Kentucky Installments Fixed Rate Promissory Note Secured by Residential Real Estate Kentucky Form

What is the Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky

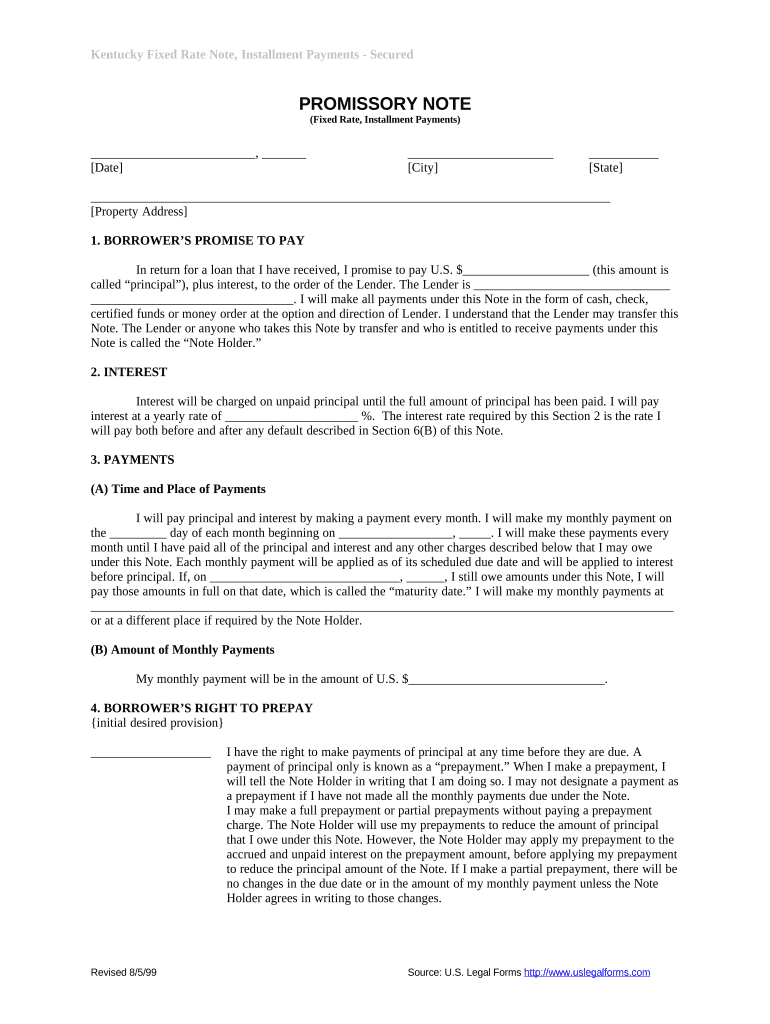

The Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a borrower's promise to repay a loan at a fixed interest rate over a specified period. This note is secured by residential real estate, meaning that the property serves as collateral for the loan. If the borrower defaults, the lender has the right to claim the property through foreclosure. This type of promissory note is commonly used in real estate transactions, providing a clear framework for both parties involved in the agreement.

Key Elements of the Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky

Several key elements are essential in the Kentucky Installments Fixed Rate Promissory Note. These include:

- Principal Amount: The total amount of money borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the principal amount.

- Payment Schedule: Details on how often payments are to be made, typically monthly.

- Maturity Date: The date by which the loan must be fully repaid.

- Collateral Description: A detailed description of the residential real estate securing the note.

Steps to Complete the Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky

Completing the Kentucky Installments Fixed Rate Promissory Note involves several steps:

- Gather Information: Collect all necessary information about the borrower, lender, and property.

- Fill Out the Form: Input details such as the principal amount, interest rate, and payment schedule into the form.

- Review Terms: Ensure all terms are clear and agreed upon by both parties.

- Sign the Document: Both parties should sign the note, ideally in the presence of a notary.

- Store Safely: Keep a copy of the signed document in a secure location for future reference.

Legal Use of the Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky

The legal use of this promissory note is governed by Kentucky state law. It must comply with specific regulations regarding interest rates, payment terms, and the rights of both the borrower and lender. The note must be executed properly to be enforceable in a court of law. It is advisable for both parties to seek legal counsel to ensure that the document meets all legal requirements and protects their interests.

How to Obtain the Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky

Obtaining the Kentucky Installments Fixed Rate Promissory Note can be done through various means:

- Online Resources: Many legal websites offer templates that can be customized for specific needs.

- Legal Professionals: Consulting with an attorney can provide tailored documents that meet all legal standards.

- Real Estate Agents: Professionals in the real estate industry may also have access to standard forms and templates.

State-Specific Rules for the Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky

In Kentucky, specific rules apply to promissory notes secured by real estate. These include limits on interest rates, requirements for notarization, and stipulations regarding foreclosure processes. Understanding these regulations is crucial for both lenders and borrowers to ensure compliance and protect their rights. Failure to adhere to these rules may result in the note being deemed unenforceable.

Quick guide on how to complete kentucky installments fixed rate promissory note secured by residential real estate kentucky

Facilitate Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky effortlessly on any gadget

Digital document management has gained more traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky on any system with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest method to modify and electronically sign Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky with ease

- Obtain Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Craft your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your updates.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky?

A Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky is a type of loan agreement that allows borrowers to repay the loan amount in fixed monthly installments until the total amount is settled. This document is secured by residential real estate, providing lenders with a level of security against default. It's an ideal solution for those looking to manage cash flow effectively in Kentucky.

-

What are the benefits of using a Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky?

Using a Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky offers several benefits, including predictable repayment terms and lower interest rates compared to unsecured loans. Borrowers can enjoy the security of being backed by their residential property, which can lead to higher loan amounts. Additionally, fixed rates provide financial stability over the term of the loan.

-

How can I create a Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky?

Creating a Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky is easy with airSlate SignNow's user-friendly platform. You can customize templates, input necessary details, and eSign the document securely online. Our solution streamlines the process, helping you manage documents efficiently.

-

What features does airSlate SignNow offer for Kentucky Installments Fixed Rate Promissory Notes?

airSlate SignNow offers a comprehensive suite of features for managing Kentucky Installments Fixed Rate Promissory Notes, including electronic signatures, document templates, and automated workflows. Our platform enhances collaboration among parties involved, ensuring all parties have access to necessary documentation. Additionally, our integration capabilities allow you to connect with various third-party applications.

-

What is the pricing structure for using airSlate SignNow for Kentucky Installments Fixed Rate Promissory Notes?

airSlate SignNow provides competitive pricing for managing Kentucky Installments Fixed Rate Promissory Notes, with several plans to suit different business needs. Users can choose from monthly or annual subscriptions, allowing for flexibility in budgeting. Our cost-effective solution ensures that businesses can manage their document workflows without breaking the bank.

-

Is my data secure when using airSlate SignNow for Kentucky Installments Fixed Rate Promissory Notes?

Yes, data security is a top priority at airSlate SignNow when managing Kentucky Installments Fixed Rate Promissory Notes. We implement robust encryption protocols and follow industry best practices to safeguard your information. Users can trust that their sensitive data is securely protected while using our platform.

-

Can I track the status of my Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky?

Absolutely! airSlate SignNow allows you to track the status of your Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky in real-time. You’ll receive notifications when documents are viewed, signed, or require your attention, enabling you to stay on top of the process without any hassle.

Get more for Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky

- Paint inspection report template xls 33244746 form

- Moda health insurance claim form indd ods health plans

- College study skills inventory form

- Water temperature log sheet form

- Form x mseb

- End of shift report template excel form

- Sample corrective action plan for behavior form

- January 13 notice updated uscis application for form

Find out other Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate Kentucky

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract