Assignment Mortgage Corporate Form

What is the Assignment Mortgage Corporate

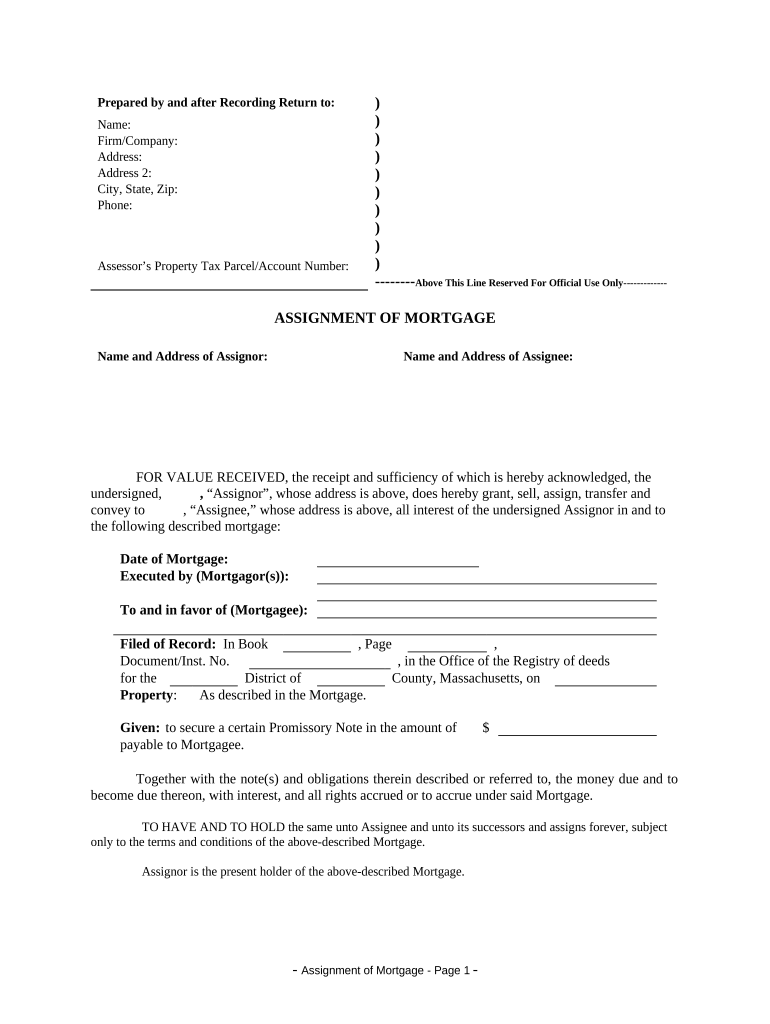

The assignment mortgage corporate is a legal document that facilitates the transfer of mortgage rights from one party to another within a corporate context. This form is essential for businesses looking to manage their real estate assets effectively. It outlines the terms under which the mortgage is assigned, ensuring that all parties understand their rights and obligations. The document typically includes information about the original mortgage, the parties involved, and any specific conditions that must be met for the assignment to be valid.

How to use the Assignment Mortgage Corporate

Using the assignment mortgage corporate involves several steps to ensure that the transfer of mortgage rights is executed correctly. First, the parties involved must review the existing mortgage agreement to understand its terms. Next, the assigning party must complete the assignment mortgage corporate form with accurate details about the mortgage and the new assignee. Once completed, both parties should sign the document, ideally using a secure eSignature platform to enhance validity and compliance. Finally, it is advisable to file the assignment with the appropriate local government office to ensure public record accuracy.

Steps to complete the Assignment Mortgage Corporate

Completing the assignment mortgage corporate requires careful attention to detail. Follow these steps:

- Review the original mortgage document to confirm the terms of the assignment.

- Gather necessary information about the new party receiving the mortgage rights.

- Fill out the assignment mortgage corporate form, ensuring all fields are completed accurately.

- Obtain signatures from both the assigning party and the assignee, preferably using an eSignature tool for security.

- Submit the completed form to the relevant local authority to record the assignment officially.

Legal use of the Assignment Mortgage Corporate

The assignment mortgage corporate is legally binding when executed in compliance with applicable laws. In the United States, it must adhere to the requirements set forth by the Uniform Commercial Code (UCC) and local real estate laws. This ensures that the assignment is recognized by courts and other entities. Proper execution, including obtaining signatures and maintaining records, is crucial for the assignment to be enforceable. Additionally, using a reliable eSignature platform can help meet legal standards for electronic documents.

Key elements of the Assignment Mortgage Corporate

Several key elements must be included in the assignment mortgage corporate to ensure its validity:

- Identification of Parties: Clearly state the names and addresses of both the assigning party and the assignee.

- Description of the Mortgage: Provide details about the original mortgage, including the property address and loan number.

- Terms of Assignment: Outline any specific conditions or obligations that the assignee must fulfill.

- Signatures: Ensure that both parties sign the document, confirming their agreement to the terms.

- Date of Execution: Include the date when the assignment is executed to establish a timeline.

Who Issues the Form

The assignment mortgage corporate is typically not issued by a specific government agency but is created by the parties involved in the transaction. However, it is essential to ensure that the form complies with local laws and regulations. Some legal professionals or real estate experts may provide templates to assist in drafting the document correctly. Once completed, the form may need to be filed with local government offices, such as the county recorder's office, to ensure it is part of the public record.

Quick guide on how to complete assignment mortgage corporate 497309720

Complete Assignment Mortgage Corporate effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Assignment Mortgage Corporate on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Assignment Mortgage Corporate without hassle

- Locate Assignment Mortgage Corporate and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Assignment Mortgage Corporate and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an assignment mortgage corporate?

An assignment mortgage corporate refers to the process of transferring the rights and obligations of a mortgage from one corporate entity to another. This type of assignment can streamline transactions for businesses looking to manage their real estate assets more effectively. Understanding this concept is vital for corporate clients involved in real estate financing.

-

How does airSlate SignNow facilitate assignment mortgage corporate transactions?

AirSlate SignNow enhances the assignment mortgage corporate process by allowing businesses to digitally sign and send documents securely. The platform's user-friendly interface simplifies the paperwork involved, ensuring that corporate transactions can be executed swiftly. This helps reduce delays and improve overall efficiency.

-

What are the pricing options for using airSlate SignNow for corporate assignments?

AirSlate SignNow offers flexible pricing plans tailored to the needs of businesses handling assignment mortgage corporate transactions. By choosing the plan that fits your organization, you can ensure that you’re only paying for the features you need, making it a cost-effective solution. Visit our pricing page for more details on our competitive rates.

-

What features does airSlate SignNow provide for managing corporate assignments?

AirSlate SignNow offers a variety of features designed for assignment mortgage corporate management, including customizable templates, bulk sending, and robust tracking capabilities. These features allow businesses to efficiently manage the signing process and maintain records seamlessly. Businesses benefit from increased organization and compliance.

-

How does eSigning enhance the assignment mortgage corporate process?

ESigning through airSlate SignNow signNowly enhances the assignment mortgage corporate process by ensuring that documents are signed quickly and securely from anywhere. This eliminates physical paperwork and associated delays, allowing businesses to finalize transactions faster and more efficiently. Digital signatures also provide legal validity and improve audit trails.

-

Can airSlate SignNow integrate with other business applications for corporate assignments?

Yes, airSlate SignNow can seamlessly integrate with various business applications, making it easier to manage assignment mortgage corporate transactions. Whether it's CRM systems or document management solutions, integration ensures a smooth workflow across your organization. This enhances productivity and ensures all parts of your business are connected.

-

What benefits can businesses expect when using airSlate SignNow for assignment mortgage corporate?

Businesses can expect numerous benefits when using airSlate SignNow for assignment mortgage corporate, including streamlined document workflows and signNow time savings. The platform’s user-friendly design and powerful features empower teams to focus on their core work while ensuring compliance and security in corporate transactions. Overall, it enhances productivity and reduces operational costs.

Get more for Assignment Mortgage Corporate

Find out other Assignment Mortgage Corporate

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile