Louisiana Limited Form

What is the Louisiana Limited?

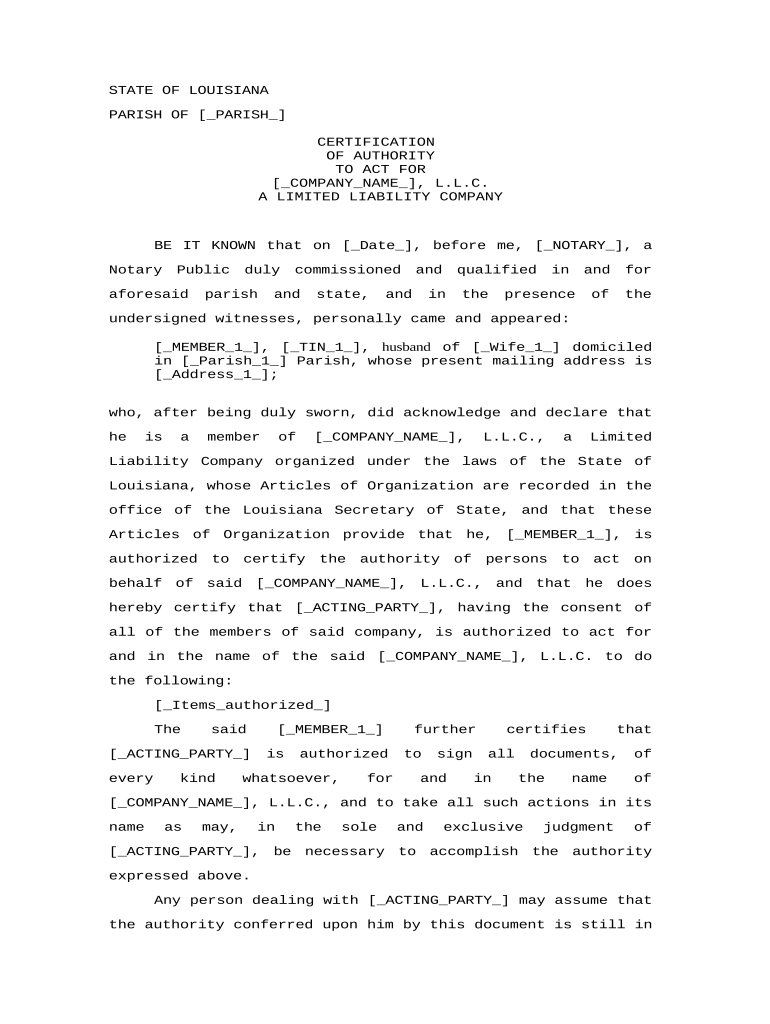

The Louisiana Limited refers to a specific type of business structure recognized in the state of Louisiana, commonly known as a Limited Liability Company (LLC). This entity provides owners with personal liability protection while allowing for flexible management and tax benefits. An LLC in Louisiana combines the characteristics of a corporation and a partnership, making it an appealing choice for many entrepreneurs. The formation of a Louisiana LLC involves filing the necessary paperwork with the state and adhering to specific regulations that govern its operation.

How to Obtain the Louisiana Limited

To obtain a Louisiana Limited, you must follow a series of steps that ensure compliance with state regulations. Begin by choosing a unique name for your LLC that complies with Louisiana naming requirements. Next, designate a registered agent who will receive legal documents on behalf of the company. After these preliminary steps, you will need to file the Articles of Organization with the Louisiana Secretary of State. This document outlines essential information about your LLC, including its name, registered agent, and management structure. Once your application is approved, you will receive a certificate confirming the establishment of your Louisiana LLC.

Steps to Complete the Louisiana Limited

Completing the Louisiana Limited involves several key steps to ensure proper formation and compliance. First, choose a suitable name for your LLC that is distinguishable from existing entities in Louisiana. Second, appoint a registered agent who will handle official correspondence. Third, prepare and file the Articles of Organization with the state, providing all required information. After filing, ensure that you obtain any necessary licenses or permits specific to your business type. Finally, consider creating an operating agreement to outline the management structure and operational procedures of your LLC, even though it is not required by law.

Legal Use of the Louisiana Limited

The legal use of a Louisiana Limited is defined by the regulations set forth by the state. This business structure allows for limited liability protection, meaning that the personal assets of the owners are generally protected from business debts and liabilities. It is essential for LLCs to adhere to state laws, including filing annual reports and maintaining proper records. Additionally, LLCs must comply with any local business regulations that may apply. Understanding these legal obligations helps ensure that the LLC operates within the framework of the law, protecting both the business and its owners.

Key Elements of the Louisiana Limited

Several key elements define the Louisiana Limited and contribute to its functionality as a business entity. These include:

- Limited Liability: Owners are not personally liable for the debts of the LLC.

- Flexible Management: LLCs can be managed by members or designated managers.

- Tax Benefits: LLCs can choose how they want to be taxed, either as a sole proprietorship, partnership, or corporation.

- Fewer Formalities: Compared to corporations, LLCs have fewer ongoing compliance requirements.

Filing Deadlines / Important Dates

When forming a Louisiana Limited, it is crucial to be aware of filing deadlines and important dates. After establishing your LLC, you must file an annual report with the Louisiana Secretary of State. This report is due on the anniversary of your LLC's formation. Additionally, if your LLC is subject to state taxes, be mindful of tax filing deadlines to avoid penalties. Keeping track of these dates ensures that your LLC remains in good standing and compliant with state regulations.

Quick guide on how to complete louisiana limited 497309122

Complete Louisiana Limited effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, alter, and eSign your documents swiftly without complications. Manage Louisiana Limited on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The optimal method to alter and eSign Louisiana Limited effortlessly

- Locate Louisiana Limited and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Alter and eSign Louisiana Limited and ensure remarkable communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Louisiana LLC and how does it work?

A Louisiana LLC, or Limited Liability Company, is a popular business structure that provides personal liability protection for its owners while allowing flexibility in management and tax treatment. By forming a Louisiana LLC, owners can separate their personal assets from their business liabilities, ensuring their assets are protected in case of legal issues. This makes it an ideal choice for entrepreneurs looking to start a business in Louisiana.

-

What are the benefits of forming a Louisiana LLC?

The benefits of forming a Louisiana LLC include limited liability protection, flexible operational structures, and pass-through taxation. This means that the profits of the business are reported on the owners' personal tax returns, avoiding double taxation. Additionally, a Louisiana LLC can enhance credibility with customers and investors, making it an attractive option for new businesses.

-

How much does it cost to start a Louisiana LLC?

The cost to start a Louisiana LLC includes a one-time filing fee with the state and can vary based on the services you use. Typically, this fee is around $100, plus any additional costs for legal assistance or operating agreements that you may require. Ultimately, airSlate SignNow offers an affordable solution for managing associated documents effectively.

-

What documents do I need to form a Louisiana LLC?

To form a Louisiana LLC, you will need to prepare and file Articles of Organization with the Secretary of State. Additionally, having an Operating Agreement is highly recommended, outlining the management structure and operational procedures. airSlate SignNow can streamline the process of drafting and eSigning these essential documents.

-

How long does it take to establish a Louisiana LLC?

The time it takes to establish a Louisiana LLC can vary, but typically it takes about 1 to 2 weeks after submitting the required documents to the state. For expedited processing, certain services may offer faster options. Utilizing airSlate SignNow can speed up the preparation and eSigning processes, helping you get started sooner.

-

Can I manage my Louisiana LLC online?

Yes, you can manage your Louisiana LLC online by utilizing various digital tools and platforms designed for business management. With airSlate SignNow, you can easily send and eSign essential documents online, making it convenient to oversee your LLC's operations from anywhere. This flexibility supports efficient management and communication with stakeholders.

-

What are the tax implications for a Louisiana LLC?

A Louisiana LLC enjoys pass-through taxation, meaning that the business's income is not taxed at the corporate level but instead passes through to the owners' personal tax returns. This structure avoids the double taxation often associated with corporations. However, owners must stay informed about any local taxes or fees specific to their Louisiana LLC.

Get more for Louisiana Limited

- Huntington mortgage group form

- Mylicensesite 240966655 form

- Ug i year prospectus 15 dr br ambedkar open university form

- Motion for continuance georgia form

- Lg1015 reporting organization information changes mn

- Date of birth mmddyyyy sex form

- Dhs 0415h form

- Form rp 467 rnw718renewal application for partial

Find out other Louisiana Limited

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement