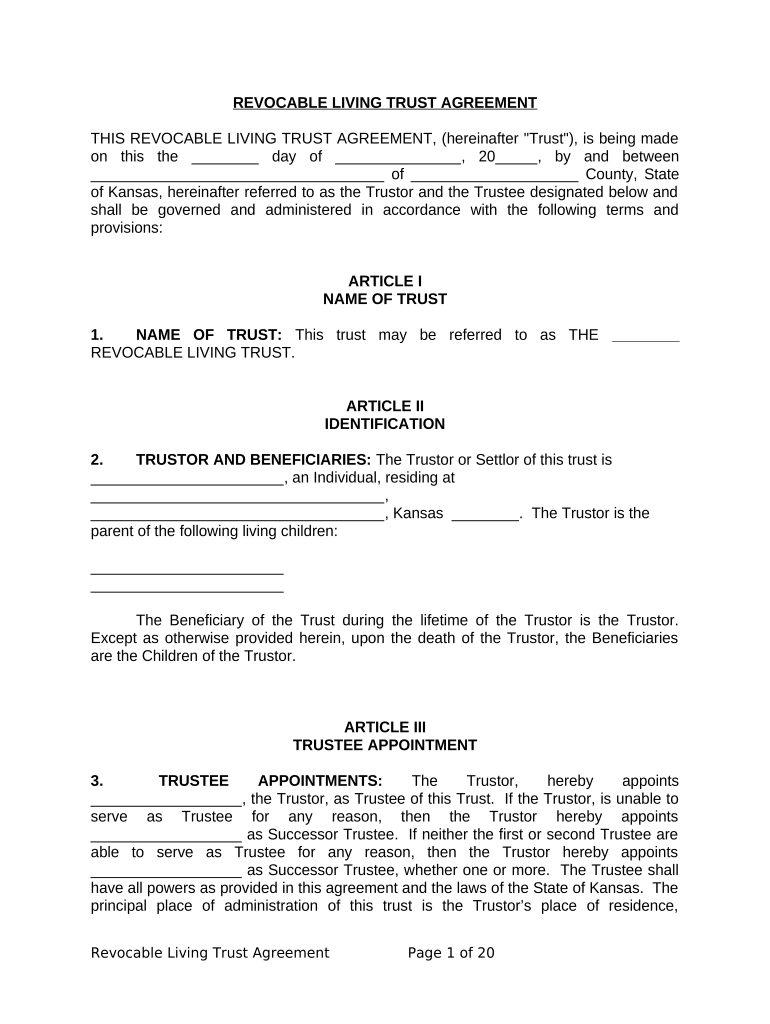

A living trust is a legal document that allows an individual to manage their assets during their lifetime and specify how those assets will be distributed after their death. For individuals who are single, divorced, or widowed with children in Kansas, a living trust can provide a way to ensure that their children are cared for and that their assets are distributed according to their wishes. This type of trust can help avoid the probate process, which can be time-consuming and costly, allowing for a smoother transition of assets to beneficiaries.

How to use the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas

Using a living trust involves several steps. First, the individual must create the trust document, detailing the assets included and the beneficiaries. Next, they must transfer ownership of their assets into the trust. This may include real estate, bank accounts, and personal property. Once established, the individual can manage the trust assets as they see fit, making changes as necessary throughout their lifetime. Upon their passing, the trust assets are distributed to the beneficiaries without the need for probate court involvement.

Steps to complete the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas

Completing a living trust involves the following steps:

- Determine the assets to include in the trust.

- Choose a trustee, who will manage the trust.

- Draft the trust document, specifying terms and conditions.

- Sign the document in accordance with Kansas state laws.

- Transfer ownership of assets into the trust.

- Review and update the trust as needed over time.

Key elements of the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas

Key elements of a living trust include the identification of the grantor (the person creating the trust), the trustee (who manages the trust), and the beneficiaries (who receive the assets). The trust document outlines how assets are to be managed and distributed, including any specific instructions regarding care for minor children. Additionally, it is important to include provisions for what happens if the grantor becomes incapacitated, ensuring that the trustee can act on their behalf.

State-specific rules for the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas

In Kansas, specific rules govern the creation and execution of living trusts. These include requirements for the trust document to be in writing and signed by the grantor. Kansas law also allows for the revocation or amendment of a living trust at any time while the grantor is alive, providing flexibility. It is essential to comply with state laws to ensure the trust is valid and enforceable.

Legal use of the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas

The legal use of a living trust in Kansas allows individuals to manage their assets effectively and ensure their wishes are honored after death. It provides a legal framework for asset distribution, which can help minimize disputes among heirs. Additionally, a living trust can protect assets from creditors and provide privacy, as it does not go through the public probate process.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children kansas

Complete Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a seamless eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and electronically sign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas without hassle

- Obtain Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas?

A Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas is a legal document that helps manage your assets during your lifetime and outlines how they will be distributed after your death. It can provide peace of mind, especially for individuals with children, by ensuring your assets are protected and managed according to your wishes.

-

How much does it cost to set up a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas?

The cost of setting up a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas can vary depending on the complexity of your estate and the services you use. Typically, hiring an attorney may range from a few hundred to several thousand dollars; however, online services like airSlate SignNow may offer more affordable options to simplify the process.

-

What are the benefits of a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas?

The benefits of a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas include avoiding probate, providing clear instructions for asset distribution, and ensuring that your children are cared for according to your wishes. It also allows for easier management of your assets if you become incapacitated.

-

Can I change my Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas after it’s created?

Yes, you can modify or revoke your Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas at any time during your lifetime as your circumstances change. It's recommended to review your trust periodically to ensure it aligns with your current needs and wishes.

-

Does a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas require a lawyer?

While it is beneficial to consult a lawyer when creating a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas, many people choose to utilize user-friendly online services like airSlate SignNow which can simplify the process and reduce costs. However, legal advice can help ensure compliance with state laws.

-

How does a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas differ from a will?

A Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas differs from a will primarily in that it avoids probate and can take effect during your lifetime. A will only takes effect after your death and must go through the probate process, which can be lengthy and costly.

-

What assets should I include in my Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas?

Common assets to include in your Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas are real estate, bank accounts, investment accounts, and personal property. Be sure to evaluate all potential assets to fully protect and manage your estate.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kansas

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online