Form RP 467 Rnw718Renewal Application for Partial 2023-2026

What is the RP 467 Form?

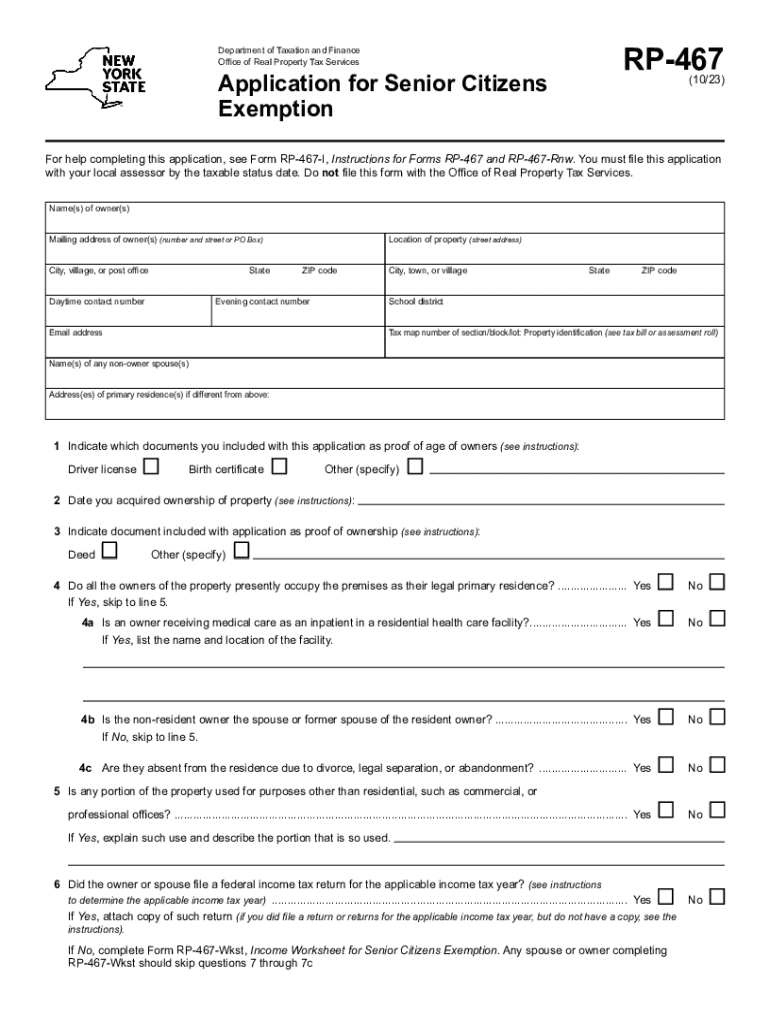

The RP 467 form, also known as the Senior Citizens Exemption application, is a document used in New York State to apply for a property tax exemption for senior citizens. This exemption is designed to provide financial relief to eligible homeowners aged sixty-five and older. By submitting this form, seniors can potentially reduce their property tax burden, making homeownership more affordable.

Eligibility Criteria for the RP 467 Form

To qualify for the RP 467 form, applicants must meet specific criteria. Primarily, the applicant must be at least sixty-five years old as of December thirty-first of the year prior to the application. Additionally, the applicant's income must not exceed the limit set by the state, which is subject to change annually. Applicants must also own the property for which they are seeking the exemption and occupy it as their primary residence.

Steps to Complete the RP 467 Form

Completing the RP 467 form involves several steps. First, gather necessary documentation, including proof of age, income statements, and property ownership details. Next, fill out the form accurately, ensuring all required fields are completed. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate local assessor’s office by the specified deadline, which is typically March fifteenth of the application year.

Required Documents for the RP 467 Form

When applying for the RP 467 form, several documents are required to support the application. These typically include:

- Proof of age, such as a birth certificate or driver's license.

- Income documentation, including tax returns and Social Security statements.

- Proof of property ownership, such as a deed or mortgage statement.

It is essential to ensure all documents are current and accurately reflect the applicant's financial status.

Form Submission Methods

The RP 467 form can be submitted through various methods, depending on local regulations. Common submission options include:

- Online submission via the local assessor's office website, if available.

- Mailing the completed form and supporting documents to the local assessor’s office.

- In-person submission at the local assessor’s office during business hours.

Each method has its own advantages, and applicants should choose the one that best suits their needs.

Key Elements of the RP 467 Form

The RP 467 form includes several key elements that applicants must complete. These include personal information such as name, address, and date of birth. Additionally, the form requires details about household income and the property in question. Understanding these elements is crucial for ensuring a complete and accurate application, which can expedite the approval process.

Filing Deadlines for the RP 467 Form

Timely submission of the RP 467 form is critical to ensure eligibility for the senior citizens exemption. The standard filing deadline is March fifteenth of the year for which the exemption is being requested. It is advisable for applicants to submit their forms well in advance of this date to avoid any last-minute issues that could affect their eligibility.

Quick guide on how to complete form rp 467 rnw718renewal application for partial

Prepare Form RP 467 Rnw718Renewal Application For Partial with ease on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form RP 467 Rnw718Renewal Application For Partial on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

How to alter and electronically sign Form RP 467 Rnw718Renewal Application For Partial effortlessly

- Obtain Form RP 467 Rnw718Renewal Application For Partial and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to keep your changes.

- Select your preferred method to send your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form RP 467 Rnw718Renewal Application For Partial and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rp 467 rnw718renewal application for partial

Create this form in 5 minutes!

How to create an eSignature for the form rp 467 rnw718renewal application for partial

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rp 467 form and how can airSlate SignNow help with it?

The rp 467 form is a document that requires electronic signatures for validation. airSlate SignNow simplifies the process by allowing users to easily send, sign, and manage the rp 467 form online, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for the rp 467 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the signing process for documents like the rp 467 form, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing the rp 467 form?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure storage for the rp 467 form. These tools enhance the signing experience and ensure that all documents are handled efficiently.

-

Can I integrate airSlate SignNow with other applications for the rp 467 form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the rp 467 form alongside your existing workflows. This integration enhances productivity and ensures a smooth document management process.

-

What are the benefits of using airSlate SignNow for the rp 467 form?

Using airSlate SignNow for the rp 467 form offers numerous benefits, including faster turnaround times, reduced paper usage, and enhanced security. These advantages help businesses streamline their operations and improve overall efficiency.

-

How secure is the signing process for the rp 467 form with airSlate SignNow?

The signing process for the rp 467 form with airSlate SignNow is highly secure. The platform employs advanced encryption and authentication measures to protect sensitive information, ensuring that your documents remain confidential.

-

Can I track the status of the rp 467 form once it's sent for signing?

Yes, airSlate SignNow allows you to track the status of the rp 467 form in real-time. You will receive notifications when the document is viewed, signed, or completed, giving you full visibility throughout the signing process.

Get more for Form RP 467 Rnw718Renewal Application For Partial

- Client intake questionnaire family counseling form

- Application for long term care medicaid form

- Fillable online change reporting form mdhs fax email

- Functional capacity evaluation form wellspan health wellspan

- Cosmetic interest questionnaire 85629774 form

- Jodi bremer landau form

- Rpp authorization form pennsylvania insurance

- Ei session note form humanservices co lancaster pa

Find out other Form RP 467 Rnw718Renewal Application For Partial

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later